Wells Fargo 2014 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

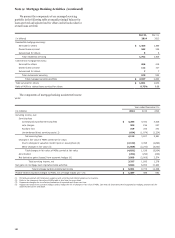

to fund ongoing vehicle sales operations. The third party auto

financing institutions manage the collateral in the VIEs, which is

indicative of power in them and we therefore do not consolidate

these VIEs.

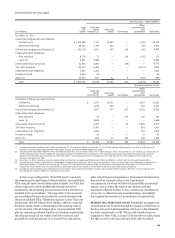

TAX CREDIT STRUCTURES We co-sponsor and make

investments in affordable housing and sustainable energy

projects that are designed to generate a return primarily through

the realization of federal tax credits. In some instances, our

investments in these structures may require that we fund future

capital commitments at the discretion of the project sponsors.

While the size of our investment in a single entity may at times

exceed 50% of the outstanding equity interests, we do not

consolidate these structures due to the project sponsor’s ability

to manage the projects, which is indicative of power in them.

INVESTMENT FUNDS We do not consolidate the investment

funds because we do not absorb the majority of the expected

future variability associated with the funds’ assets, including

variability associated with credit, interest rate and liquidity risks.

OTHER TRANSACTIONS WITH VIEs Auction rate securities

(ARS) are debt instruments with long-term maturities, which re-

price more frequently, and preferred equities with no maturity.

At December 31, 2014, we held in our available-for-sale

securities portfolio $567 million of ARS issued by VIEs

compared with $653 million at December 31, 2013. We acquired

the ARS pursuant to agreements entered into in 2008 and 2009.

We do not consolidate the VIEs that issued the ARS because

we do not have power over the activities of the VIEs.

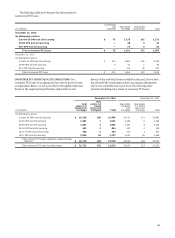

TRUST PREFERRED SECURITIES VIEs that we wholly own

issue debt securities or preferred equity to third party investors.

All of the proceeds of the issuance are invested in debt securities

or preferred equity that we issue to the VIEs. The VIEs’

operations and cash flows relate only to the issuance,

administration and repayment of the securities held by third

parties. We do not consolidate these VIEs because the sole assets

of the VIEs are receivables from us, even though we own all of

the voting equity shares of the VIEs, have fully guaranteed the

obligations of the VIEs and may have the right to redeem the

third party securities under certain circumstances. In our

consolidated balance sheet at December 31, 2014 and December

31, 2013, we reported the debt securities issued to the VIEs as

long-term junior subordinated debt with a carrying value of

$2.1 billion and $1.9 billion, respectively, and the preferred

equity securities issued to the VIEs as preferred stock with a

carrying value of $2.5 billion at both dates. These amounts are in

addition to the involvements in these VIEs included in the

preceding table.

In 2013, we redeemed $2.8 billion of trust preferred

securities that will no longer count as Tier 1 capital under the

Dodd-Frank Act and the Basel Committee recommendations

known as the Basel III standards.

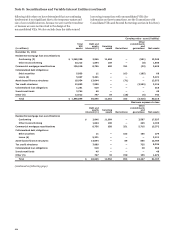

Securitization Activity Related to Unconsolidated

VIEs

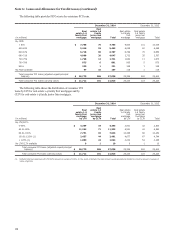

We use VIEs to securitize consumer and CRE loans and other

types of financial assets. We typically retain the servicing rights

from these sales and may continue to hold other beneficial

interests in the VIEs. We may also provide liquidity to investors

in the beneficial interests and credit enhancements in the form

of standby letters of credit. Through these securitizations we

may be exposed to liability under limited amounts of recourse as

well as standard representations and warranties we make to

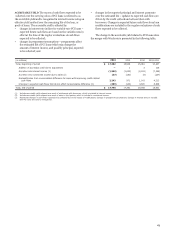

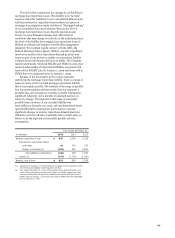

purchasers and issuers. The following table presents the cash

flows with our securitization trusts that were involved in

transfers accounted for as sales.

Year ended December 31,

2014 2013

Other Other Other

Mortgage financial Mortgage financial Mortgage financial

(in millions) loans assets loans assets loans assets

Sales proceeds from securitizations $ 164,331 — 357,807 — 535,372 —

Fees from servicing rights retained 4,062 8 4,240 10 4,433 10

Cash flows from other interests held (1) 1,417 75 2,284 93 1,767 135

Purchases of delinquent assets 6 — 18 — 62 —

Servicing advances, net of repayments (170) — (34) — 226 —

(1) Cash flows from other interests held include principal and interest payments received on retained bonds and excess cash flows received on interest-only strips.

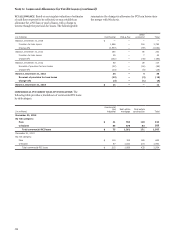

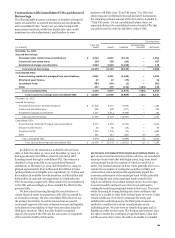

In 2014, 2013, and 2012, we recognized net gains of

$288 million, $149 million and $518 million, respectively, from

transfers accounted for as sales of financial assets in

securitizations. These net gains primarily relate to commercial

mortgage securitizations and residential mortgage

securitizations where the loans were not already carried at fair

value.

Sales with continuing involvement during 2014, 2013 and

2012 predominantly related to securitizations of residential

mortgages that are sold to the GSEs, including FNMA, FHLMC

and GNMA (conforming residential mortgage securitizations).

During 2014, 2013 and 2012 we transferred $155.8 billion,

$343.9 billion and $517.3 billion respectively, in fair value of

conforming residential mortgages to unconsolidated VIEs and

recorded the transfers as sales. Substantially all of these

transfers did not result in a gain or loss because the loans were

already carried at fair value. In connection with all of these

transfers, in 2014 we recorded a $1.2 billion servicing asset,

measured at fair value using a Level 3 measurement technique,

available-for-sale securities of $751 million, classified as Level 2,

and a $44 million liability for repurchase losses which reflects

management’s estimate of probable losses related to various

representations and warranties for the loans transferred, initially

measured at fair value. In 2013, we recorded a $3.5 billion

servicing asset and a $143 million liability. In 2012, we recorded

a $4.9 billion servicing asset and a $275 million liability.

2012

185