Wells Fargo 2014 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

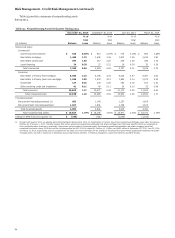

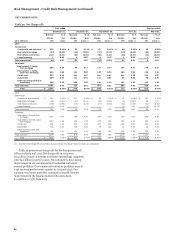

Risk Management - Credit Risk Management (continued)

line from a variable interest rate to a fixed rate with terms

including interest-only payments for a fixed period between

three to seven years or a fully amortizing payment with a fixed

period between five to 30 years. At the end of the draw period, a

line of credit generally converts to an amortizing payment

schedule with repayment terms of up to 30 years based on the

balance at time of conversion. Certain lines and loans have been

structured with a balloon payment, which requires full

repayment of the outstanding balance at the end of the term

period. The conversion of lines or loans to fully amortizing or

balloon payoff may result in a significant payment increase,

which can affect some borrowers’ ability to repay the

outstanding balance.

The lines that enter their amortization period may

experience higher delinquencies and higher loss rates than the

ones in their draw or term period. We have considered this

increased inherent risk in our allowance for credit loss estimate.

In anticipation of our borrowers reaching the end of their

contractual commitment, we have created a program to inform,

educate and help these borrowers transition from interest-only

to fully-amortizing payments or full repayment. We monitor the

performance of the borrowers moving through the program in

an effort to refine our ongoing program strategy.

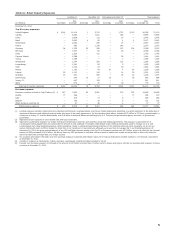

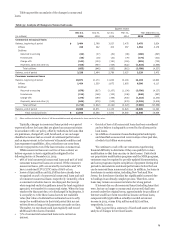

Table 30 reflects the outstanding balance of our portfolio of

junior lien lines and loans and senior lien lines segregated into

scheduled end of draw or end of term periods and products that

are currently amortizing, or in balloon repayment status. It

excludes real estate 1-4 family first lien line reverse mortgages,

which total $2.3 billion, because they are predominantly insured

by the FHA, and it excludes PCI loans, which total $130 million,

because their losses were generally reflected in our

nonaccretable difference established at the date of acquisition.

Table 30: Junior Lien Mortgage Line and Loan and Senior Lien Mortgage Line Portfolios Payment Schedule

Scheduled end of draw / term

Outstanding balance 2020 and

(in millions) December 31, 2014 2015 2016 2017 2018 2019 thereafter (1) Amortizing

Junior residential lines $ 52,658 4,813 6,451 6,692 3,633 1,422 24,639 5,008

Junior loans (2) 6,958 65 98 103 11 8 1,175 5,498

Total junior lien (3)(4) 59,616 4,878 6,549 6,795 3,644 1,430 25,814 10,506

First lien lines 17,080 1,089 923 932 1,053 467 11,394 1,222

Total (3)(4) $ 76,696 5,967 7,472 7,727 4,697 1,897 37,208 11,728

% of portfolios 100% 7.8% 9.7% 10.1% 6.1% 2.5% 48.5% 15.3%

(1) The annual scheduled end of draw or term ranges from $1.7 billion to $10.0 billion and averages $5.3 billion per year for 2020 and thereafter. The loans that convert in

2025 and thereafter have draw periods that generally extend to 15 or 20 years.

(2) Junior loans within the term period predominantly represent principal and interest products that require a balloon payment upon the end of the loan term. Amortizing junior

loans include $62 million of balloon loans that have reached end of term and are now past due.

(3) Lines in their draw period are predominantly interest-only. The unfunded credit commitments total $70.1 billion at December 31, 2014.

(4) Includes scheduled end-of-term balloon payments totaling $455 million, $386 million, $501 million, $518 million, $445 million, and $1.9 billion for 2015, 2016, 2017, 2018,

2019, 2020 and thereafter, respectively. Amortizing lines include $189 million of end-of-term balloon payments, which are past due. At December 31, 2014, $425 million,

or 7% of outstanding lines of credit that are amortizing, are 30 or more days past due compared to $1.3 billion, or 2% for lines in their draw period.

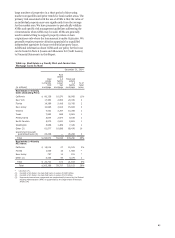

CREDIT CARDS Our credit card portfolio totaled $31.1 billion at

December 31, 2014, which represented 4% of our total

outstanding loans. In November 2014, we purchased an existing

private label and co-branded credit card loan portfolio in

connection with the Dillard's program agreement. The net

charge-off rate for our credit card portfolio was 3.14% for 2014,

compared with 3.62% for 2013.

AUTOMOBILE Our automobile portfolio, predominantly

composed of indirect loans, totaled $55.7 billion at December 31,

2014. The net charge-off rate for our automobile portfolio was

0.70% for 2014, compared with 0.63% for 2013.

OTHER REVOLVING CREDIT AND INSTALLMENT Other

revolving credit and installment loans totaled $35.8 billion at

December 31, 2014, and primarily included student and security-

based loans. Student loans totaled $11.9 billion at December 31,

2014, compared with $22.0 billion at December 31, 2013,

reflecting the transfer of $9.7 billion in government guaranteed

student loans to loans held for sale at June 30, 2014, of which

$8.3 billion were sold in fourth quarter 2014. The net charge-off

rate for other revolving credit and installment loans was 1.35%

for 2014, compared with 1.41% for 2013.

72