Wells Fargo 2014 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

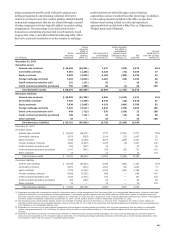

Note 16: Derivatives

We primarily use derivatives to manage exposure to market risk,

including interest rate risk, credit risk and foreign currency risk,

and to assist customers with their risk management objectives.

We designate certain derivatives as hedging instruments in a

qualifying hedge accounting relationship (fair value or cash flow

hedge). Our remaining derivatives consist of economic hedges

that do not qualify for hedge accounting and derivatives held for

customer accommodation, trading or other purposes.

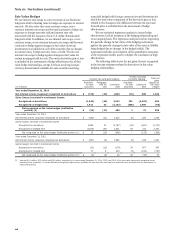

Our asset/liability management approach to interest rate,

foreign currency and certain other risks includes the use of

derivatives. Such derivatives are typically designated as fair

value or cash flow hedges, or economic hedges. This helps

minimize significant, unplanned fluctuations in earnings, fair

values of assets and liabilities, and cash flows caused by interest

rate, foreign currency and other market risk volatility. This

approach involves modifying the repricing characteristics of

certain assets and liabilities so that changes in interest rates,

foreign currency and other exposures do not have a significantly

adverse effect on the net interest margin, cash flows and

earnings. As a result of fluctuations in these exposures, hedged

assets and liabilities will gain or lose fair value. In a fair value or

economic hedge, the effect of this unrealized gain or loss will

generally be offset by the gain or loss on the derivatives linked to

the hedged assets and liabilities. In a cash flow hedge, where we

manage the variability of cash payments due to interest rate

fluctuations by the effective use of derivatives linked to hedged

assets and liabilities, the hedged asset or liability is not adjusted

and the unrealized gain or loss on the derivative is generally

reflected in other comprehensive income and not in earnings.

We also offer various derivatives, including interest rate,

commodity, equity, credit and foreign exchange contracts, to our

customers as part of our trading businesses. These derivative

transactions, which involve us engaging in market-making

activities or acting as an intermediary, are conducted in an effort

to help customers manage their market price risks. We usually

offset our exposure from such derivatives by entering into other

financial contracts, such as separate derivative or security

transactions. The customer accommodations and any offsetting

derivatives are treated as customer accommodation, trading and

other derivatives in our disclosures. Additionally, this category

includes embedded derivatives that are required to be accounted

for separately from their host contracts.

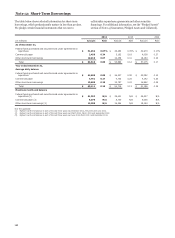

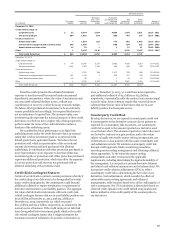

The following table presents the total notional or

contractual amounts and fair values for our derivatives.

Derivative transactions can be measured in terms of the notional

amount, but this amount is not recorded on the balance sheet

and is not, when viewed in isolation, a meaningful measure of

the risk profile of the instruments. The notional amount is

generally not exchanged, but is used only as the basis on which

interest and other payments are determined. Derivatives

designated as qualifying hedging instruments and economic

hedges are recorded on the balance sheet at fair value in other

assets or other liabilities. Customer accommodation, trading and

other derivatives are recorded on the balance sheet at fair value

in trading assets, other assets or other liabilities.

205