Wells Fargo 2014 Annual Report Download - page 209

Download and view the complete annual report

Please find page 209 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

using counterparty specific credit risk limits, using master traded markets are settled through a central clearing

netting arrangements and obtaining collateral. Derivative organization and are excluded from this percentage. In addition

contracts executed in over-the-counter markets include bilateral to the netting amounts included in the table, we also have

contractual arrangements that are not cleared through a central balance sheet netting related to resale and repurchase

clearing organization but are typically subject to master netting agreements that are disclosed within Note 14 (Guarantees,

arrangements. The percentage of our bilateral derivative Pledged Assets and Collateral).

transactions outstanding at period end in such markets, based

on gross fair value, is provided within the following table. Other

derivative contracts executed in over-the-counter or exchange-

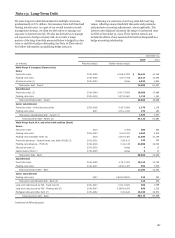

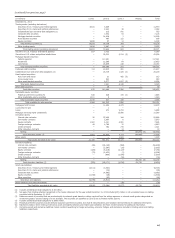

Gross Gross amounts

amounts not offset in

offset in consolidated Percent

Gross consolidated Net amounts in balance sheet exchanged in

amounts balance consolidated (Disclosure-only Net over-the-counter

(in millions) recognized sheet (1) balance sheet (2) netting) (3) amounts market (4)

December 31, 2014

Derivative assets

Interest rate contracts $ 63,698 (56,051) 7,647 (769) 6,878 45%

Commodity contracts 7,461 (1,233) 6,228 (72) 6,156 27

Equity contracts 9,005 (2,842) 6,163 (405) 5,758 54

Foreign exchange contracts 7,404 (4,923) 2,481 (85) 2,396 98

Credit contracts-protection sold 151 (131) 20 — 20 90

Credit contracts-protection purchased 755 (689) 66 (1) 65 100

Total derivative assets $ 88,474 (65,869) 22,605 (1,332) 21,273

Derivative liabilities

Interest rate contracts $ 60,059 (54,394) 5,665 (4,244) 1,421 44%

Commodity contracts 7,702 (1,459) 6,243 (33) 6,210 81

Equity contracts 7,038 (2,845) 4,193 (484) 3,709 82

Foreign exchange contracts 7,827 (5,511) 2,316 (270) 2,046 100

Credit contracts-protection sold 943 (713) 230 (199) 31 100

Credit contracts-protection purchased 168 (121) 47 (18) 29 86

Other contracts 44 — 44 — 44 100

Total derivative liabilities $ 83,781 (65,043) 18,738 (5,248) 13,490

December 31, 2013

Derivative assets

Interest rate contracts $ 55,846 (48,271) 7,575 (1,101) 6,474 65 %

Commodity contracts 2,673 (659) 2,014 (72) 1,942 52

Equity contracts 7,824 (3,254) 4,570 (239) 4,331 81

Foreign exchange contracts 4,843 (3,567) 1,276 (9) 1,267 100

Credit contracts-protection sold 354 (302) 52 — 52 92

Credit contracts-protection purchased 1,147 (841) 306 (33) 273 100

Other contracts 13 — 13 — 13 100

Total derivative assets $ 72,700 (56,894) 15,806 (1,454) 14,352

Derivative liabilities

Interest rate contracts $ 56,538 (53,902) 2,636 (482) 2,154 66 %

Commodity contracts 2,603 (952) 1,651 (11) 1,640 73

Equity contracts 7,794 (3,502) 4,292 (124) 4,168 94

Foreign exchange contracts 4,508 (3,652) 856 — 856 100

Credit contracts-protection sold 1,532 (1,432) 100 — 100 100

Credit contracts-protection purchased 368 (299) 69 — 69 89

Other contracts 16 — 16 — 16 100

Total derivative liabilities $ 73,359 (63,739) 9,620 (617) 9,003

(1) Represents amounts with counterparties subject to enforceable master netting arrangements that have been offset in the consolidated balance sheet, including related cash

collateral and portfolio level counterparty valuation adjustments. Counterparty valuation adjustments were $266 million and $236 million related to derivative assets and

$56 million and $67 million related to derivative liabilities as of December 31, 2014 and 2013, respectively. Cash collateral totaled $5.2 billion and $4.6 billion, netted against

derivative assets and liabilities, respectively, at December 31, 2014, and $4.3 billion and $11.3 billion, respectively, at December 31, 2013.

(2) Net derivative assets of $16.9 billion and $14.4 billion are classified in Trading assets as of December 31, 2014 and 2013, respectively. $5.7 billion and $1.4 billion are

classified in Other assets in the consolidated balance sheet as of December 31, 2014 and 2013, respectively. Net derivative liabilities are classified in Accrued expenses and

other liabilities in the consolidated balance sheet.

(3) Represents the fair value of non-cash collateral pledged and received against derivative assets and liabilities with the same counterparty that are subject to enforceable

master netting arrangements. U.S. GAAP does not permit netting of such non-cash collateral balances in the consolidated balance sheet but requires disclosure of these

amounts.

(4) Represents derivatives executed in over-the-counter markets not settled through a central clearing organization. Over-the-counter percentages are calculated based on

Gross amounts recognized as of the respective balance sheet date. The remaining percentage represents derivatives settled through a central clearing organization, which

are executed in either over-the-counter or exchange-traded markets.

207