Wells Fargo 2014 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Risk Management - Asset/Liability Management (continued)

Incremental Risk Charge according to the market risk capital

rule, must capture losses due to both issuer default and

migration risk at the 99.9% confidence level over the one-year

capital horizon under the assumption of constant level of risk or

a constant position assumption. The model covers all non-

securitized credit-sensitive products.

The Company calculates Incremental Risk by generating a

portfolio loss distribution using Monte Carlo simulation, which

assumes numerous scenarios, where an assumption is made that

the portfolio’s composition remains constant for a one-year time

horizon. Individual issuer credit grade migration and issuer

default risk is modeled through generation of the issuer’s credit

rating transition based upon statistical modeling. Correlation

between credit grade migration and default is captured by a

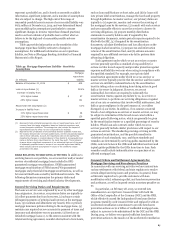

Table 51: Market Risk Regulatory Capital Modeled Components

multifactor proprietary model which takes into account industry

classifications as well as regional effects. Additionally, the

impact of market and issuer specific concentrations is reflected

in the modeling framework by assignment of a higher charge for

portfolios that have increasing concentrations in particular

issuers or sectors. Lastly, the model captures product basis risk;

that is, it reflects the material disparity between a position and

its hedge.

Table 51 provides information on the Incremental Risk

Charge results for the quarter ended December 31, 2014. For this

charge, the required capital at quarter end equals the average for

the quarter.

Quarter ended December 31, 2014 December 31, 2014

Risk- Risk-

Quarter based weighted

(in millions) Average Low High end capital (1) assets (1)

Total VaR $ 49 39 83 50 146 1,822

Total Stressed VaR 490 440 571 480 1,469 18,359

Incremental Risk Charge 345 310 382 338 345 4,317

(1) Represents the required component amount for market risk based upon the respective VaR and Incremental Risk Charge requirements.

Securitized Products Charge Basel III requires a separate

market risk capital charge for positions classified as a

securitization or re-securitization. The primary criteria for

classification as a securitization are whether there is a transfer of

risk and whether the credit risk associated with the underlying

exposures has been separated into at least two tranches

reflecting different levels of seniority. Covered trading

securitizations positions include consumer and commercial

asset-backed securities (ABS), commercial mortgage-backed

securities (CMBS), residential mortgage-backed securities

(RMBS), and collateralized loan and other debt obligations

(CLO/CDO) positions. The securitization capital requirements

are the greater of the capital requirements of the net long or

short exposure, and are capped at the maximum loss that could

be incurred on any given transaction. Table 52 shows the

aggregate net fair market value of securities and derivative

securitization positions by exposure type that meet the

regulatory definition of a covered trading securitization position

at December 31, 2014 and 2013.

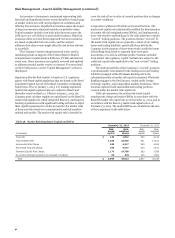

Table 52: Covered Securitization Positions by Exposure Type

(Market Value)

(in millions)

December 31, 2014

ABS CMBS RMBS CLO/CDO

Securitization exposure:

Securities

Derivatives

Total

$ 752

(1)

751

709

5

714

689

23

712

553

(31)

522

December 31, 2013

Securitization Exposure:

Securities

Derivatives

Total $

604

(2)

602

559

2

561

479

16

495

561

(72)

489

SECURITIZATION DUE DILIGENCE AND RISK MONITORING The

market risk capital rule requires that the Company conduct due

diligence on the risk of each position within three days of the

purchase of a securitization position. The Company's due

diligence on the creditworthiness of each position provides an

understanding of the features that would materially affect the

performance of a securitization or re-securitization. The due

diligence analysis is performed again on a quarterly basis for

each securitization and re-securitization position. The Company

uses an automated solution to track the due diligence associated

with securitization activity. The Company aims to manage the

risks associated with securitization and re-securitization

positions through the use of offsetting positions and portfolio

diversification.

Standardized Specific Risk Charge For debt and equity positions

that are not evaluated by the approved internal specific risk

models, a regulatory prescribed standard specific risk charge is

applied. The standard specific risk add-on for sovereign entities,

public sector entities, and depository institutions is based on the

Organization for Economic Co-operation and Development

(OECD) country risk classifications (CRC) and the remaining

contractual maturity of the position. These risk add-ons for debt

positions range from 0.25% to 12%. The add-on for corporate

debt is based on creditworthiness and the remaining contractual

maturity of the position. All other types of debt positions are

subject to an 8% add-on. The standard specific risk add-on for

equity positions is generally 8%.

Comprehensive Risk Charge / Correlation Trading The market

risk capital rule requires capital for correlation trading positions.

The Company's remaining correlation trading exposure covered

under the market risk capital rule matured in fourth quarter

2014.

VaR Backtesting The market risk capital rule requires

backtesting as one form of validation of the VaR model.

Backtesting is a comparison of the daily VaR estimate with the

actual clean profit and loss (clean P&L) as defined by the market

94