Wells Fargo 2014 Annual Report Download - page 263

Download and view the complete annual report

Please find page 263 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

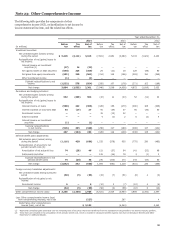

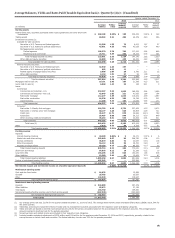

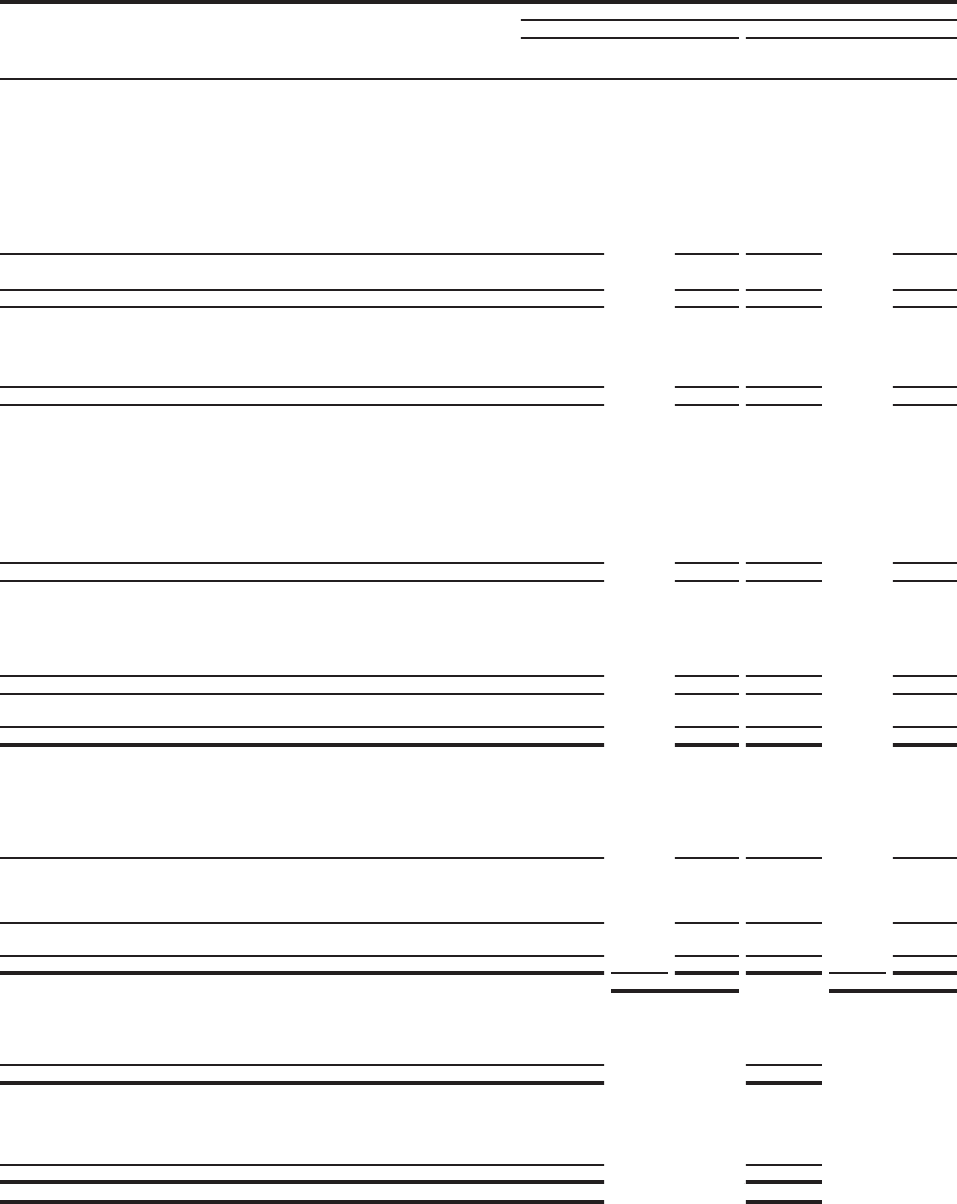

Average Balances, Yields and Rates Paid (Taxable-Equivalent basis) - Quarterly (1)(2) - (Unaudited)

Quarter ended December 31,

2014 2013

Interest Interest

Average Yields/ income/ Average Yields/ income/

(in millions) balance rates expense balance rates expense

Earning assets

Federal funds sold, securities purchased under resale agreements and other short-term

investments $ 268,109 0.28% $ 188 205,276 0.28% $ 148

Trading assets 60,383 3.21 485 45,379 3.40 386

Investment securities (3):

Available-for-sale securities:

Securities of U.S. Treasury and federal agencies 19,506 1.55 76 6,611 1.67 27

Securities of U.S. states and political subdivisions 43,891 4.30 472 42,025 4.38 460

Mortgage-backed securities:

Federal agencies 109,270 2.78 760 117,910 2.94 866

Residential and commercial 24,711 5.89 364 29,233 6.35 464

Total mortgage-backed securities 133,981 3.36 1,124 147,143 3.62 1,330

Other debt and equity securities 44,980 3.87 438 55,325 3.43 478

Total available-for-sale securities 242,358 3.48 2,110 251,104 3.65 2,295

Held-to-maturity securities:

Securities of U.S. Treasury and federal agencies 32,930 2.25 187 — — —

Securities of U.S. states and political subdivisions 902 4.92 11 — — —

Federal agency mortgage-backed securities 5,586 2.07 29 2,780 3.11 22

Other debt securities 6,118 1.81 27 65 1.99 —

Total held-to-maturity securities 45,536 2.22 254 2,845 3.09 22

Total investment securities 287,894 3.28 2,364 253,949 3.65 2,317

Mortgages held for sale (4) 19,191 3.90 187 21,396 4.13 221

Loans held for sale (4) 6,968 1.43 25 138 8.21 3

Loans:

Commercial:

Commercial and industrial - U.S. 218,297 3.32 1,825 189,939 3.54 1,696

Commercial and industrial - Non U.S. 43,049 2.03 221 41,062 1.88 194

Real estate mortgage 112,277 3.69 1,044 110,674 3.90 1,087

Real estate construction 18,336 4.33 200 16,744 4.76 201

Lease financing 12,268 5.35 164 12,085 5.68 171

Total commercial 404,227 3.39 3,454 370,504 3.59 3,349

Consumer:

Real estate 1-4 family first mortgage 264,799 4.16 2,754 257,265 4.15 2,672

Real estate 1-4 family junior lien mortgage 60,177 4.28 648 66,809 4.29 721

Credit card 29,477 11.71 870 25,865 12.23 798

Automobile 55,457 6.08 849 50,213 6.70 849

Other revolving credit and installment 35,292 6.01 534 42,662 4.94 531

Total consumer

Total loans (4)

445,202

849,429

5.06

4.27

5,655

9,109

442,814

813,318

5.01

4.36

5,571

8,920

Other

Total earning assets

4,829

$ 1,496,803

5.30

3.31%

64

$ 12,422

4,728

1,344,184

5.22

3.57%

61

$ 12,056

Funding sources

Deposits:

Interest-bearing checking $ 40,498 0.06% $ 6 35,171 0.07% $ 6

Market rate and other savings 593,940 0.07 99 568,750 0.08 110

Savings certificates 35,870 0.80 72 43,067 0.94 102

Other time deposits 56,119 0.39 55 39,700 0.48 47

Deposits in foreign offices 99,289 0.15 37 86,333 0.15 32

Total interest-bearing deposits 825,716 0.13 269 773,021 0.15 297

Short-term borrowings 64,676 0.12 19 52,286 0.12 15

Long-term debt 183,286 1.35 620 153,470 1.65 635

Other liabilities 15,580 2.44

0.37

—

0.27

3.04%

96

1,004

—

1,004

$ 11,418

12,822

991,599

352,585

1,344,184

15,998

25,637

119,947

2.70

0.42

—

0.30

3.27%

87

1,034

—

1,034

$ 11,022

Total interest-bearing liabilities

Portion of noninterest-bearing funding sources

Total funding sources

Net interest margin and net interest income on a taxable-equivalent basis (5)

Noninterest-earning assets

Cash and due from banks

Goodwill

Other

1,089,258

407,545

$ 1,496,803

$ 16,932

25,705

124,320

Total noninterest-earning assets $ 166,957 161,582

Noninterest-bearing funding sources

Deposits $ 324,080 287,379

Other liabilities 65,672 57,138

Total equity 184,750 169,650

Noninterest-bearing funding sources used to fund earning assets (407,545) (352,585)

Net noninterest-bearing funding sources $ 166,957 161,582

Total assets $ 1,663,760 1,505,766

(1) Our average prime rate was 3.25% for the quarters ended December 31, 2014 and 2013. The average three-month London Interbank Offered Rate (LIBOR) was 0.24% for

the same quarters.

(2) Yield/rates and amounts include the effects of hedge and risk management activities associated with the respective asset and liability categories.

(3) Yields and rates are based on interest income/expense amounts for the period, annualized based on the accrual basis for the respective accounts. The average balance

amounts represent amortized cost for the periods presented.

(4) Nonaccrual loans and related income are included in their respective loan categories.

(5) Includes taxable-equivalent adjustments of $238 million and $219 million for the quarters ended December 31, 2014 and 2013, respectively, primarily related to tax-

exempt income on certain loans and securities. The federal statutory tax rate was 35% for the periods presented.

261