Wells Fargo 2014 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

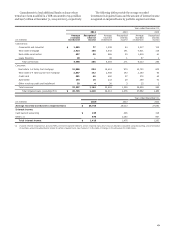

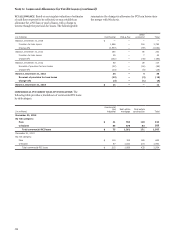

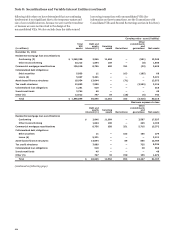

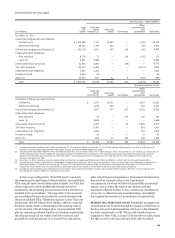

The classifications of assets and liabilities in our balance

sheet associated with our transactions with VIEs follow:

Transfers

that we

VIEs that VIEs that account for

we do not we as secured

(in millions) consolidate consolidate borrowings Total

December 31, 2014

Cash $ — 117 4 121

Trading assets 2,165 — 204 2,369

Investment securities (1) 18,271 875 4,592 23,738

Mortgages held for sale — — — —

Loans 13,195 4,509 5,280 22,984

Mortgage servicing rights 12,562 — — 12,562

Other assets 7,456 316 52 7,824

Total assets 53,649 5,817 10,132 69,598

Short-term borrowings — — 3,141 3,141

Accrued expenses and other liabilities 848 49 (2) 1 898

Long-term debt 2,585 1,628 (2) 4,990 9,203

Total liabilities 3,433 1,677 8,132 13,242

Noncontrolling interests — 103 — 103

Net assets $ 50,216 4,037 2,000 56,253

December 31, 2013

Cash $ — 165 7 172

Trading assets 1,206 162 193 1,561

Investment securities (1) 18,795 1,352 8,976 29,123

Mortgages held for sale — 38 — 38

Loans 7,652 6,058 6,021 19,731

Mortgage servicing rights (3) 15,281 — — 15,281

Other assets 6,151 347 110 6,608

Total assets 49,085 8,122 15,307 72,514

Short-term borrowings — 29 7,871 7,900

Accrued expenses and other liabilities (3) 1,395 99 (2) 3 1,497

Long-term debt (3) 2,109 2,356 (2) 5,673 10,138

Total liabilities 3,504 2,484 13,547 19,535

Noncontrolling interests — 5 — 5

Net assets $ 45,581 5,633 1,760 52,974

(1) Excludes certain debt securities related to loans serviced for the Federal National Mortgage Association (FNMA), Federal Home Loan Mortgage Corporation (FHLMC) and

GNMA.

(2) Includes the following VIE liabilities at December 31, 2014 and 2013, respectively, with recourse to the general credit of Wells Fargo: Accrued expenses and other liabilities,

$0 million and $9 million; and Long-term debt, $0 million and $29 million.

(3) Amounts have been revised for "VIEs that we do not consolidate" to include assets and liabilities related to certain commercial mortgage securitizations and to conform to

the current year presentation of long-term debt.

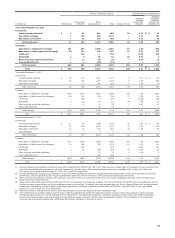

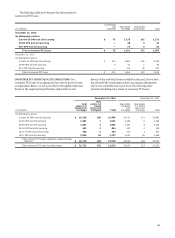

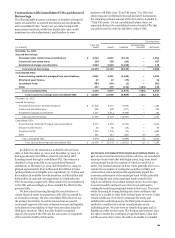

Transactions with Unconsolidated VIEs

Our transactions with VIEs include securitizations of residential

mortgage loans, CRE loans, student loans, auto loans and leases

and dealer floorplan loans; investment and financing activities

involving collateralized debt obligations (CDOs) backed by asset-

backed and CRE securities, collateralized loan obligations

(CLOs) backed by corporate loans, and other types of structured

financing. We have various forms of involvement with VIEs,

including servicing, holding senior or subordinated interests,

entering into liquidity arrangements, credit default swaps and

other derivative contracts. Involvements with these

unconsolidated VIEs are recorded on our balance sheet primarily

in trading assets, investment securities, loans, MSRs, other

assets and other liabilities, as appropriate.

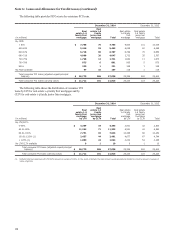

The following tables provide a summary of unconsolidated

VIEs with which we have significant continuing involvement, but

we are not the primary beneficiary. We do not consider our

continuing involvement in an unconsolidated VIE to be

significant when it relates to third-party sponsored VIEs for

which we were not the transferor (unless we are servicer and

have other significant forms of involvement) or if we were the

sponsor only or sponsor and servicer but do not have any other

forms of significant involvement.

Significant continuing involvement includes transactions

where we were the sponsor or transferor and have other

significant forms of involvement. Sponsorship includes

transactions with unconsolidated VIEs where we solely or

materially participated in the initial design or structuring of the

entity or marketing of the transaction to investors. When we

transfer assets to a VIE and account for the transfer as a sale, we

are considered the transferor. We consider investments in

securities (other than those held temporarily in trading), loans,

guarantees, liquidity agreements, written options and servicing

of collateral to be other forms of involvement that may be

significant. We have excluded certain transactions with

unconsolidated VIEs from the balances presented in the

181