Wells Fargo 2014 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the level of the federal funds rate. As noted above, a declining or

low interest rate environment and a flattening yield curve which

may result from the FRB’s actions could negatively affect our net

interest income and net interest margin as it may result in us

holding lower yielding loans and investment securities on our

balance sheet.

RISKS RELATED TO CREDIT AND OUR MORTGAGE

BUSINESS

As one of the largest lenders in the U.S., increased

credit risk, including as a result of a deterioration in

economic conditions, could require us to increase our

provision for credit losses and allowance for credit

losses and could have a material adverse effect on our

results of operations and financial condition. When we

loan money or commit to loan money we incur credit risk, or the

risk of losses if our borrowers do not repay their loans. As one of

the largest lenders in the U.S., the credit performance of our loan

portfolios significantly affects our financial results and

condition. As noted above, if the current economic environment

were to deteriorate, more of our customers may have difficulty in

repaying their loans or other obligations which could result in a

higher level of credit losses and provision for credit losses. We

reserve for credit losses by establishing an allowance through a

charge to earnings. The amount of this allowance is based on our

assessment of credit losses inherent in our loan portfolio

(including unfunded credit commitments). The process for

determining the amount of the allowance is critical to our

financial results and condition. It requires difficult, subjective

and complex judgments about the future, including forecasts of

economic or market conditions that might impair the ability of

our borrowers to repay their loans. We might increase the

allowance because of changing economic conditions, including

falling home prices and higher unemployment, significant loan

growth, or other factors. For example, if oil prices remain low for

a prolonged period of time, we may have to increase the

allowance, particularly to cover potential losses on loans to

customers in the energy sector. Additionally, the regulatory

environment or external factors, such as natural disasters, also

can influence recognition of credit losses in our loan portfolios

and impact our allowance for credit losses.

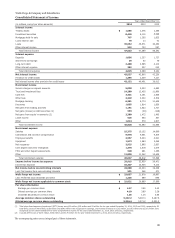

Reflecting the continued improved credit performance in

our loan portfolios, our provision for credit losses was

$1.6 billion and $2.2 billion less than net charge-offs in 2014 and

2013, respectively, which had a positive effect on our earnings.

Future allowance levels may increase or decrease based on a

variety of factors, including loan growth, portfolio performance

and general economic conditions. While we believe that our

allowance for credit losses was appropriate at December 31,

2014, there is no assurance that it will be sufficient to cover

future credit losses, especially if housing and employment

conditions worsen. In the event of significant deterioration in

economic conditions or if we experience significant loan growth,

we may be required to build reserves in future periods, which

would reduce our earnings.

For more information, refer to the “Risk Management –

Credit Risk Management” and “Critical Accounting Policies –

Allowance for Credit Losses” sections in this Report.

We may have more credit risk and higher credit losses

to the extent our loans are concentrated by loan type,

industry segment, borrower type, or location of the

borrower or collateral. Our credit risk and credit losses can

increase if our loans are concentrated to borrowers engaged in

the same or similar activities or to borrowers who as a group

may be uniquely or disproportionately affected by economic or

market conditions. We experienced the effect of concentration

risk in 2009 and 2010 when we incurred greater than expected

losses in our residential real estate loan portfolio due to a

housing slowdown and greater than expected deterioration in

residential real estate values in many markets, including the

Central Valley California market and several Southern California

metropolitan statistical areas. As California is our largest

banking state in terms of loans and deposits, deterioration in

real estate values and underlying economic conditions in those

markets or elsewhere in California could result in materially

higher credit losses. In addition, deterioration in macro-

economic conditions generally across the country could result in

materially higher credit losses, including for our residential real

estate loan portfolio. We may experience higher delinquencies

and higher loss rates as our consumer real estate secured lines of

credit reach their contractual end of draw period and begin to

amortize. Additionally, we may experience higher delinquencies

and higher loss rates as borrowers in our consumer Pick-a-Pay

portfolio reach their recast trigger, particularly if interest rates

increase significantly which may cause more borrowers to

experience a payment increase of more than 7.5% upon recast.

We are currently the largest CRE lender in the U.S. A

deterioration in economic conditions that negatively affects the

business performance of our CRE borrowers, including increases

in interest rates and/or declines in commercial property values,

could result in materially higher credit losses and have a

material adverse effect on our financial results and condition.

Challenging economic conditions in Europe have increased

our foreign credit risk. Although our foreign loan exposure

represented only approximately 6% of our total consolidated

outstanding loans and 3% of our total assets at

December 31, 2014, continued European economic difficulties

could indirectly have a material adverse effect on our credit

performance and results of operations and financial condition to

the extent it negatively affects the U.S. economy and/or our

borrowers who have foreign operations.

For more information, refer to the “Risk Management –

Credit Risk Management” section and Note 6 (Loans and

Allowance for Credit Losses) to Financial Statements in this

Report.

We may incur losses on loans, securities and other

acquired assets of Wachovia that are materially greater

than reflected in our fair value adjustments. We

accounted for the Wachovia merger under the purchase method

of accounting, recording the acquired assets and liabilities of

Wachovia at fair value. All PCI loans acquired in the merger were

recorded at fair value based on the present value of their

expected cash flows. We estimated cash flows using internal

credit, interest rate and prepayment risk models using

assumptions about matters that are inherently uncertain. We

may not realize the estimated cash flows or fair value of these

loans. In addition, although the difference between the pre-

merger carrying value of the credit-impaired loans and their

expected cash flows – the “nonaccretable difference” – is

available to absorb future charge-offs, we may be required to

increase our allowance for credit losses and related provision

expense because of subsequent additional credit deterioration in

these loans.

For more information, refer to the “Critical Accounting

Policies – Purchased Credit-Impaired (PCI) Loans” and “Risk

Management – Credit Risk Management” sections in this

Report.

121