Wells Fargo 2014 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

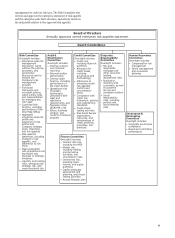

Operating Segment Results

The following discussion provides a description of each of our

operating segments, including cross-sell metrics and financial

results.

COMMUNITY BANKING offers a complete line of diversified

financial products and services for consumers and small

businesses including checking and savings accounts, credit and

debit cards, and auto, student, and small business lending. These

products also include investment, insurance and trust services in

39 states and D.C., and mortgage and home equity loans in all 50

states and D.C. through its Regional Banking and Wells Fargo

Home Lending business units. The Community Banking

segment also includes the results of our Corporate Treasury

activities net of allocations in support of the other operating

segments and results of investments in our affiliated venture

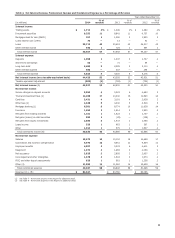

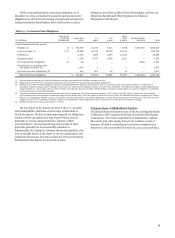

Table 9a - Community Banking

capital partnerships. Our retail banking household cross-sell was

6.17 products per household in November 2014, up from 6.16 in

November 2013 and 6.05 in November 2012. The November

2014 cross-sell ratio included the acquisition of an existing

private label and co-branded credit card loan portfolio in

connection with a new program agreement with Dillard's, Inc.

(Dillard's), a major retail department store. We believe there is

more opportunity for cross-sell as we continue to earn more

business from our customers. Our goal is eight products per

household, which is approximately one-half of our estimate of

potential demand for an average U.S. household. In November

2014, one of every four of our retail banking households had

eight or more of our products. Table 9a provides additional

financial information for Community Banking.

Year ended December 31,

(in millions, except average balances which are in billions) 2014 2013 2012

Net interest income $ 29,709 28,839 29,045

Noninterest income:

Service charges on deposit accounts 3,386 3,463 3,298

Trust and investment fees:

Brokerage advisory, commissions and other fees 1,796 1,603 1,401

Trust and investment management 817 755 699

Investment banking (1) (80) (77) (41)

Total trust and investment fees 2,533 2,281 2,059

Card fees 3,167 2,958 2,638

Other fees 2,296 2,342 2,294

Mortgage banking 6,011 8,335 11,235

Insurance 127 130 147

Net gains from trading activities 134 244 133

Net gains (losses) on debt securities 253 (77) (120)

Net gains from equity investments (2) 1,731 1,033 875

Other income of the segment 1,515 791 1,801

Total noninterest income 21,153 21,500 24,360

Total revenue 50,862 50,339 53,405

Provision for credit losses 1,681 2,755 6,835

Noninterest expense:

Personnel expense 17,077 17,693 17,195

Equipment 1,740 1,733 1,759

Net occupancy 2,181 2,133 2,093

Core deposit and other intangibles 629 697 781

FDIC and other deposit assessments 584 621 907

Outside professional services 1,124 1,117 1,311

Operating losses 1,065 698 2,029

Other expense of the segment 3,726 4,031 4,765

Total noninterest expense 28,126 28,723 30,840

Income before income tax expense and noncontrolling interests 21,055 18,861 15,730

Income tax expense 6,350 5,799 4,774

Net income from noncontrolling interests (3) 525 330 464

Net income $ 14,180 12,732 10,492

Average loans $ 503.2 499.3 487.1

Average core deposits 642.3 620.1 591.2

(1) Represents syndication and underwriting fees paid to Wells Fargo Securities which are offset in our Wholesale Banking segment.

(2) Predominantly represents gains resulting from venture capital investments.

(3) Reflects results attributable to noncontrolling interests primarily associated with the Company’s consolidated merchant services joint venture and venture capital

investments.

45