Wells Fargo 2014 Annual Report Download - page 242

Download and view the complete annual report

Please find page 242 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

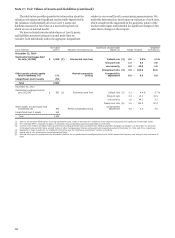

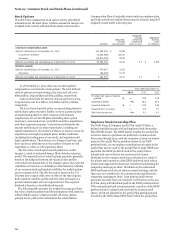

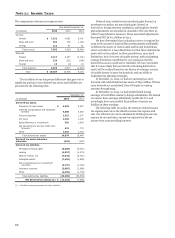

Note 19: Common Stock and Stock Plans (continued)

Stock Options Compensation Plans if originally issued under an employee plan,

The table below summarizes stock option activity and related and in the activity and related information for Director Awards if

information for the stock plans. Options assumed in mergers are originally issued under a director plan.

included in the activity and related information for Incentive

Weighted-

average Aggregate

Weighted- remaining intrinsic

average contractual value

Number exercise price term (in yrs.) (in millions)

Incentive compensation plans

Options outstanding as of December 31, 2013 140,484,056 $ 42.86

Canceled or forfeited (2,844,648) 206.02

Exercised (39,976,208) 29.93

Options exercisable and outstanding as of December 31, 2014 97,663,200 43.40 2.7 $ 2,476

Director awards

Options outstanding as of December 31, 2013 479,637 31.95

Exercised (88,090) 31.43

Options exercisable and outstanding as of December 31, 2014 391,547 32.07 2.1 9

As of December 31, 2014, there was no unrecognized

compensation cost related to stock options. The total intrinsic

value of options exercised during 2014, 2013 and 2012 was

$805 million, $643 million and $694 million, respectively.

Cash received from the exercise of stock options for 2014,

2013 and 2012 was $1.2 billion, $1.6 billion and $1.5 billion,

respectively.

We do not have a specific policy on repurchasing shares to

satisfy share option exercises. Rather, we have a general policy

on repurchasing shares to meet common stock issuance

requirements for our benefit plans (including share option

exercises), conversion of our convertible securities, acquisitions

and other corporate purposes. Various factors determine the

amount and timing of our share repurchases, including our

capital requirements, the number of shares we expect to issue for

acquisitions and employee benefit plans, market conditions

(including the trading price of our stock), and regulatory and

legal considerations. These factors can change at any time, and

there can be no assurance as to the number of shares we will

repurchase or when we will repurchase them.

The fair value of each option award granted on or after

January 1, 2006, is estimated using a Black-Scholes valuation

model. The expected term of reload options granted is generally

based on the midpoint between the valuation date and the

contractual termination date of the original option. Our expected

volatilities are based on a combination of the historical volatility

of our common stock and implied volatilities for traded options

on our common stock. The risk-free rate is based on the U.S.

Treasury zero-coupon yield curve in effect at the time of grant.

Both expected volatility and the risk-free rates are based on a

period commensurate with our expected term. The expected

dividend is based on a fixed dividend amount.

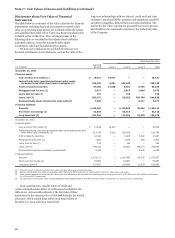

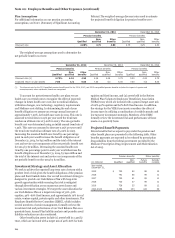

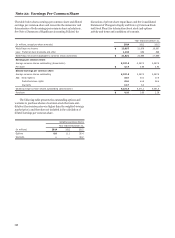

The following table presents the weighted-average per share

fair value of options granted and the assumptions used, based on

a Black-Scholes option valuation model. All of the options

granted in 2013 and 2012 resulted from the reload feature.

Year ended December 31,

2014 2013 2012

Per share fair value of options

granted $ — 1.58 2.79

Expected volatility —% 18.3 29.2

Expected dividends $ — 0.93 0.68

Expected term (in years) — 0.5 0.7

Risk-free interest rate —% 0.1 0.1

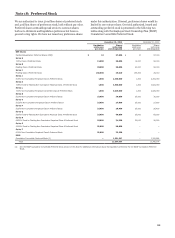

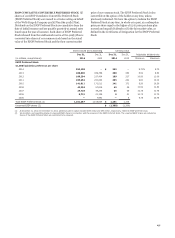

Employee Stock Ownership Plan

The Wells Fargo & Company 401(k) Plan (401(k) Plan) is a

defined contribution plan with an Employee Stock Ownership

Plan (ESOP) feature. The ESOP feature enables the 401(k) Plan

to borrow money to purchase our preferred or common stock.

From 1994 through 2014, with the exception of 2009, we loaned

money to the 401(k) Plan to purchase shares of our ESOP

preferred stock. As our employer contributions are made to the

401(k) Plan and are used by the 401(k) Plan to make ESOP loan

payments, the ESOP preferred stock in the 401(k) Plan is

released and converted into our common stock shares.

Dividends on the common stock shares allocated as a result of

the release and conversion of the ESOP preferred stock reduce

retained earnings and the shares are considered outstanding for

computing earnings per share. Dividends on the unallocated

ESOP preferred stock do not reduce retained earnings, and the

shares are not considered to be common stock equivalents for

computing earnings per share. Loan principal and interest

payments are made from our employer contributions to the 401

(k) Plan, along with dividends paid on the ESOP preferred stock.

With each principal and interest payment, a portion of the ESOP

preferred stock is released and converted to common stock

shares, which are allocated to the 401(k) Plan participants and

invested in the Wells Fargo ESOP Fund within the 401(k) Plan.

240