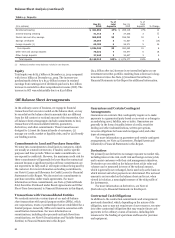

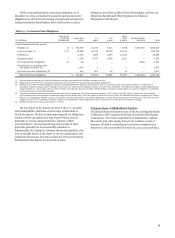

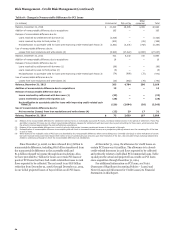

Wells Fargo 2014 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Risk Management

Financial institutions must manage a variety of business risks

that can significantly affect their financial performance. Among

the key risks that we must manage are operational risks, credit

risks, and asset/liability management risks, which include

interest rate, market, and liquidity and funding risks. Our risk

culture is strongly rooted in our Vision and Values, and in

order to succeed in our mission of satisfying all our customers’

financial needs and helping them succeed financially, our

business practices and operating model must support prudent

risk management practices.

Risk Management Framework and Culture

The key elements of our risk management framework and

culture include the following:

• We strongly believe in managing risk as close to

the source as possible. We manage risk through three

lines of defense, and the first line of defense is our team

members in our lines of business who are responsible for

identifying, assessing, monitoring, managing, mitigating,

and owning the risks in their businesses. All of our team

members have accountability for risk management.

• We recognize the importance of strong oversight.

Our Corporate Risk group, led by our Chief Risk Officer

who reports to the Board’s Risk Committee, as well as

other corporate functions such as the Law Department,

Corporate Controllers, and the Human Resources

Department serve as the second line of defense and

provide company-wide leadership, oversight, an enterprise

view, and appropriate challenge to help ensure effective

and consistent understanding and management of all risks

by our lines of business. Wells Fargo Audit Services, led by

our Chief Auditor who reports to the Board’s Audit and

Examination Committee, serves as the third line of defense

and through its audit, assurance, and advisory work

evaluates and helps improve the effectiveness of the

governance, risk management, and control processes

across the enterprise.

• We have a significant bias for conservatism. We

strive to maintain a conservative financial position

measured by satisfactory asset quality, capital levels,

funding sources, and diversity of revenues. Our risk is

distributed by geography, product type, industry segment,

and asset class, and while we want to grow the Company,

we will attempt to do so in a way that supports our long-

term goals and does not compromise our ability to manage

risk.

• We have a long-term customer focus. Our focus is

on knowing our customers and meeting our customers’

long-term financial needs by offering products and value-

added services that are appropriate for their needs and

circumstances. In addition, our team members are

committed to operational excellence, and we recognize

that our infrastructure, systems, processes, and

compliance programs must support the financial success

of our customers through a superior customer service

experience.

• We must understand and follow our risk appetite.

Our risk management framework is based on

understanding and following our overall enterprise

statement of risk appetite, which describes the nature and

level of risks that we are willing to take to achieve our

strategic and business objectives. This statement provides

the philosophical underpinnings that guide business and

risk leaders as they manage risk on a day-to-day basis. Our

CEO and Operating Committee, which consists of our

Chief Risk Officer and other senior executives, develop our

enterprise statement of risk appetite in the context of our

risk management framework and culture described above.

The Board approves our statement of risk appetite

annually, and the Board’s Risk Committee reviews and

approves any proposed changes to the statement to help

ensure that it remains consistent with our risk profile.

As part of our review of our risk appetite, we maintain

metrics along with associated objectives to measure and

monitor the amount of risk that the Company is prepared to

take. Actual results of these metrics are reported to the

Enterprise Risk Management Committee on a quarterly basis

as well as to the Risk Committee of the Board. Our operating

segments also have business-specific risk appetite statements

based on the enterprise statement of risk appetite. The metrics

included in the operating segment statements are harmonized

with the enterprise level metrics to ensure consistency where

appropriate. Business lines also maintain metrics and

qualitative statements that are unique to their line of business.

This allows for monitoring of risk and definition of risk

appetite deeper within the organization.

Our risk culture seeks to promote proactive risk

management and puts the customer first by implementing an

ongoing program of training, performance management, and

regular communication. Our risk culture also depends on the

“tone at the top” set by our Board, CEO, and Operating

Committee members. The Board and the Operating Committee

are the starting point for establishing and reinforcing our risk

culture and have overall and ultimate responsibility to provide

oversight for the three lines of defense and the risks we take.

The Board and the Operating Committee carry out their

oversight through governance committees with specific risk

management responsibilities described below.

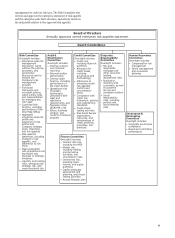

Board Oversight of Risk

The Board allocates its oversight responsibilities across its

seven standing committees, all of which report to the full

Board. Each Board committee has defined authorities and

responsibilities for considering a specific set of risk issues, as

outlined in each of their charters and as summarized on the

following chart, and works closely with management to

understand and oversee the Company’s key risk exposures.

Allocating risk responsibilities among each Board level

committee increases the overall amount of attention devoted to

risk management. The Risk Committee serves as a focal point

for enterprise-wide risk issues, overseeing all key risks facing

the Company, and supports and assists the other six Board

level committees as they consider their specific risk issues. To

ensure that the Risk Committee does not duplicate the risk

oversight efforts of other Board committees, the Risk

Committee includes the Chairs of each of the Board’s other

standing committees to provide a comprehensive perspective

on risk across the Company and across all individual risk types.

In addition to providing a forum for risk issues at the Board

level, the Risk Committee plays an active role in approving and

overseeing the Company’s enterprise-wide risk management

framework established by management to manage risk, and the

functional framework and oversight policies established by

54