Wells Fargo 2014 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our team members understand

their eorts can add up in big ways,

which is why we say the spirit of our

philanthropy and volunteerism is

summed up best by a “Small is Huge”

mindset that believes no opportunity

is too small to make a dierence in an

individual’s or community’s future.

WellsFargo also strives to be

a responsible corporate citizen.

In2014, WellsFargo contributed

more than $281million, up 2percent

from 2013, to 17,100 community

nonprofits. These organizations help

our neighbors most in need and

contribute to the revitalization and

growth of the economy. I am proud

that of all U.S. companies, we were the

top corporate philanthropist in cash

donations in2012 and ranked second

in2013, according to TheChronicle

ofPhilanthropy (rankings for 2014

will be released later in2015).

We also strive to be responsive to

economic, social, and environmental

challenges. This includes helping

underserved consumers who wish

to enter or re-enter the banking

system. We oer them products and

services such as low-cost checking

and remittance services, secured

credit cards, and loans. Our Hands

on Banking® program provides a

wide array of free, easy-to-access

financial education resources—from

how-to guidance on budgeting and

car buying, to saving and paying for

college, to investing. We now oer

Hands on Banking courses designed

for military members, seniors, small

business owners, and youth. Since

2003, we’ve reached nearly a half-

million people, distributing Hands

on Banking CDs to schools and

organizations all over the world.

Earlier I mentioned the work we

do to help people keep their homes.

We also help low- to moderate-

income households buy homes in

many ways, but I am especially

proud of our LIFT programs. These

programs provide education and

down payment assistance to potential

homebuyers in communities that the

last recession hit hard. Since 2012,

we have committed $230million to

our LIFT programs, helping more

than 8,500 people and families buy

homes in 32 communities. In2014,

we also donated $6million to 54local

nonprofits through the WellsFargo

Housing Foundation Priority Markets

Program, which helps stabilize and

revitalize distressed neighborhoods.

And, as part of our support for those

who serve our country, we have

donated more than 200 mortgage-

free homes to veterans over the past

twoyears.

Additionally, we are making

progress in our environmental eorts

to contribute to a more sustainable

future. Since 2012, WellsFargo has

deployed more than $37billion to

support environmental opportunities,

such as clean technology, renewable

energy, “greener” buildings,

sustainable agriculture, and alternative

transportation. In2014, we expanded

this focus with the WellsFargo

Innovation Incubator(IN2), a five-

year, $10million grant to help fund

startup companies with innovative

environmental technologies.

To learn more about our community

eorts, I invite you to read our

Corporate Social Responsibility

Report at wellsfargo.com under

“AboutWellsFargo.”

Staying grounded, moving ahead

As a company sets its sights on the

future, the right culture is essential.

It keeps its team members connected

to the company’s reason for being.

AtWellsFargo, we strike that balance

by focusing on six strategic priorities

we believe we must master each

day we board the stagecoach. These

priorities receive our attention

because they allow us to devote talent

and resources to eorts focused on

our future, initiatives that we believe

are vital to continuing the success

we’ve enjoyed in the post-financial

crisis era.

Our six day-to-day strategic

priorities are:

• Putting customers first.

Ourbusiness is built around an

unwavering focus on customers.

Our people provide products and

services to meet customer needs

through multiple, convenient ways

that add up to high-quality, caring

relationships and guidance.

• Growing revenue. Revenue is the

grade our customers give us each

day when they reward us with

their business. When we serve

customers well, the money we earn

is the result. We generate revenue

from more than 90 businesses,

which provide diverse sources of

income through economic cycles.

• Managing expenses. We focus on

operating eciently by thoughtfully

managing our resources and

exercising discipline to invest in

the areas that matter most to our

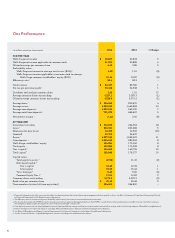

customers and stakeholders. In2014,

our eciency ratio (how much

expense we incur for every dollar of

revenue we earn) was 58.1percent for

the full year, within our target range

of 55 to 59percent, and industry-

leading among our large bank peers.

• Living our vision and values.

We seek to bring our vision and

values to life in all that we do,

demonstrating who we are through

our actions.

• Connecting with communities

and stakeholders. We believe

there’s a connection between our

success and the success of our

key stakeholders—customers,

communities, investors, and team

members. These are relationships

we nurture each day.

• Managing risk. Strong risk

management has been a

cornerstone of our long-term

success, so we continue to invest

significantly in this area.

With these priorities well understood,

we are able to devote additional talents

and resources to four areas that we

believe are critical to WellsFargo’s

future: creating exceptional customer

experiences, digitizing the enterprise,

making diversity and inclusion part

of our DNA, and leading the way in

risk and operational excellence.