Wells Fargo 2014 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Risk Management - Asset/Liability Management (continued)

An inventory of scenarios is maintained representing both

historical and hypothetical stress events that affect a broad range

of market risk factors with varying degrees of correlation and

differing time horizons. Hypothetical scenarios assess the impact

of large movements in financial variables on portfolio values.

Typical examples include a 100 basis point increase across the

yield curve or a 10% decline in stock market indexes. Historical

scenarios utilize an event-driven approach: the stress scenarios

are based on plausible but rare events, and the analysis

addresses how these events might affect the risk factors relevant

to a portfolio.

The Company’s stress testing framework is also used in

calculating results in support of the Federal Reserve Board’s

Comprehensive Capital Analysis & Review (CCAR) and internal

stress tests. Stress scenarios are regularly reviewed and updated

to address potential market events or concerns. For more detail

on the CCAR process, see the “Capital Management” section in

this Report.

Regulatory Market Risk Capital is based on U.S. regulatory

agency risk-based capital regulations that are based on the Basel

Committee Capital Accord of the Basel Committee on Banking

Supervision. Prior to January 1, 2013, U.S. banking regulators’

market risk capital requirements were subject to Basel I and

thereafter based on Basel 2.5. Effective January 1, 2014, the

Company must calculate regulatory capital based on the Basel III

market risk capital rule, which integrated Basel 2.5, and requires

banking organizations with significant trading activities to adjust

their capital requirements to better account for the market risks

of those activities based on a comprehensive and risk sensitive

method and models. The market risk capital rule is intended to

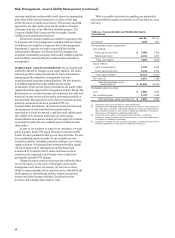

Table 48: Market Risk Regulatory Capital and RWAs

cover the risk of loss in value of covered positions due to changes

in market conditions.

Composition of Material Portfolio of Covered Positions The

market risk capital rule substantially modified the determination

of market risk risk-weighted assets (RWAs), and implemented a

more risk-sensitive methodology for the risks inherent in certain

“covered” trading positions. The positions that are “covered” by

the market risk capital rule are generally a subset of our trading

assets and trading liabilities, specifically those held by the

Company for the purpose of short-term resale or with the intent

of benefiting from actual or expected short-term price

movements, or to lock in arbitrage profits. Positions excluded

from market risk regulatory capital treatment are subject to the

credit risk capital rules applicable to the “non-covered” trading

positions.

The material portfolio of the Company’s “covered” positions

is predominantly concentrated in the trading assets and trading

liabilities managed within Wholesale Banking where the

substantial portion of market risk capital is required. Wholesale

Banking engages in the fixed income, traded credit, foreign

exchange, equities, and commodities markets businesses. Other

business segments hold small additional trading positions

covered under the market risk capital rule.

Table 48 summarizes the market risk-based capital

requirements charge and market RWAs in accordance with the

Basel III market risk capital rule as of December 31, 2014, and in

accordance with the Basel 2.5 market risk capital rule as of

December 31, 2013. The market RWAs are calculated as the sum

of the components in the table below.

December 31, 2014 December 31, 2013

(in millions)

Total VaR $

Risk-

based

capital

146

Risk-

weighted

assets

1,822

Risk-

based

capital

252

Risk-

weighted

assets

3,149

Total Stressed VaR 1,469 18,359 921 11,512

Incremental Risk Charge

Securitized Products Charge

Standard Specific Risk Charge

De minimis Charges (positions not included in models)

345

766

1,177

66

4,317

9,577

14,709

829

393

633

583

125

4,913

7,913

7,289

1,563

Total $ 3,969 49,613 2,907 36,339

92