Wells Fargo 2014 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

risk capital rule. Clean P&L is the change in the value of the

Company’s covered trading positions that would have occurred

had previous end-of-day covered trading positions remained

unchanged (therefore, excluding fees, commissions, net interest

income, and intraday trading gains and losses). The backtesting

analysis compares the daily Total VaR for each of the trading

days in the preceding 12 months with the net clean P&L. Clean

P&L does not include credit adjustments and other activity not

representative of daily price changes driven by market risk

factors. The clean P&L measure of revenue is used to evaluate

the performance of the Total VaR and is not comparable to our

actual daily trading net revenues, as reported elsewhere in this

Report.

Any observed clean P&L loss in excess of the Total VaR is

considered a market risk regulatory capital backtesting

exception. The actual number of exceptions (that is, the number

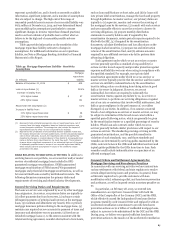

Table 53: Daily Total 1-Day 99% VaR Measure (Rolling 12 Months)

of business days for which the clean P&L losses exceed the

corresponding 1-day, 99% Total VaR measure) over the

preceding 12 months is used to determine the capital multiplier

for the capital calculation. The number of actual backtesting

exceptions is dependent on current market performance relative

to historic market volatility. This capital multiplier increases

from a minimum of three to a maximum of four, depending on

the number of exceptions. No backtesting exceptions occurred

over the preceding 12 months. Backtesting is also performed at

granular levels within the Company with sub-portfolio results

provided to federal regulators.

Table 53 shows daily Total VaR (1-day, 99%) for the 12

months ended December 31, 2014. The Company’s average Total

VaR for fourth quarter 2014 was $22 million with a low of $17

million and a high of $28 million.

Market Risk Governance The Finance Committee of our Board

has primary oversight over market risk-taking activities of the

Company and reviews the acceptable market risk appetite. The

Corporate Risk Group’s Market Risk Committee, which reports

to the Finance Committee of the Board, is responsible for

governance and oversight over market risk-taking activities

across the Company as well as the establishment of market risk

appetite and associated limits. The Corporate Market Risk

Group, which is part of the Corporate Risk Group, administers

and monitors compliance with the requirements established by

the Market Risk Committee. The Corporate Market Risk Group

has oversight responsibilities in identifying, measuring and

monitoring the Company’s market risk. The group is responsible

for developing corporate market risk policy, creating

quantitative market risk models, establishing independent risk

limits, calculating and analyzing market risk capital, and

reporting aggregated and line-of-business market risk

information. Limits are regularly reviewed to ensure they remain

relevant and within the market risk appetite for the Company.

An automated limits-monitoring system enables a daily

comprehensive review of multiple limits mandated across

businesses. Limits are set with inner boundaries that will be

periodically breached to promote an ongoing dialogue of risk

exposure within the Company. Each line of business that exposes

the Company to market risk has direct responsibility for

managing market risk in accordance with defined risk tolerances

and approved market risk mandates and hedging strategies. We

measure and monitor market risk for both management and

regulatory capital purposes.

Model Risk Management The market risk capital models are

governed by our Corporate Model Risk Committee (CMoR)

policies and procedures, which include model validation. The

purpose of model validation includes ensuring the model is

appropriate for its intended use and that appropriate controls

exist to help mitigate the risk of invalid results. Model validation

assesses the adequacy and appropriateness of the model,

including reviewing its key components such as inputs,

processing components, logic or theory, output results and

supporting model documentation. Validation also includes

95