Wells Fargo 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

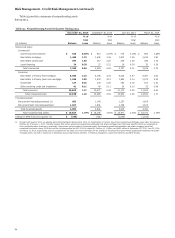

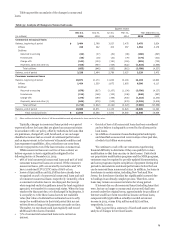

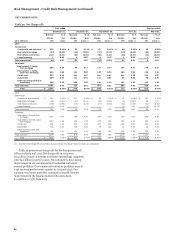

Risk Management - Credit Risk Management (continued)

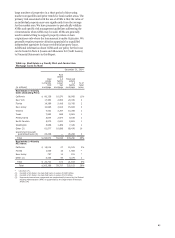

Table 34: Foreclosed Assets

Quarter ended

Dec 31, Sep 30, Jun 30, Mar 31, Year ended Dec 31,

(in millions) 2014 2014 2014 2014 2014 2013

Summary by loan segment

Government insured/guaranteed (1) $ 982 1,140 1,257 1,609 982 2,093

PCI loans:

Commercial 352 394 457 461 352 497

Consumer 212 214 208 177 212 149

Total PCI loans 564 608 665 638 564 646

All other loans:

Commercial 565 579 634 736 565 759

Consumer 498 504 449 439 498 439

Total all other loans 1,063 1,083 1,083 1,175 1,063 1,198

Total foreclosed assets $ 2,609 2,831 3,005 3,422 2,609 3,937

Analysis of changes in foreclosed assets

Balance, beginning of period $ 2,831 3,005 3,422 3,937 3,937 4,023

Net change in government insured/guaranteed (1)(2) (158) (117) (352) (484) (1,111) 584

Additions to foreclosed assets (3) 362 364 421 448 1,595 1,852

Reductions:

Sales (462) (421) (493) (490) (1,866) (2,673)

Write-downs and net gains (losses) on sales 36 — 7 11 54 151

Total reductions (426) (421) (486) (479) (1,812) (2,522)

Balance, end of period $ 2,609 2,831 3,005 3,422 2,609 3,937

(1) During fourth quarter 2014, we adopted Accounting Standards Update (ASU) 2014-14, Classification of Certain Government-Guaranteed Mortgage Loans Upon Foreclosure,

effective as of January 1, 2014. This ASU requires that government guaranteed residential real estate mortgage loans that meet specific criteria be recognized as other

receivables upon foreclosure; previously, these assets were included in foreclosed assets. Government guaranteed residential real estate mortgage loans that completed

foreclosure during 2014 and met the criteria specified by ASU 2014-14 totaled $1.5 billion, $1.1 billion, and $693 million at September 30, 2014, June 30, 2014, and

March 31, 2014, respectively, and are excluded from this table. For more information on the changes in foreclosures for government guaranteed residential real estate

mortgage loans, see Note 1 (Summary of Significant Accounting Policies) and Note 7 (Premises, Equipment, Lease Commitments and Other Assets).

(2) Foreclosed government insured/guaranteed loans are temporarily transferred to and held by us as servicer, until reimbursement is received from FHA or VA. The net change

in government insured/guaranteed foreclosed assets is made up of inflows from mortgages held for investment and MHFS, and outflows when we are reimbursed by FHA/

VA. Transfers from government insured/guaranteed loans to foreclosed assets amounted to $45 million, $41 million, $43 million, and $62 million for the quarters ended

December 31, September 30, June 30, and March 31, 2014 and $191 million and $2.9 billion for the years ended December 31, 2014 and 2013, respectively. The amounts

previously reported for the quarterly net change in government insured/guaranteed foreclosed assets have been revised to exclude $375 million, $409 million and

$693 million at September 30, 2014, June 30, 2014, and March 31, 2014, respectively, to reflect the impact of the adoption of ASU 2014-14.

(3) Predominantly include loans moved into foreclosure from nonaccrual status, PCI loans transitioned directly to foreclosed assets and repossessed automobiles.

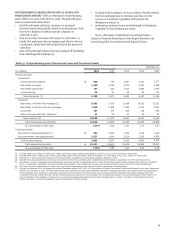

Foreclosed assets at December 31, 2014, included

$1.6 billion of foreclosed residential real estate that had

collateralized commercial and consumer loans, of which 59% is

predominantly FHA insured or VA guaranteed and expected to

have minimal or no loss content. The remaining foreclosed

assets balance of $1.0 billion has been written down to estimated

net realizable value. The decrease in foreclosed assets at

December 31, 2014, compared with December 31, 2013, was the

result of the adoption of ASU 2014-14, which requires that

government guaranteed residential real estate mortgage loans

that meet specific criteria be recognized as other receivables

upon foreclosure (previously, these were included in foreclosed

assets). Of the $2.6 billion in foreclosed assets at December 31,

2014, 33% have been in the foreclosed assets portfolio one year

or less.

76