Wells Fargo 2014 Annual Report Download - page 148

Download and view the complete annual report

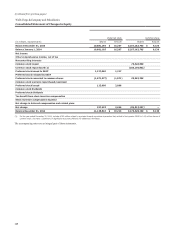

Please find page 148 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 1: Summary of Significant Accounting Policies (continued)

benefit payments for our plans. Such portfolios are derived from

a broad-based universe of high quality corporate bonds as of the

measurement date.

Our determination of the reasonableness of our expected

long-term rate of return on plan assets is highly quantitative by

nature. We evaluate the current asset allocations and expected

returns under two sets of conditions: projected returns using

several forward-looking capital market assumptions, and

historical returns for the main asset classes dating back to 1970

or the earliest period for which historical data was readily

available for the asset classes included. Using long term

historical data allows us to capture multiple economic

environments, which we believe is relevant when using historical

returns. We place greater emphasis on the forward-looking

return and risk assumptions than on historical results. We use

the resulting projections to derive a base line expected rate of

return and risk level for the Cash Balance Plan’s prescribed asset

mix. We evaluate the portfolio based on: (1) the established

target asset allocations over short term (one-year) and longer

term (ten-year) investment horizons, and (2) the range of

potential outcomes over these horizons within specific standard

deviations. We perform the above analyses to assess the

reasonableness of our expected long-term rate of return on plan

assets. We consider the expected rate of return to be a long-term

average view of expected returns. The use of an expected long

term rate of return on plan assets may cause us to recognize

pension income returns that are greater or less than the actual

returns of plan assets in any given year. Differences between

expected and actual returns in each year, if any, are included in

our net actuarial gain or loss amount, which is recognized in

OCI. We generally amortize net actuarial gain or loss in excess of

a 5% corridor from accumulated OCI into net periodic pension

cost over the estimated average remaining participation period,

which at December 31, 2014, is 21 years. See Note 20 (Employee

Benefits and Other Expenses) for additional information on our

pension accounting.

Income Taxes

We file consolidated and separate company federal income tax

returns, foreign tax returns and various combined and separate

company state tax returns.

We evaluate two components of income tax expense:

current and deferred. Current income tax expense represents our

estimated taxes to be paid or refunded for the current period and

includes income tax expense related to our uncertain tax

positions. We determine deferred income taxes using the

balance sheet method. Under this method, the net deferred tax

asset or liability is based on the tax effects of the differences

between the book and tax bases of assets and liabilities, and

recognizes enacted changes in tax rates and laws in the period in

which they occur. Deferred income tax expense results from

changes in deferred tax assets and liabilities between periods.

Deferred tax assets are recognized subject to management's

judgment that realization is “more likely than not.” Uncertain tax

positions that meet the more likely than not recognition

threshold are measured to determine the amount of benefit to

recognize. An uncertain tax position is measured at the largest

amount of benefit that management believes has a greater than

50% likelihood of realization upon settlement. Tax benefits not

meeting our realization criteria represent unrecognized tax

benefits. Foreign taxes paid are generally applied as credits to

reduce federal income taxes payable. We account for interest and

penalties as a component of income tax expense.

Stock-Based Compensation

We have stock-based employee compensation plans as more

fully discussed in Note 19 (Common Stock and Stock Plan). Our

Long-Term Incentive Compensation Plan provides for awards of

incentive and nonqualified stock options, stock appreciation

rights, restricted shares, restricted share rights (RSRs),

performance share awards (PSAs) and stock awards without

restrictions. For most awards, we measure the cost of employee

services received in exchange for an award of equity

instruments, such as stock options, RSRs or PSAs, based on the

fair value of the award on the grant date. The cost is normally

recognized in our income statement over the vesting period of

the award; awards with graded vesting are expensed on a

straight line method. Awards that continue to vest after

retirement are expensed over the shorter of the period of time

between the grant date and the final vesting period or between

the grant date and when a team member becomes retirement

eligible; awards to team members who are retirement eligible at

the grant date are subject to immediate expensing upon grant.

Beginning in 2013, certain RSRs and all PSAs granted

include discretionary performance based vesting conditions and

are subject to variable accounting. For these awards, the

associated compensation expense fluctuates with changes in our

stock price. For PSAs, compensation expense also fluctuates

based on the estimated outcome of meeting the performance

conditions.

Earnings Per Common Share

We compute earnings per common share by dividing net income

(after deducting dividends on preferred stock) by the average

number of common shares outstanding during the year. We

compute diluted earnings per common share by dividing net

income (after deducting dividends and related accretion on

preferred stock) by the average number of common shares

outstanding during the year, plus the effect of common stock

equivalents (for example, stock options, restricted share rights,

convertible debentures and warrants) that are dilutive.

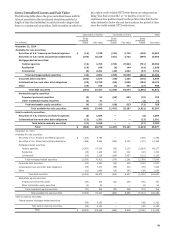

Fair Value of Financial Instruments

We use fair value measurements in our fair value disclosures and

to record certain assets and liabilities at fair value on a recurring

basis, such as trading assets, or on a nonrecurring basis such as

measuring impairment on assets carried at amortized cost.

DETERMINATION OF FAIR VALUE We base our fair values on

the price that would be received to sell an asset or paid to

transfer a liability in an orderly transaction between market

participants at the measurement date. These fair value

measurements are based on exit prices and determined by

maximizing the use of observable inputs. However, for certain

instruments we must utilize unobservable inputs in determining

fair value due to the lack of observable inputs in the market,

which requires greater judgment in measuring fair value.

In instances where there is limited or no observable market

data, fair value measurements for assets and liabilities are based

primarily upon our own estimates or combination of our own

estimates and third-party vendor or broker pricing, and the

measurements are often calculated based on current pricing for

products we offer or issue, the economic and competitive

environment, the characteristics of the asset or liability and

other such factors. As with any valuation technique used to

estimate fair value, changes in underlying assumptions used,

including discount rates and estimates of future cash flows,

could significantly affect the results of current or future values.

146