Wells Fargo 2014 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

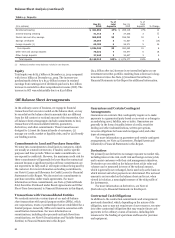

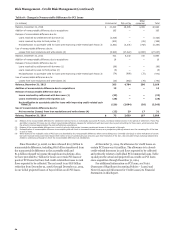

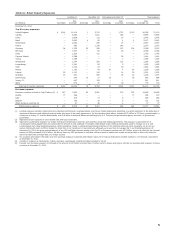

Table 19: Actual and Projected Loss Results on PCI Loans Since Acquisition of Wachovia

Other

(in millions) Commercial Pick-a-Pay consumer Total

Release of nonaccretable difference due to:

Loans resolved by settlement with borrower (1) $ 1,545 — — 1,545

Loans resolved by sales to third parties (2) 336 — 85 421

Reclassification to accretable yield for loans with improving credit-related cash flows (3) 1,734 5,991 843 8,568

Total releases of nonaccretable difference due to better than expected losses 3,615 5,991 928 10,534

Provision for losses due to credit deterioration (4) (1,629) — (104) (1,733)

Actual and projected losses on PCI loans less than originally expected $ 1,986 5,991 824 8,801

(1) Release of the nonaccretable difference for settlement with borrower, on individually accounted PCI loans, increases interest income in the period of settlement. Pick-a-Pay

and Other consumer PCI loans do not reflect nonaccretable difference releases for settlements with borrowers due to pool accounting for those loans, which assumes that

the amount received approximates the pool performance expectations.

(2) Release of the nonaccretable difference as a result of sales to third parties increases noninterest income in the period of the sale.

(3) Reclassification of nonaccretable difference to accretable yield will result in increased interest income as a prospective yield adjustment over the remaining life of the loan

or pool of loans.

(4) Provision for additional losses is recorded as a charge to income when it is estimated that the cash flows expected to be collected for a PCI loan or pool of loans may not

support full realization of the carrying value.

Significant Loan Portfolio Reviews Measuring and

monitoring our credit risk is an ongoing process that tracks

delinquencies, collateral values, FICO scores, economic trends

by geographic areas, loan-level risk grading for certain portfolios

(typically commercial) and other indications of credit risk. Our

credit risk monitoring process is designed to enable early

identification of developing risk and to support our

determination of an appropriate allowance for credit losses. The

following discussion provides additional characteristics and

analysis of our significant portfolios. See Note 6 (Loans and

Allowance for Credit Losses) to Financial Statements in this

Report for more analysis and credit metric information for each

of the following portfolios.

COMMERCIAL AND INDUSTRIAL LOANS AND LEASE

FINANCING For purposes of portfolio risk management, we

aggregate commercial and industrial loans and lease financing

according to market segmentation and standard industry

codes. We generally subject commercial and industrial loans and

lease financing to individual risk assessment using our internal

borrower and collateral quality ratings. Our ratings are aligned

to regulatory definitions of pass and criticized categories with

criticized divided between special mention, substandard,

doubtful and loss categories.

The commercial and industrial loans and lease financing

portfolio totaled $284.1 billion or 33% of total loans at

December 31, 2014. The net charge-off rate for this portfolio was

0.10% in 2014 compared with 0.15% in 2013. At December 31,

2014, 0.20% of this portfolio was nonaccruing, compared with

0.32% at December 31, 2013. In addition, $16.7 billion of this

portfolio was rated as criticized in accordance with regulatory

guidance at December 31, 2014, compared with $17.5 billion at

December 31, 2013.

A majority of our commercial and industrial loans and lease

financing portfolio is secured by short-term assets, such as

accounts receivable, inventory and securities, as well as long-

lived assets, such as equipment and other business assets.

Generally, the collateral securing this portfolio represents a

secondary source of repayment.

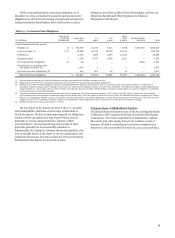

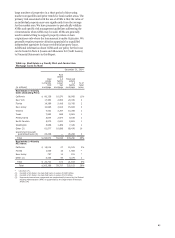

Table 20 provides a breakout of commercial and industrial

loans and lease financing by industry, and includes $45.0 billion

of foreign loans at December 31, 2014, that were reported in a

separate foreign loan class in prior periods. Foreign loans totaled

$14.9 billion within the investors category, $18.1 billion within

the financial institutions category and $1.3 billion within the oil

and gas category.

The investors category includes loans to special purpose

vehicles (SPVs) formed by sponsoring entities to invest in

financial assets backed predominantly by commercial and

residential real estate or corporate cash flow, and are repaid

from the asset cash flows or the sale of assets by the SPV. We

limit loan amounts to a percentage of the value of the underlying

assets, as determined by us, based primarily on analysis of

underlying credit risk and other factors such as asset duration

and ongoing performance.

The $18.1 billion of foreign loans in the financial institutions

category were primarily originated by our Global Financial

Institutions (GFI) business. GFI has relationships with over

1,500 financial institutions, many of which are headquartered

outside the U.S., and for whom we provide a variety of

relationship focused products and services, including loans

supporting short-term trade finance and working capital needs.

Slightly more than half of our oil and gas loans were to

businesses in the exploration and production (E&P) sector.

Nearly all of these E&P loans are secured by oil and/or gas

reserves and have underlying borrowing base arrangements

which include regular (typically semi-annual)

“redeterminations” that consider refinements to borrowing

structure and prices used to determine borrowing limits. The

remainder of the oil and gas loans were to midstream and

services and equipment companies.

61