Wells Fargo 2014 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268

|

|

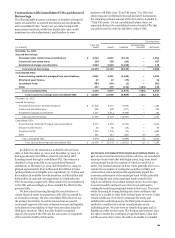

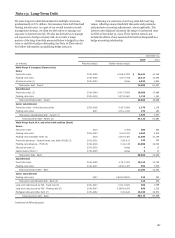

Note 13: Long-Term Debt

We issue long-term debt denominated in multiple currencies,

predominantly in U.S. dollars. Our issuances have both fixed and

floating interest rates. As a part of our overall interest rate risk

management strategy, we often use derivatives to manage our

exposure to interest rate risk. We also use derivatives to manage

our exposure to foreign currency risk. As a result, a major

portion of the long-term debt presented below is hedged in a fair

value or cash flow hedge relationship. See Note 16 (Derivatives)

for further information on qualifying hedge contracts.

Following is a summary of our long-term debt carrying

values, reflecting unamortized debt discounts and premiums,

and purchase accounting adjustments, where applicable. The

interest rates displayed represent the range of contractual rates

in effect at December 31, 2014. These interest rates do not

include the effects of any associated derivatives designated in a

hedge accounting relationship.

December 31,

2014 2013

(in millions)

Wells Fargo & Company (Parent only)

Senior

Fixed-rate notes

Floating-rate notes

Structured notes (1)

Total senior debt - Parent

Subordinated

Fixed-rate notes (2)

Floating-rate notes

Total subordinated debt - Parent

Junior subordinated

Fixed-rate notes - hybrid trust securities

Floating-rate notes

Total junior subordinated debt - Parent (3)

Total long-term debt - Parent (2)

Wells Fargo Bank, N.A. and other bank entities (Bank)

Senior

Fixed-rate notes

Floating-rate notes

Floating-rate extendible notes (4)

Fixed-rate advances - Federal Home Loan Bank (FHLB) (5)

Floating-rate advances - FHLB (5)

Structured notes (1)

Capital leases (Note 7)

Total senior debt - Bank

Subordinated

Fixed-rate notes

Floating-rate notes

Total subordinated debt - Bank

Junior subordinated

Floating-rate notes

Total junior subordinated debt - Bank (3)

Long-term debt issued by VIE - Fixed rate (6)

Long-term debt issued by VIE - Floating rate (6)

Mortgage notes and other debt (7)

Total long-term debt - Bank

Maturity date(s)

2015-2038

2015-2048

2015-2053

2016-2044

2015-2016

2029-2036

2027

2015

2015-2053

2016

2015-2031

2018-2019

2015-2025

2015-2025

2015-2038

2016-2017

2027

2020-2047

2016-2047

2015-2062

Stated interest rate(s)

0.625-6.75%

0.00-3.735

Varies

3.45-7.574%

0.573-0.601

5.95-7.95%

0.731-1.231

0.75%

0.00-0.511

0.281-0.387

3.83-8.17

0.22-0.35

Varies

Varies

4.75-7.74%

0.442-3.107

0.802-0.881%

0.00-7.00%

0.296-18.970

0.00-9.20

$ 54,441

15,317

4,825

74,583

19,688

1,215

20,903

1,378

272

1,650

97,136

500

4,969

11,048

125

34,000

4

9

50,655

10,310

994

11,304

313

313

609

996

16,239

80,116

44,145

12,445

4,891

61,481

17,469

1,190

18,659

1,178

263

1,441

81,581

500

2,219

10,749

160

19,000

13

11

32,652

10,725

1,616

12,341

303

303

1,098

1,230

16,874

64,498

(continued on following page)

197