Wells Fargo 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

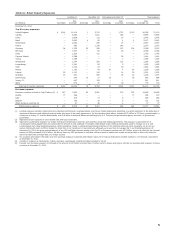

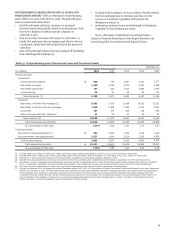

Table 22: Select Country Exposures

Lending (1) Securities (2) Derivatives and other (3) Total exposure

Non- Non- Non- Non-

(in millions) Sovereign sovereign Sovereign sovereign Sovereign sovereign Sovereign sovereign (4) Total

December 31, 2014

Top 20 country exposures:

United Kingdom $ 5,014 11,014 1 3,710 — 1,371 5,015 16,095 21,110

Canada — 8,283 — 1,251 — 365 — 9,899 9,899

China — 2,838 — 113 — 27 — 2,978 2,978

Brazil — 2,645 4 28 — 4 4 2,677 2,681

Netherlands — 2,262 — 268 — 37 — 2,567 2,567

France — 882 — 1,145 — 343 — 2,370 2,370

Germany 94 1,323 60 599 — 137 154 2,059 2,213

Bermuda — 1,937 — 65 — 26 — 2,028 2,028

India — 1,625 — 121 — — — 1,746 1,746

Cayman Islands — 1,588 — — — 26 — 1,614 1,614

Turkey — 1,588 — — — 1 — 1,589 1,589

Switzerland — 1,044 — 362 — 122 — 1,528 1,528

Luxembourg — 1,391 — 95 — 9 — 1,495 1,495

Chile — 1,426 — 23 — 33 — 1,482 1,482

Mexico — 1,192 — 43 67 4 67 1,239 1,306

Ireland 53 1,101 — 104 — 16 53 1,221 1,274

Australia 22 641 — 558 — 36 22 1,235 1,257

South Korea — 945 13 17 23 — 36 962 998

Jersey, C.I. — 647 — 193 — 1 — 841 841

Spain — 673 — 70 — 33 — 776 776

Total top 20 country exposures $ 5,183 45,045 78 8,765 90 2,591 5,351 56,401 61,752

Eurozone exposure:

Eurozone countries included in Top 20 above (5) $ 147 7,632 60 2,281 — 575 207 10,488 10,695

Austria 77 396 — — — — 77 396 473

Italy — 206 — 73 — 6 — 285 285

Belgium — 103 — 19 — 9 — 131 131

Other Eurozone countries (6) — 37 — 38 — 2 — 77 77

Total Eurozone exposure $ 224 8,374 60 2,411 — 592 284 11,377 11,661

(1) Lending exposure includes funded loans and unfunded commitments, leveraged leases, and money market placements presented on a gross basis prior to the deduction of

impairment allowance and collateral received under the terms of the credit agreements. For the countries listed above, includes $373 million in PCI loans, predominantly to

customers in Jersey, C.I. and the Netherlands, and $1.8 billion in defeased leases secured largely by U.S. Treasury and government agency securities, or government

guaranteed.

(2) Represents issuer exposure on cross-border debt and equity securities.

(3) Represents counterparty exposure on foreign exchange and derivative contracts, and securities resale and lending agreements. This exposure is presented net of

counterparty netting adjustments and reduced by the amount of cash collateral. It includes credit default swaps (CDS) predominantly used to manage our U.S. and

London-based cash credit trading businesses, which sometimes results in selling and purchasing protection on the identical reference entity. Generally, we do not use

market instruments such as CDS to hedge the credit risk of our investment or loan positions, although we do use them to manage risk in our trading businesses. At

December 31, 2014, the gross notional amount of our CDS sold that reference assets in the Top 20 or Eurozone countries was $3.3 billion, which was offset by the notional

amount of CDS purchased of $3.4 billion. We did not have any CDS purchased or sold that reference pools of assets that contain sovereign debt or where the reference

asset was solely the sovereign debt of a foreign country.

(4) For countries presented in the table, total non-sovereign exposure comprises $20.9 billion exposure to financial institutions and $36.4 billion to non-financial corporations

at December 31, 2014.

(5) Consists of exposure to Netherlands, France, Germany, Luxembourg, Ireland and Spain included in Top 20.

(6) Includes non-sovereign exposure to Portugal in the amount of $67 million and less than $1 million each to Greece and Cyprus. We had no sovereign debt exposure to these

countries at December 31, 2014.

65