Wells Fargo 2014 Annual Report Download - page 58

Download and view the complete annual report

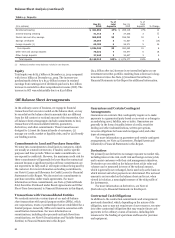

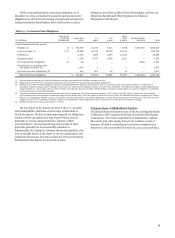

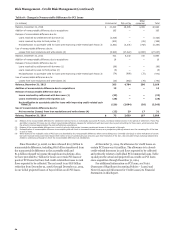

Please find page 58 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Risk Management (continued)

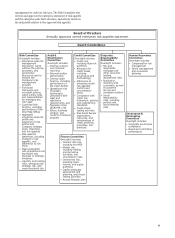

Management Oversight of Risk

In addition to the Board level committees that consider risk

issues, the Company has established several management-level

governance committees (governance committees) to support

Wells Fargo leaders in carrying out their responsibilities to

manage risk on a daily basis. Each governance committee has a

defined set of authorities and responsibilities specific to a

single risk type or set of risk types. Accordingly, risk

governance committees are responsible for making decisions

on risk issues in line with each committee’s authorities, or

escalating issues up the committee structure for further

consideration.

The Enterprise Risk Management Committee, chaired by

the Wells Fargo Chief Risk Officer, oversees the management

of all types of risk across the Company. The Enterprise Risk

Management Committee reports into and escalates matters

directly to the Board’s Risk Committee, and as such serves as

the focal point for risk governance and monitoring at the

management level. The Enterprise Risk Management

Committee is responsible for monitoring and evaluating the

Company’s risk profile relative to its risk appetite across risk

types, businesses, and activities; providing active oversight of

risk mitigation and the adequacy of risk management

resources, skills, and capabilities across the enterprise;

reporting periodically to senior management and the Board on

the most significant current and emerging risks, risk

management issues, initiatives, and concerns; and addressing

key risk issues which are escalated to it by its members or its

reporting committees.

A number of governance committees that are responsible

for issues specific to an individual risk type report into the

Enterprise Risk Management Committee, including the Market

Risk Committee, the Corporate Model Risk Committee, the

Counterparty Credit Risk Committee, the Operational Risk

Management Committee, the Regulatory Compliance Risk

Management Committee, the BSA/AML (Financial Crimes)

Risk Committee, the International Oversight Committee, and

the Legal Entity Governance Committee. Certain of these

governance committees have dual escalation and/or

informational reporting paths to the Board level committee

primarily responsible for the oversight of the specific risk type.

The Market Risk Committee is responsible for addressing

key market risk management issues related to the Company’s

trading, hedging, market-making, and investment activities.

The Corporate Model Risk Committee assists in evaluating and

managing the Company’s exposure to model risk and conducts

oversight of the model risk management processes. The

Counterparty Credit Risk Committee provides broad oversight

of Wells Fargo’s counterparty risk-taking activities and issuer

concentration risk. The Operational Risk Management

Committee’s primary responsibility is to understand

operational risk issues and concerns and work with

management across the Company to ensure risks are managed

effectively. The mandates of the Regulatory Compliance Risk

Management Committee and the BSA/AML (Financial Crimes)

Risk Committee are to provide forums through which material

regulatory compliance and BSA/AML risks of the Company,

respectively, are appropriately identified, communicated,

escalated, and managed within the Company’s corresponding

risk management frameworks.

The International Oversight Committee provides broad

oversight of the Company’s foreign risk exposure to ensure it is

consistent with the overall risk appetite of the Company. The

Legal Entity Governance Committee provides executive

leadership and oversight of the legal entity lifecycle framework

and related corporate policies.

While the Enterprise Risk Management Committee and

the committees that report to it serve as the focal point for the

management of enterprise-wide risk issues, the management of

specific risk types is supported by additional management-level

governance committees. These committees include the SOX

Disclosure Committee, the Regulatory Reporting Oversight

Committee, the Capital Reporting Sub-committee, which all

report to the Board’s Audit & Examination Committee; the

Stress Testing Committee, the Corporate Asset and Liability

Committee, the Economic Scenario Approval Committee,

which all report to the Board’s Finance Committee; the

Allowance for Credit Losses Approval Committee, which

reports to the Board’s Credit Committee; and the Incentive

Compensation Committee and the Employee Benefit Review

Committee, which both report to the Board’s Human

Resources Committee.

These committees help management facilitate enterprise-

wide understanding and monitoring of risks and challenges

faced by the Company. Management’s corporate risk

organization, which is part of the second line of defense, is

headed by the Company’s Chief Risk Officer who, among other

things, provides oversight, opines on the performance and

strategy of all risks taken by the businesses, and provides

credible challenge to risks incurred. The Chief Risk Officer, as

well as the Chief Enterprise, Credit, Market, Compliance,

Operational, Information Security and Financial Crimes Risk

Officers as his or her direct reports, work closely with the

Board’s committees and frequently provide reports and

updates to the committees and the committee chairs on risk

issues during and outside of regular committee meetings, as

appropriate. The full Board receives reports at each of its

meetings from the committee chairs about committee

activities, including risk oversight matters, and receives a

quarterly report from the Enterprise Risk Management

Committee regarding current or emerging risk issues.

56