Wells Fargo 2014 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

_________________________

This Annual Report, including the Financial Review and the Financial Statements and related Notes, contains forward-looking

statements, which may include forecasts of our financial results and condition, expectations for our operations and business, and our

assumptions for those forecasts and expectations. Do not unduly rely on forward-looking statements. Actual results may differ

materially from our forward-looking statements due to several factors. Factors that could cause our actual results to differ materially

from our forward-looking statements are described in this Report, including in the “Forward-Looking Statements” and “Risk Factors”

sections, and in the “Regulation and Supervision” section of our Annual Report on Form 10-K for the year ended December 31, 2014

(2014 Form 10-K).

When we refer to “Wells Fargo,” “the Company,” “we,” “our” or “us” in this Report, we mean Wells Fargo & Company and Subsidiaries

(consolidated). When we refer to the “Parent,” we mean Wells Fargo & Company. When we refer to “legacy Wells Fargo,” we mean

Wells Fargo excluding Wachovia Corporation (Wachovia). See the Glossary of Acronyms for terms used throughout this Report.

Financial Review1

Overview

Wells Fargo & Company is a nationwide, diversified,

community-based financial services company with $1.7 trillion

in assets. Founded in 1852 and headquartered in San Francisco,

we provide banking, insurance, investments, mortgage, and

consumer and commercial finance through more than

8,700 locations, 12,500 ATMs, the internet (wellsfargo.com) and

mobile banking, and we have offices in 36 countries to support

our customers who conduct business in the global economy.

With approximately 265,000 active, full-time equivalent team

members, we serve one in three households in the United States

and ranked No. 29 on Fortune’s 2014 rankings of America’s

largest corporations. We ranked fourth in assets and first in the

market value of our common stock among all U.S. banks at

December 31, 2014.

We use our Vision and Values to guide us toward growth

and success. Our vision is to satisfy all our customers’ financial

needs, help them succeed financially, be recognized as the

premier financial services company in our markets and be one of

America’s great companies. Important to our strategy to achieve

this vision is to increase the number of our products our

customers use and to offer them all of the financial products that

fulfill their financial needs. We aspire to create deep and

enduring relationships with our customers by discovering their

needs and delivering the most relevant products, services,

advice, and guidance.

We have six primary values, which are based on our vision

and provide the foundation for everything we do. First, we value

and support our people as a competitive advantage and strive to

attract, develop, retain and motivate the most talented people we

can find. Second, we strive for the highest ethical standards with

our team members, our customers, our communities and our

shareholders. Third, with respect to our customers, we strive to

base our decisions and actions on what is right for them in

everything we do. Fourth, for team members we strive to build

and sustain a diverse and inclusive culture - one where they feel

valued and respected for who they are as well as for the skills and

experiences they bring to our company. Fifth, we also look to

each of our team members to be leaders in establishing, sharing

and communicating our vision. Sixth, we strive to make risk

management a competitive advantage by working hard to ensure

1

Financial information for certain periods prior to 2014 was revised to

reflect our determination that certain factoring arrangements did not

qualify as loans. See Note 1 (Summary of Significant Accounting Policies)

to Financial Statements in this Report for more information.

that appropriate controls are in place to reduce risks to our

customers, maintain and increase our competitive market

position, and protect Wells Fargo’s long-term safety, soundness

and reputation.

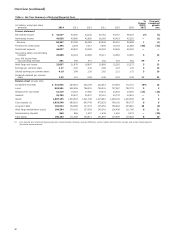

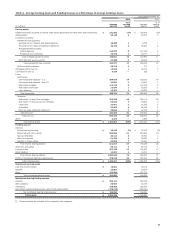

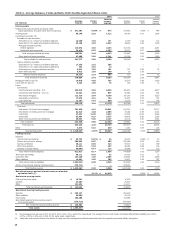

Financial Performance

We completed another outstanding year of financial results in

2014 and remained America’s most profitable bank. We

generated record earnings, produced strong loan and deposit

growth, grew the number of customers we serve, improved credit

quality, enhanced our strong risk management practices,

strengthened our capital and liquidity levels and rewarded our

shareholders by increasing our dividend and buying back more

shares. Wells Fargo net income was $23.1 billion in 2014, an

increase of 5% compared with 2013, with record diluted earnings

per share (EPS) of $4.10, also up 5% from the prior year. Our

achievements during 2014 demonstrated the benefit of our

diversified business model and our continued focus on the real

economy.

Noteworthy items included:

• revenue of $84.3 billion, up 1% from 2013;

• pre-tax pre-provision profit (PTPP) of $35.3 billion, up 1%;

• our loans increased $40.3 billion, up 5%, even with the

planned runoff in our non-strategic/liquidating portfolios,

and our core loan portfolio grew by $60.3 billion, up 8%;

• our deposit franchise continued to generate strong

customer deposit growth, with total deposits up

$89.1 billion, or 8%;

• our credit performance continued to be strong with total

net charge-offs down $1.6 billion, or 35%, from a year ago

and our net charge-off ratio declined to 35 basis points of

average loans;

• we continued to maintain solid customer relationships

across the Company, with retail banking household cross-

sell of 6.17 products per household (November 2014);

Wholesale Banking cross-sell of 7.2 products per

relationship (September 2014); and Wealth, Brokerage and

Retirement cross-sell of 10.49 products per retail banking

household (November 2014);

• we maintained strong capital levels as our estimated

Common Equity Tier I ratio under Basel III (Advanced

Approach, fully phased-in) was 10.43%; and

• our common stock price increased 21% and we returned

$12.5 billion in capital to our shareholders through an

increased common stock dividend and additional net share

repurchases (up 74% from 2013).

30