Wells Fargo 2014 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

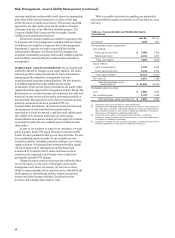

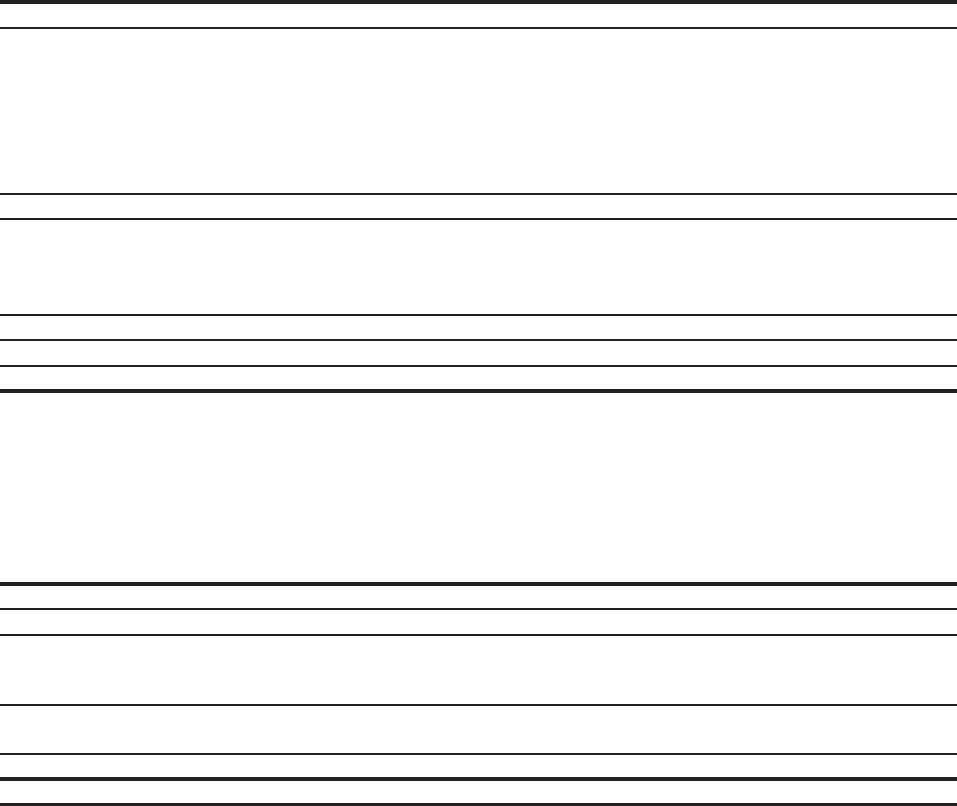

Table 62 presents changes in RWAs for 2014. Effective

January 1, 2014, we commenced transitioning RWAs from Basel

I to Basel III (General Approach) under final rules adopted by

federal banking regulators in July 2013.

Table 62: Analysis of Changes in RWAs

(in millions)

Basel I RWAs at December 31, 2013 $ 1,141,514

Net change in on-balance sheet RWAs:

Investment securities (7,944)

Securities financing transactions 1,984

Loans 45,055

Market risk 13,274

Other 20,831

Total change in on-balance sheet RWAs 73,200

Net change in off-balance sheet RWAs:

Commitments and guarantees 19,687

Derivatives (231)

Other 8,375

Total change in off-balance sheet RWAs 27,831

Total change in RWAs 101,031

Basel III (General Approach) RWAs at December 31, 2014 $ 1,242,545

The increase in total RWAs from December 31, 2013, was

primarily due to increased lending activity.

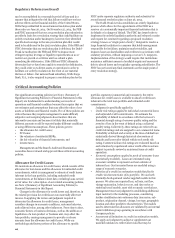

Table 63 provides information regarding our CET1

calculation as estimated under Basel III using the Advanced

Approach, fully phased-in method.

Table 63: Common Equity Tier 1 Under Basel III (Advanced Approach, Fully Phased-In) (1)(2)

(in billions) December 31, 2014

Common Equity Tier 1 (transition amount) under Basel III $

Adjustments from transition amount to fully phased-in Basel III (3):

Cumulative other comprehensive income

Other (2.8)

Total adjustments (0.4)

Common Equity Tier 1 (fully phased-in) under Basel III (C) $ 136.7

Total RWAs anticipated under Basel III (4) (D) $ 1,310.5

Common Equity Tier 1 to total RWAs anticipated under Basel III (Advanced Approach, fully phased-in) (C)/(D) 10.43%

(1) CET1 is a non-GAAP financial measure that is used by investors, analysts and bank regulatory agencies to assess the capital position of financial services companies.

Management reviews CET1 along with other measures of capital as part of its financial analyses and has included this non-GAAP financial information, and the

corresponding reconciliation to total equity, because of current interest in such information on the part of market participants.

(2) The Basel III CET1 and RWAs are estimated based on the Basel III capital rules adopted July 2, 2013, by the FRB. The rules establish a new comprehensive capital

framework for U.S. banking organizations that implement the Basel III capital framework and certain provisions of the Dodd-Frank Act. The rules are being fully phased in

effective January 1, 2014, through the end of 2021.

(3) Assumes cumulative other comprehensive income is fully phased in and certain other intangible assets are fully phased out under Basel III capital rules.

(4) The final Basel III capital rules provide for two capital frameworks: the Standardized Approach intended to replace Basel I, and the Advanced Approach applicable to certain

institutions. Under the final rules, we will be subject to the lower of our CET1 ratio calculated under the Standardized Approach and under the Advanced Approach in the

assessment of our capital adequacy. While the amount of RWAs determined under the Standardized and Advanced Approaches has been converging, the amount of RWAs

as of December 31, 2014, was based on the Advanced Approach, which was higher than RWAs under the Standardized Approach, and thus resulted in a lower CET1 ratio

compared with the Standardized Approach. Basel III capital rules adopted by the Federal Reserve Board incorporate different classification of assets, with risk weights

based on Wells Fargo's internal models, along with adjustments to address a combination of credit/counterparty, operational and market risks, and other Basel III

elements.

137.1

2.4

105