Wells Fargo 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

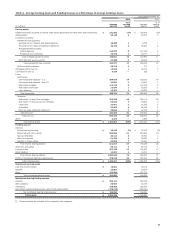

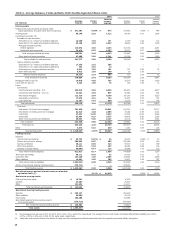

Table 9b - Wholesale Banking

(in millions, except average balances which are in billions)

Net interest income

Noninterest income:

Service charges on deposit accounts

Trust and investment fees:

Brokerage advisory, commissions and other fees

Trust and investment management

Investment banking

Total trust and investment fees

Card fees

Other fees

Mortgage banking

Insurance

Net gains from trading activities

Net gains (losses) on debt securities

Net gains from equity investments

Other income of the segment

Total noninterest income

$

2014

11,955

1,663

333

1,824

1,803

3,960

262

2,048

370

1,352

872

335

636

29

11,527

Year ended December 31,

2013 2012

12,298 12,648

1,559 1,383

270 235

1,789 1,672

1,839 1,341

3,898 3,248

231 200

1,993 2,219

426 407

1,559 1,585

1,211 1,426

45 (13)

425 511

419 478

11,766 11,444

Total revenue 23,482 24,064 24,092

Provision (reversal of provision) for credit losses

Noninterest expense:

Personnel expense

Equipment

Net occupancy

Core deposit and other intangibles

FDIC and other deposit assessments

Outside professional services

Operating losses

Other expense of the segment

Total noninterest expense

Income before income tax expense and noncontrolling interest

Income tax expense

Net income from noncontrolling interest

Net income

Average loans

Average core deposits

$

$

(266)

7,093

186

442

391

269

1,107

98

3,389

12,975

10,773

3,165

24

7,584

313.4

274.0

(445)

6,763

194

454

425

259

1,023

43

3,217

12,378

12,131

3,984

14

8,133

287.7

237.2

286

6,315

268

441

473

313

953

193

3,126

12,082

11,724

3,943

7

7,774

273.8

227.0

Wholesale Banking reported net income of $7.6 billion in

2014, down $549 million, or 7%, from $8.1 billion in 2013, which

was up 5% from $7.8 billion in 2012. The year over year decrease

in net income during 2014 was the result of lower revenues,

increased noninterest expense and higher provision for credit

losses. The year over year increase in net income during 2013

was the result of improvement in provision for credit losses and

stable revenue performance partially offset by increased

noninterest expense. Revenue in 2014 of $23.5 billion decreased

$582 million, or 2%, from $24.1 billion in 2013, as growth in

asset backed finance, asset management, commercial real estate

brokerage, corporate banking, equipment finance, international,

principal investing and treasury management was more than

offset by lower PCI resolution income as well as lower crop

insurance fee income. Revenue in 2013 of $24.1 billion was flat

from 2012, as business growth from asset backed finance, asset

management, capital markets and commercial real estate was

offset by lower PCI resolution income.

Net interest income of $12.0 billion in 2014 decreased

$343 million, or 3%, from 2013, which was down 3% from 2012.

The decrease in 2014 and 2013 was due to lower PCI resolutions

and net interest margin compression due to declining loan yields

and fees that was partially offset by increased interest income

primarily from strong loan growth. Average loans of

$313.4 billion in 2014 increased $25.7 billion, or 9%, from

$287.7 billion in 2013, which was up 5% from $273.8 billion in

2012. The loan growth in 2014 and 2013 was broad based across

many Wholesale Banking businesses. Average core deposits of

$274.0 billion in 2014 increased $36.8 billion, or 16%, from

2013 which was up 4%, from 2012, reflecting continued strong

customer liquidity for both years.

Noninterest income of $11.5 billion in 2014 decreased

$239 million, or 2%, from 2013 as business growth in asset

backed finance, asset management, commercial real estate

brokerage, corporate banking, equipment finance, international,

principal investing and treasury management was more than

offset by lower customer accommodation related gains on

47