Wells Fargo 2014 Annual Report Download - page 186

Download and view the complete annual report

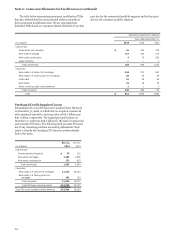

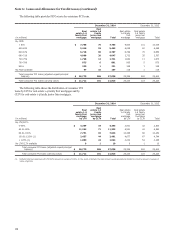

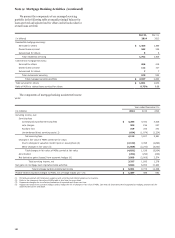

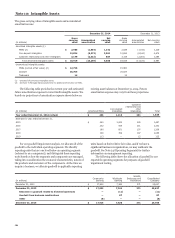

Please find page 186 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 8: Securitizations and Variable Interest Entities (continued)

interests issued by the VIEs. We also may be exposed to limited

liability related to recourse agreements and repurchase

agreements we make to our issuers and purchasers, which are

included in other commitments and guarantees. In certain

instances, we may service residential mortgage loan

securitizations structured by third parties whose loans we did

not originate or transfer. Our residential mortgage loan

securitizations consist of conforming and nonconforming

securitizations.

Conforming residential mortgage loan securitizations are

those that are guaranteed by the government-sponsored entities

(GSEs), including GNMA. Because of the power of the GSEs over

the VIEs that hold the assets from these conforming residential

mortgage loan securitizations, we do not consolidate them.

The loans sold to the VIEs in nonconforming residential

mortgage loan securitizations are those that do not qualify for a

GSE guarantee. We may hold variable interests issued by the

VIEs, primarily in the form of senior securities. We do not

consolidate the nonconforming residential mortgage loan

securitizations included in the table because we either do not

hold any variable interests, hold variable interests that we do not

consider potentially significant or are not the primary servicer

for a majority of the VIE assets.

Other commitments and guarantees include amounts

related to loans sold that we may be required to repurchase, or

otherwise indemnify or reimburse the investor or insurer for

losses incurred, due to material breach of contractual

representations and warranties as well as other retained

recourse arrangements. The maximum exposure to loss for

material breach of contractual representations and warranties

represents a stressed case estimate we utilize for determining

stressed case regulatory capital needs and is considered to be a

remote scenario.

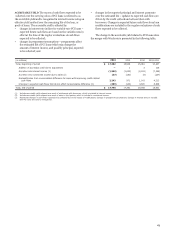

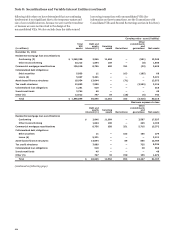

COMMERCIAL MORTGAGE LOAN SECURITIZATIONS

Commercial mortgage loan securitizations are financed through

the issuance of fixed or floating-rate asset-backed securities,

which are collateralized by the loans transferred to the VIE. In a

typical securitization, we may transfer loans we originate to

these VIEs, account for the transfers as sales, retain the right to

service the loans and may hold other beneficial interests issued

by the VIEs. In certain instances, we may service commercial

mortgage loan securitizations structured by third parties whose

loans we did not originate or transfer. We typically serve as

primary or master servicer of these VIEs. The primary or master

servicer in a commercial mortgage loan securitization typically

cannot make the most significant decisions impacting the

performance of the VIE and therefore does not have power over

the VIE. We do not consolidate the commercial mortgage loan

securitizations included in the disclosure because we either do

not have power or do not have a variable interest that could

potentially be significant to the VIE.

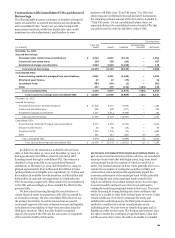

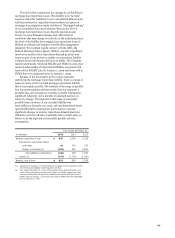

COLLATERALIZED DEBT OBLIGATIONS (CDOs) A CDO is a

securitization where a VIE purchases a pool of assets consisting

of asset-backed securities and issues multiple tranches of equity

or notes to investors. In some CDOs, a portion of the assets are

obtained synthetically through the use of derivatives such as

credit default swaps or total return swaps.

In addition to our role as arranger we may have other forms

of involvement with these CDOs. Such involvement may include

acting as liquidity provider, derivative counterparty, secondary

market maker or investor. For certain CDOs, we may also act as

the collateral manager or servicer. We receive fees in connection

with our role as collateral manager or servicer.

We assess whether we are the primary beneficiary of CDOs

based on our role in them in combination with the variable

interests we hold. Subsequently, we monitor our ongoing

involvement to determine if the nature of our involvement has

changed. We are not the primary beneficiary of these CDOs in

most cases because we do not act as the collateral manager or

servicer, which generally denotes power. In cases where we are

the collateral manager or servicer, we are not the primary

beneficiary because we do not hold interests that could

potentially be significant to the VIE.

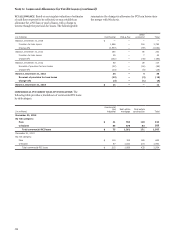

COLLATERALIZED LOAN OBLIGATIONS (CLOs) A CLO is a

securitization where an SPE purchases a pool of assets consisting

of loans and issues multiple tranches of equity or notes to

investors. Generally, CLOs are structured on behalf of a third

party asset manager that typically selects and manages the assets

for the term of the CLO. Typically, the asset manager has the

power over the significant decisions of the VIE through its

discretion to manage the assets of the CLO. We assess whether

we are the primary beneficiary of CLOs based on our role in

them and the variable interests we hold. In most cases, we are

not the primary beneficiary because we do not have the power to

manage the collateral in the VIE.

In addition to our role as arranger, we may have other forms

of involvement with these CLOs. Such involvement may include

acting as underwriter, derivative counterparty, secondary market

maker or investor. For certain CLOs, we may also act as the

servicer, for which we receive fees in connection with that role.

We also earn fees for arranging these CLOs and distributing the

securities.

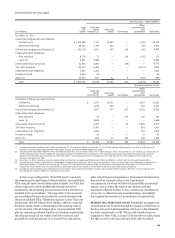

ASSET-BASED FINANCE STRUCTURES We engage in various

forms of structured finance arrangements with VIEs that are

collateralized by various asset classes including energy contracts,

auto and other transportation leases, intellectual property,

equipment and general corporate credit. We typically provide

senior financing, and may act as an interest rate swap or

commodity derivative counterparty when necessary. In most

cases, we are not the primary beneficiary of these structures

because we do not have power over the significant activities of

the VIEs involved in them.

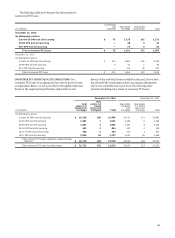

In fourth quarter 2014, we sold $8.3 billion of government

guaranteed student loans, including the rights to service the

loans, to a third party, resulting in a $217 million gain. In

connection with the sale, we provided $6.5 billion in floating-

rate loan financing to an asset backed financing entity (VIE)

formed by the third party purchaser. Our financing, which is

fully collateralized by government guaranteed student loans, is

measured at amortized cost and classified in loans on the

balance sheet. The collateral supporting our loan includes a

portion of the student loans we sold. We are not the primary

beneficiary of the VIE and, therefore, are not required to

consolidate the entity as we do not have power over the

significant activities of the entity. For information on the

estimated fair value of the loan and related sensitivity analysis,

see the Retained Interests from Unconsolidated VIEs section in

this Note.

In addition, we also have investments in asset-backed

securities that are collateralized by auto leases or loans and cash.

These fixed-rate and variable-rate securities have been

structured as single-tranche, fully amortizing, unrated bonds

that are equivalent to investment-grade securities due to their

significant overcollateralization. The securities are issued by

VIEs that have been formed by third party auto financing

institutions primarily because they require a source of liquidity

184