Wells Fargo 2014 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

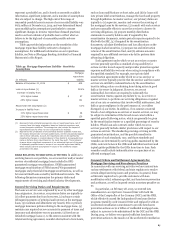

RWA Rollforward Table 49 depicts the changes in the market

risk regulatory capital and RWAs under Basel III for the full year

and fourth quarter of 2014.

Table 49: Analysis of Changes in Market Risk Regulatory

Capital and RWAs

(in millions)

Balance, December 31, 2013

Total VaR

Total Stressed VaR

Incremental Risk Charge

Securitized Products Charge

Standardized Specific Risk Charge

De minimis Charges

Balance, December 31, 2014

$

$

Risk-

based

capital

2,907

(106)

548

(48)

133

594

(59)

3,969

Risk-

weighted

assets

36,339

(1,327)

6,847

(596)

1,664

7,420

(734)

49,613

Balance, September 30, 2014

Total VaR

Total Stressed VaR

Incremental Risk Charge

Securitized Products Charge

Standardized Specific Risk Charge

De minimis Charges

Balance, December 31, 2014

$

$

4,089

(97)

110

(23)

18

(120)

(8)

3,969

51,117

(1,215)

1,370

(284)

227

(1,500)

(102)

49,613

The increase in standardized specific risk charge for risk-

based capital and RWAs in 2014 resulted primarily from a

change during the quarter ended March 31, 2014, in positions

now subject to standardized specific risk charges. All changes to

market risk regulatory capital and RWAs in the quarter ended

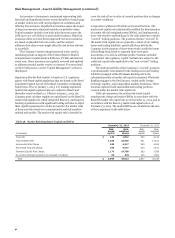

Table 50: Regulatory 10-Day 99% General VaR by Risk Category

December 31, 2014, were associated with changes in positions

due to normal trading activity.

Regulatory Market Risk Capital Components The capital

required for market risk on the Company’s “covered” positions is

determined by internally developed models or standardized

specific risk charges. The market risk regulatory capital models

are subject to internal model risk management and validation.

The models are continuously monitored and enhanced in

response to changes in market conditions, improvements in

system capabilities, and changes in the Company’s market risk

exposure. The Company is required to obtain and has received

prior written approval from its regulators before using its

internally developed models to calculate the market risk capital

charge.

Basel III prescribes various VaR measures in the

determination of regulatory capital and risk-weighted assets.

The Company uses the same VaR models for both market risk

management purposes as well as regulatory capital calculations.

For regulatory purposes, we use the following metrics to

determine the Company’s market risk capital requirements:

General VaR measures the risk of broad market movements such

as changes in the level of credit spreads, interest rates, equity

prices, commodity prices, and foreign exchange rates. General

VaR uses historical simulation analysis based on 99% confidence

level and a 10-day time horizon.

Table 50 shows the General VaR measure categorized by

major risk categories. Average 10-day General VaR was

$36 million for the quarter ended December 31, 2014, compared

with $29 million for the quarter ended September 30, 2014. The

increase was primarily driven by changes in portfolio

composition.

Quarter ended

December 31, 2014 September 30, 2014

Period Period

(in millions) end Average Low High end Average Low High

Wholesale General VaR Risk Categories

Credit $ 34 45 34 52 47 43 25 74

Interest rate 66 68 48 96 73 79 63 103

Equity 9 10 4 16 10 7 4 11

Commodity 3 3 1 7 3 4 2 9

Foreign exchange 4 3 1 11 2 4 1 16

Diversification benefit (1) (81) (92) (102) (107)

Wholesale General VaR $ 35 37 22 54 33 30 20 44

Company General VaR 35 36 23 54 33 29 19 42

(1) The period-end VaR was less than the sum of the VaR components described above, which is due to portfolio diversification. The diversification effect arises because the

risks are not perfectly correlated causing a portfolio of positions to usually be less risky than the sum of the risks of the positions alone. The diversification benefit is not

meaningful for low and high metrics since they may occur on different days.

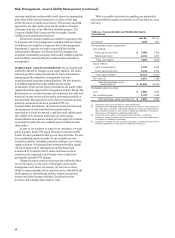

Specific Risk measures the risk of loss that could result from Total Stressed VaR (as presented in Table 51) uses a historical

factors other than broad market movements, or name-specific period of significant financial stress over a continuous 12 month

market risk. Specific Risk uses Monte Carlo simulation analysis period using historically available market data and is composed

based on a 99% confidence level and a 10-day time horizon. of Stressed General VaR and Stressed Specific Risk. Total

Stressed VaR uses the same methodology and models as Total

Total VaR (as presented in Table 51) is composed of General VaR VaR.

and Specific Risk and uses the previous 12 months of historical

market data to comply with regulatory requirements.

93