Wells Fargo 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

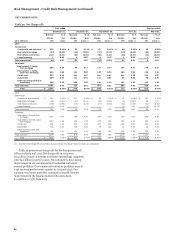

TROUBLED DEBT RESTRUCTURINGS (TDRs)

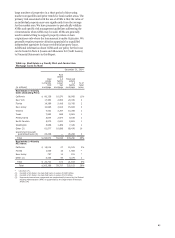

Table 35: Troubled Debt Restructurings (TDRs)

December 31,

(in millions) 2014 2013 2012 2011 2010

Commercial TDRs

Commercial and industrial $ 724 1,034 1,700 2,046 619

Real estate mortgage 1,880 2,248 2,625 2,262 725

Real estate construction 314 475 801 1,008 407

Lease financing 2 8 20 33 —

Total commercial TDRs 2,920 3,765 5,146 5,349 1,751

Consumer TDRs

Real estate 1-4 family first mortgage 18,226 18,925 17,804 13,799 11,603

Real estate 1-4 family junior lien mortgage 2,437 2,468 2,390 1,986 1,626

Credit Card 338 431 531 593 548

Automobile 127 189 314 260 214

Other revolving credit and installment 49 33 24 19 16

Trial modifications 452 650 705 651 —

Total consumer TDRs (1) 21,629 22,696 21,768 17,308 14,007

Total TDRs $ 24,549 26,461 26,914 22,657 15,758

TDRs on nonaccrual status $ 7,104 8,172 10,149 6,811 5,185

TDRs on accrual status (1) 17,445 18,289 16,765 15,846 10,573

Total TDRs $ 24,549 26,461 26,914 22,657 15,758

(1) TDR loans include $2.1 billion, $2.5 billion, $1.9 billion, $318 million, and $429 million at December 31, 2014, 2013, 2012, 2011, and 2010, respectively, of government

insured/guaranteed loans that are predominantly insured by the FHA or guaranteed by the VA and are accruing.

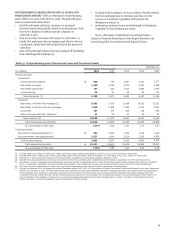

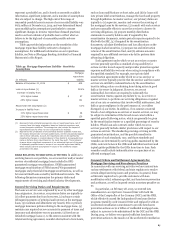

Table 36: TDRs Balance by Quarter During 2014

Dec 31, Sep 30, Jun 30, Mar 31,

(in millions) 2014 2014 2014 2014

Commercial TDRs

Commercial and industrial $ 724 836 950 1,088

Real estate mortgage 1,880 2,034 2,179 2,233

Real estate construction 314 328 391 454

Lease financing 2 3 5 6

Total commercial TDRs 2,920 3,201 3,525 3,781

Consumer TDRs

Real estate 1-4 family first mortgage 18,226 18,366 18,582 19,043

Real estate 1-4 family junior lien mortgage 2,437 2,464 2,463 2,460

Credit Card 338 358 379 399

Automobile 127 135 151 169

Other revolving credit and installment 49 45 38 34

Trial modifications 452 473 469 593

Total consumer TDRs 21,629 21,841 22,082 22,698

Total TDRs $ 24,549 25,042 25,607 26,479

TDRs on nonaccrual status $ 7,104 7,313 7,638 7,774

TDRs on accrual status 17,445 17,729 17,969 18,705

Total TDRs $ 24,549 25,042 25,607 26,479

Table 35 and Table 36 provide information regarding the

recorded investment of loans modified in TDRs. The allowance

for loan losses for TDRs was $3.6 billion and $4.5 billion at

December 31, 2014 and 2013, respectively. See Note 6 (Loans

and Allowance for Credit Losses) to Financial Statements in this

Report for additional information regarding TDRs. In those

situations where principal is forgiven, the entire amount of such

forgiveness is immediately charged off to the extent not done so

prior to the modification. We sometimes delay the timing on the

repayment of a portion of principal (principal forbearance) and

charge off the amount of forbearance if that amount is not

considered fully collectible.

Our nonaccrual policies are generally the same for all loan

types when a restructuring is involved. We re-underwrite loans

at the time of restructuring to determine whether there is

sufficient evidence of sustained repayment capacity based on the

borrower’s documented income, debt to income ratios, and other

factors. Loans lacking sufficient evidence of sustained repayment

77