Wells Fargo 2014 Annual Report Download - page 213

Download and view the complete annual report

Please find page 213 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

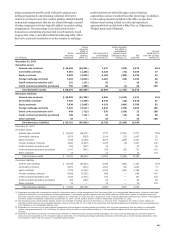

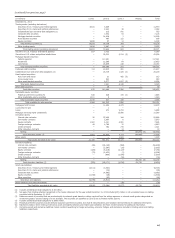

Notional amount

Protection Protection

(in millions) Fair value

liability Protection

sold (A)

sold - non-

investment

grade

purchased with

identical

underlyings (B)

Net

protection

sold (A)-(B)

Other

protection

purchased Range of

maturities

December 31, 2014

Credit default swaps on:

Corporate bonds $ 23 6,344 2,904 4,894 1,450 2,831 2015 - 2021

Structured products 654 1,055 874 608 447 277 2017 - 2052

Credit protection on:

Default swap index — 1,659 292 777 882 1,042 2015 - 2019

Commercial mortgage-backed securities index 246 1,058 — 608 450 355 2047 - 2063

Asset-backed securities index 19 52 1 1 51 81 2045 - 2046

Other 1 2,136 2,136 — 2,136 5,185 2015 - 2025

Total credit derivatives $ 943 12,304 6,207 6,888 5,416 9,771

December 31, 2013

Credit default swaps on:

Corporate bonds $ 48 10,947 5,237 6,493 4,454 5,557 2014-2021

Structured products 1,091 1,553 1,245 894 659 389 2016-2052

Credit protection on:

Default swap index — 3,270 388 2,471 799 898 2014-2018

Commercial mortgage-backed securities index 344 1,106 1 535 571 535 2049-2052

Asset-backed securities index 48 55 — 1 54 87 2045-2046

Other 1 2,570 2,570 3 2,567 5,451 2014-2025

Total credit derivatives $ 1,532 19,501 9,441 10,397 9,104 12,917

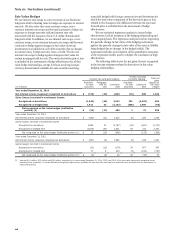

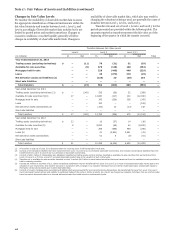

Protection sold represents the estimated maximum

exposure to loss that would be incurred under an assumed

hypothetical circumstance, where the value of our interests and

any associated collateral declines to zero, without any

consideration of recovery or offset from any economic hedges.

We believe this hypothetical circumstance to be an extremely

remote possibility and accordingly, this required disclosure is

not an indication of expected loss. The amounts under non-

investment grade represent the notional amounts of those credit

derivatives on which we have a higher risk of being required to

perform under the terms of the credit derivative and are a

function of the underlying assets.

We consider the risk of performance to be high if the

underlying assets under the credit derivative have an external

rating that is below investment grade or an internal credit

default grade that is equivalent thereto. We believe the net

protection sold, which is representative of the net notional

amount of protection sold and purchased with identical

underlyings, in combination with other protection purchased, is

more representative of our exposure to loss than either non-

investment grade or protection sold. Other protection purchased

represents additional protection, which may offset the exposure

to loss for protection sold, that was not purchased with an

identical underlying of the protection sold.

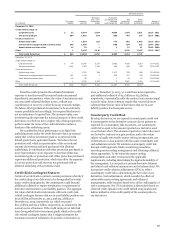

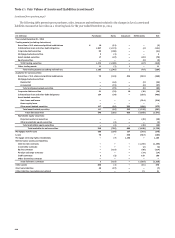

Credit-Risk Contingent Features

Certain of our derivative contracts contain provisions whereby if

the credit rating of our debt were to be downgraded by certain

major credit rating agencies, the counterparty could demand

additional collateral or require termination or replacement of

derivative instruments in a net liability position. The aggregate

fair value of all derivative instruments with such credit-risk-

related contingent features that are in a net liability position was

$13.6 billion at December 31, 2014, and $14.3 billion at

December 31, 2013, respectively, for which we posted

$10.5 billion and $12.2 billion, respectively, in collateral in the

normal course of business. If the credit rating of our debt had

been downgraded below investment grade, which is the credit-

risk-related contingent feature that if triggered requires the

maximum amount of collateral to be posted, on December 31,

2014, or December 31, 2013, we would have been required to

post additional collateral of $3.1 billion or $2.5 billion,

respectively, or potentially settle the contract in an amount equal

to its fair value. Some contracts require that we provide more

collateral than the fair value of derivatives that are in a net

liability position if a downgrade occurs.

Counterparty Credit Risk

By using derivatives, we are exposed to counterparty credit risk

if counterparties to the derivative contracts do not perform as

expected. If a counterparty fails to perform, our counterparty

credit risk is equal to the amount reported as a derivative asset

on our balance sheet. The amounts reported as a derivative asset

are derivative contracts in a gain position, and to the extent

subject to legally enforceable master netting arrangements, net

of derivatives in a loss position with the same counterparty and

cash collateral received. We minimize counterparty credit risk

through credit approvals, limits, monitoring procedures,

executing master netting arrangements and obtaining collateral,

where appropriate. To the extent the master netting

arrangements and other criteria meet the applicable

requirements, including determining the legal enforceability of

the arrangement, it is our policy to present derivative balances

and related cash collateral amounts net on the balance sheet. We

incorporate credit valuation adjustments (CVA) to reflect

counterparty credit risk in determining the fair value of our

derivatives. Such adjustments, which consider the effects of

enforceable master netting agreements and collateral

arrangements, reflect market-based views of the credit quality of

each counterparty. Our CVA calculation is determined based on

observed credit spreads in the credit default swap market and

indices indicative of the credit quality of the counterparties to

our derivatives.

211