Wells Fargo 2014 Annual Report Download - page 230

Download and view the complete annual report

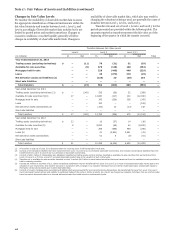

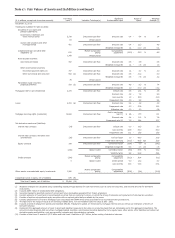

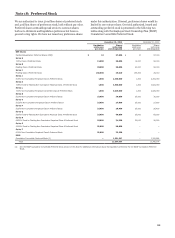

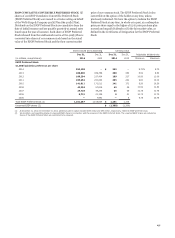

Please find page 230 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 17: Fair Values of Assets and Liabilities (continued)

Significant Recurring Level 3 Fair Value Asset and

Liability Input Sensitivity

We generally use discounted cash flow or similar internal

modeling techniques to determine the fair value of our Level 3

assets and liabilities. Use of these techniques requires

determination of relevant inputs and assumptions, some of

which represent significant unobservable inputs as indicated in

the preceding tables. Accordingly, changes in these unobservable

inputs may have a significant impact on fair value.

Certain of these unobservable inputs will (in isolation) have

a directionally consistent impact on the fair value of the

instrument for a given change in that input. Alternatively, the

fair value of the instrument may move in an opposite direction

for a given change in another input. Where multiple inputs are

used within the valuation technique of an asset or liability, a

change in one input in a certain direction may be offset by an

opposite change in another input having a potentially muted

impact to the overall fair value of that particular instrument.

Additionally, a change in one unobservable input may result in a

change to another unobservable input (that is, changes in certain

inputs are interrelated to one another), which may counteract or

magnify the fair value impact.

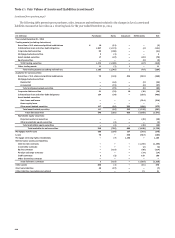

SECURITIES, LOANS, MORTGAGES HELD FOR SALE and

NONMARKETABLE EQUITY INVESTMENTS The fair values of

predominantly all Level 3 trading securities, mortgages held for

sale, loans, other nonmarketable equity investments, and

available-for-sale securities have consistent inputs, valuation

techniques and correlation to changes in underlying inputs. The

internal models used to determine fair value for these Level 3

instruments use certain significant unobservable inputs within a

discounted cash flow or market comparable pricing valuation

technique. Such inputs include discount rate, prepayment rate,

default rate, loss severity, utilization rate, comparability

adjustment and weighted average life.

These Level 3 assets would decrease (increase) in value

based upon an increase (decrease) in discount rate, default rate,

loss severity, or weighted average life inputs. Conversely, the fair

value of these Level 3 assets would generally increase (decrease)

in value if the prepayment rate input were to increase (decrease)

or if the utilization rate input were to increase (decrease).

Generally, a change in the assumption used for default rate

is accompanied by a directionally similar change in the risk

premium component of the discount rate (specifically, the

portion related to credit risk) and a directionally opposite change

in the assumption used for prepayment rates. Unobservable

inputs for loss severity, utilization rate and weighted average life

do not increase or decrease based on movements in the other

significant unobservable inputs for these Level 3 assets.

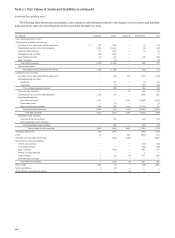

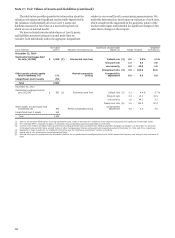

DERIVATIVE INSTRUMENTS Level 3 derivative instruments

are valued using market comparable pricing, option pricing and

discounted cash flow valuation techniques. We utilize certain

unobservable inputs within these techniques to determine the

fair value of the Level 3 derivative instruments. The significant

unobservable inputs consist of credit spread, a comparability

adjustment, prepayment rate, default rate, loss severity, initial-

value servicing, fall-out factor, volatility factor, weighted average

life, conversion factor, and correlation factor.

Level 3 derivative assets (liabilities) where we are long the

underlying would decrease (increase) in value upon an increase

(decrease) in default rate, fall-out factor, credit spread,

conversion factor, or loss severity inputs. Conversely, Level 3

derivative assets (liabilities) would increase (decrease) in value

upon an increase (decrease) in prepayment rate, initial-value

servicing, weighted average life, or volatility factor inputs. The

inverse of the above relationships would occur for instruments in

which we are short the underlying. The correlation factor and

comparability adjustment inputs may have a positive or negative

impact on the fair value of these derivative instruments

depending on the change in value of the item the correlation

factor and comparability adjustment is referencing. The

correlation factor and comparability adjustment is considered

independent from movements in other significant unobservable

inputs for derivative instruments.

Generally, for derivative instruments for which we are

subject to changes in the value of the underlying referenced

instrument, change in the assumption used for default rate is

accompanied by directionally similar change in the risk premium

component of the discount rate (specifically, the portion related

to credit risk) and a directionally opposite change in the

assumption used for prepayment rates. Unobservable inputs for

loss severity, fall-out factor, initial-value servicing, weighted

average life, conversion factor, and volatility do not increase or

decrease based on movements in other significant unobservable

inputs for these Level 3 instruments.

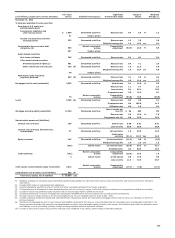

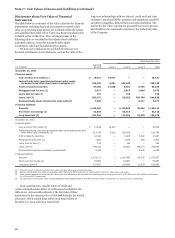

MORTGAGE SERVICING RIGHTS We use a discounted cash

flow valuation technique to determine the fair value of Level 3

mortgage servicing rights. These models utilize certain

significant unobservable inputs including prepayment rate,

discount rate and costs to service. An increase in any of these

unobservable inputs will reduce the fair value of the mortgage

servicing rights and alternatively, a decrease in any one of these

inputs would result in the mortgage servicing rights increasing in

value. Generally, a change in the assumption used for the default

rate is accompanied by a directionally similar change in the

assumption used for cost to service and a directionally opposite

change in the assumption used for prepayment. The sensitivity

of our residential MSRs is discussed further in Note 8

(Securitizations and Variable Interest Entities).

228