Wells Fargo 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Operational Risk Management

Operational risk is the risk of loss resulting from inadequate or

failed internal controls and processes, people and systems, or

resulting from external events. These losses may be caused by

events such as fraud, breaches of customer privacy, business

disruptions, inappropriate employee behavior, vendors that do

not perform their responsibilities and regulatory fines and

penalties.

To address these risks, Wells Fargo maintains an

operational risk management framework that includes the

following objectives:

• Provide a structured approach for identifying, measuring,

managing, reporting, and monitoring operational risks

across all areas of Wells Fargo;

• Understand operational risk across the Company by

establishing and maintaining an effective operational risk

management program;

• Adequately control operational risk-related losses;

• Establish and hold an appropriate level of capital for such

losses in accordance with regulatory guidance; and

• Support the Board as it carries out its oversight duties and

responsibilities relating to management’s establishment of

an effective operational risk management program.

Wells Fargo’s operational risk management program seeks

to accomplish these objectives by managing operational risk

across the Company in a comprehensive, interconnected, and

consistent manner, in line with the enterprise statement of risk

appetite and relevant regulatory requirements.

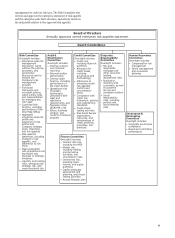

The Audit & Examination Committee of the Board (A&E

Committee) has primary responsibility for oversight of

operational risk. In this capacity it reviews and approves the

operational risk management framework and significant

supporting risk policies and programs, including the

Company’s business continuity, information security, and third

party risk management policies and programs. The A&E

Committee periodically reviews updates from management on

the state of operational risk and the general condition of

operational risk management in the Company.

At the management level, the Operational Risk

Management Committee oversees operational risk

management across the Company and informs and advises the

Chief Operational Risk Officer on matters that affect the

Company's operational risk profile.

Information security is a significant operational risk for

financial institutions such as Wells Fargo, and includes the risk

of losses resulting from cyber attacks. Wells Fargo and other

financial institutions continue to be the target of various

evolving and adaptive cyber attacks, including malware and

denial-of-service, as part of an effort to disrupt the operations

of financial institutions, potentially test their cybersecurity

capabilities, or obtain confidential, proprietary or other

information. Wells Fargo has not experienced any material

losses relating to these or other cyber attacks. Addressing

cybersecurity risks is a priority for Wells Fargo, and we

continue to develop and enhance our controls, processes and

systems in order to protect our networks, computers, software

and data from attack, damage or unauthorized access. We are

also proactively involved in industry cybersecurity efforts and

working with other parties, including our third-party service

providers and governmental agencies, to continue to enhance

defenses and improve resiliency to cybersecurity threats. See

the “Risk Factors” section in this Report for additional

information regarding the risks associated with a failure or

breach of our operational or security systems or infrastructure,

including as a result of cyber attacks.

57