Wells Fargo 2014 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(continued from previous page)

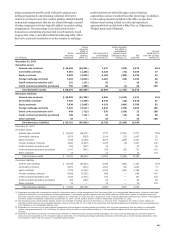

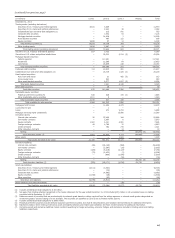

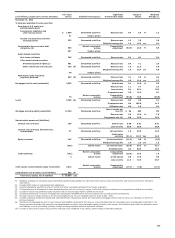

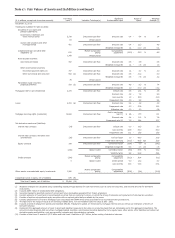

(in millions) Level 1 Level 2 Level 3 Netting Total

December 31, 2013

Trading assets (excluding derivatives)

Securities of U.S. Treasury and federal agencies 8,301 3,669 — — 11,970

Securities of U.S. states and political subdivisions — 2,043 39 — 2,082

Collateralized loan and other debt obligations (1) — 212 541 — 753

Corporate debt securities — 7,052 53 — 7,105

Mortgage-backed securities — 14,608 1 — 14,609

Asset-backed securities — 487 122 — 609

Equity securities 5,908 87 13 — 6,008

Total trading securities (2) 14,209 28,158 769 — 43,136

Other trading assets 2,694 2,487 54 — 5,235

Total trading assets (excluding derivatives) 16,903 30,645 823 — 48,371

Securities of U.S. Treasury and federal agencies 557 5,723 — — 6,280

Securities of U.S. states and political subdivisions — 39,322 3,214 (3) — 42,536

Mortgage-backed securities:

Federal agencies — 117,591 — — 117,591

Residential — 12,389 64 — 12,453

Commercial — 18,609 138 — 18,747

Total mortgage-backed securities — 148,589 202 — 148,791

Corporate debt securities 113 20,833 281 — 21,227

Collateralized loan and other debt obligations (4) — 18,739 1,420 (3) — 20,159

Asset-backed securities:

Auto loans and leases — 21 492 (3) — 513

Home equity loans — 843 — — 843

Other asset-backed securities — 6,577 1,657 (3) — 8,234

Total asset-backed securities — 7,441 2,149 — 9,590

Other debt securities — 39 — — 39

Total debt securities 670 240,686 7,266 — 248,622

Marketable equity securities:

Perpetual preferred securities (5) 508 628 729 (3) — 1,865

Other marketable equity securities 1,511 9 — — 1,520

Total marketable equity securities 2,019 637 729 — 3,385

Total available-for-sale securities 2,689 241,323 7,995 — 252,007

Mortgages held for sale — 11,505 2,374 — 13,879

Loans held for sale — 1 — — 1

Loans — 272 5,723 — 5,995

Mortgage servicing rights (residential) — — 15,580 — 15,580

Derivative assets:

Interest rate contracts 36 55,466 344 — 55,846

Commodity contracts — 2,667 6 — 2,673

Equity contracts 1,522 4,221 2,081 — 7,824

Foreign exchange contracts 44 4,789 10 — 4,843

Credit contracts — 782 719 — 1,501

Other derivative contracts — — 13 — 13

Netting — — — (56,894) (6) (56,894)

Total derivative assets (7) 1,602 67,925 3,173 (56,894) 15,806

Other assets — — 1,503 — 1,503

Total assets recorded at fair value 21,194 351,671 37,171 (56,894) 353,142

Derivative liabilities:

Interest rate contracts (26) (56,128) (384) — (56,538)

Commodity contracts — (2,587) (16) — (2,603)

Equity contracts (449) (5,218) (2,127) — (7,794)

Foreign exchange contracts (75) (4,432) (1) — (4,508)

Credit contracts — (806) (1,094) — (1,900)

Other derivative contracts — — (16) — (16)

Netting — — — 63,739 (6) 63,739

Total derivative liabilities (7) (550) (69,171) (3,638) 63,739 (9,620)

Short sale liabilities:

Securities of U.S. Treasury and federal agencies (4,311) (2,063) — — (6,374)

Securities of U.S. states and political subdivisions — (24) — — (24)

Corporate debt securities — (4,683) — — (4,683)

Equity securities (1,788) (48) — — (1,836)

Other securities — (95) — — (95)

Total short sale liabilities (6,099) (6,913) — — (13,012)

Other liabilities (excluding derivatives) — — (39) — (39)

Total liabilities recorded at fair value (6,649) (76,084) (3,677) 63,739 (22,671)

(1) Includes collateralized debt obligations of $2 million.

(2) Net gains from trading activities recognized in the income statement for the year ended December 31, 2013 include $(29) million in net unrealized losses on trading

securities held at December 31, 2013.

(3) Balances consist of securities that are predominantly investment grade based on ratings received from the ratings agencies or internal credit grades categorized as

investment grade if external ratings are not available. The securities are classified as Level 3 due to limited market activity.

(4) Includes collateralized debt obligations of $693 million.

(5) Perpetual preferred securities include ARS and corporate preferred securities. See Note 8 (Securitizations and Variable Interest Entities) for additional information.

(6) Represents balance sheet netting of derivative asset and liability balances and related cash collateral. See Note 16 (Derivatives) for additional information.

(7) Derivative assets and derivative liabilities include contracts qualifying for hedge accounting, economic hedges, and derivatives included in trading assets and trading

liabilities, respectively.

217