Wells Fargo 2014 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Earnings Performance (continued)

trading assets, lower insurance income related to a decline in

crop insurance fee income and the 2014 divestiture of 40

insurance offices, and lower other income. The reduction in

other income was caused by the financial results of low-income

housing tax credits and other nonmarketable investments which

are accounted for under the equity accounting method, partially

offset by a gain on the divestiture of the 40 insurance offices.

Noninterest income of $11.8 billion in 2013 increased

$322 million, or 3%, from 2012 due to strong growth in asset

backed finance, asset management, capital markets, commercial

banking, commercial real estate and corporate banking.

Noninterest expense in 2014 increased $597 million, or 5%,

compared with 2013, which was up 2%, or $296 million, from

2012. The increase in both 2014 and 2013 was due to higher

personnel expenses and higher non-personnel expenses related

to growth initiatives and compliance and regulatory

requirements. The provision for credit losses increased

$179 million from 2013 due primarily to strong commercial loan

growth in 2014. The provision for credit losses in 2013 decreased

$731 million from 2012, due to lower loan losses.

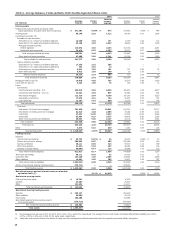

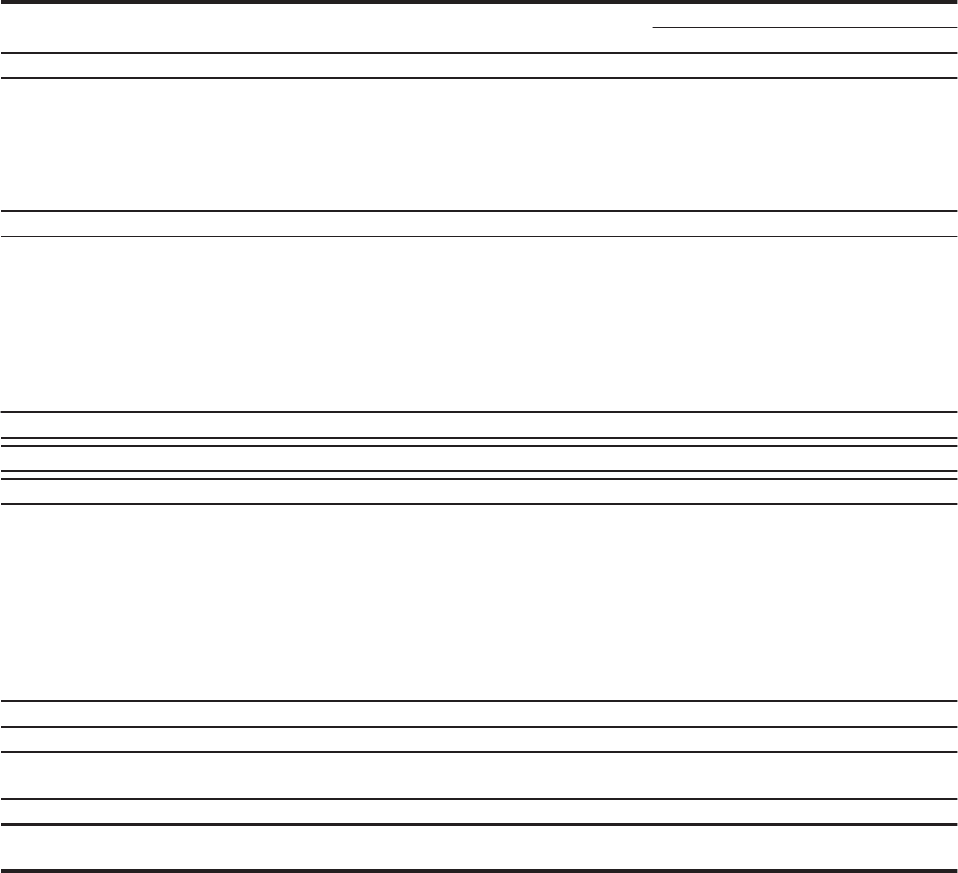

Table 9c - Wealth, Brokerage and Retirement

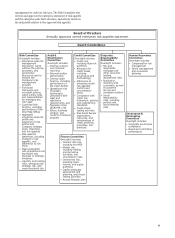

WEALTH, BROKERAGE AND RETIREMENT provides a full

range of financial advisory services to clients using a planning

approach to meet each client's financial needs. Wealth

Management provides affluent and high net worth clients with a

complete range of wealth management solutions, including

financial planning, private banking, credit, investment

management and fiduciary services. Abbot Downing, a

Wells Fargo business, provides comprehensive wealth

management services to ultra-high net worth families and

individuals as well as endowments and foundations. Brokerage

serves customers' advisory, brokerage and financial needs as

part of one of the largest full-service brokerage firms in the

United States. Retirement is a national leader in providing

institutional retirement and trust services (including 401(k) and

pension plan record keeping) for businesses and reinsurance

services for the life insurance industry. Wealth, Brokerage and

Retirement cross-sell was 10.49 products per retail banking

household in November 2014, up from 10.42 in November 2013

and 10.27 in November 2012. Table 9c provides additional

financial information for Wealth, Brokerage and Retirement.

Year ended December 31,

(in millions, except average balances which are in billions) 2014 2013 2012

Net interest income $ 3,179 2,888 2,768

Noninterest income:

Service charges on deposit accounts 18 17 18

Trust and investment fees:

Brokerage advisory, commissions and other fees 8,855 8,133 7,299

Trust and investment management 1,595 1,532 1,435

Investment banking (1) (13) (16) (14)

Total trust and investment fees 10,437 9,649 8,720

Card fees 4 4 1

Other fees 16 19 18

Mortgage banking 1 (24) (38)

Insurance 176 125 118

Net gains from trading activities 155 171 151

Net gains on debt securities 5 3 5

Net gains from equity investments 13 14 99

Other income of the segment 214 337 300

Total noninterest income 11,039 10,315 9,392

Total revenue 14,218 13,203 12,160

Provision (reversal of provision) for credit losses (50) (16) 125

Noninterest expense:

Personnel expense 7,320 7,093 6,544

Equipment 51 63 47

Net occupancy 412 399 404

Core deposit and other intangibles 350 382 420

FDIC and other deposit assessments 127 136 236

Outside professional services 491 412 388

Operating losses 93 90 29

Other expense of the segment 2,063 1,880 1,825

Total noninterest expense 10,907 10,455 9,893

Income before income tax expense and noncontrolling interest 3,361 2,764 2,142

Income tax expense 1,276 1,050 814

Net income from noncontrolling interest 2 2 —

Net income $ 2,083 1,712 1,328

Average loans $ 52.1 46.1 42.7

Average core deposits 154.9 150.1 137.5

(1) Represents syndication and underwriting fees paid to Wells Fargo Securities which are offset in our Wholesale Banking segment.

48