Wells Fargo 2014 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

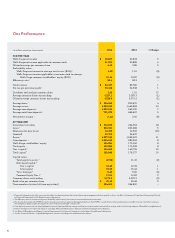

Our results also reflected our

commitment to protect the interests

of our stakeholders. For example,

in2014 the credit quality of our loans

was the best I can recall in my 33years

at the company. Credit losses fell to

$2.9billion, a 35percent improvement

over $4.5billion in2013. Net charge-

os as a percentage of average

loans remained near historic lows—

0.35percent in2014, compared with

0.56percent in2013.

WellsFargo is one of the

most valuable companies

intheworld

By market value as of Dec.31, 2014

(inbillions)

Apple

ExxonMobil

Microsoft

Berkshire Hathaway

Google

PetroChina (China)

Johnson & Johnson

WellsFargo

Walmart

ICBC (China)

U.S. companies except where stated

Source: Bloomberg

Our capital also grew, remaining

well above regulatory minimum levels.

At the end of 2014, our Common

Equity Tier1 capital was $137.1billion,

resulting in a Common Equity Tier1

capital ratio of 11.04percent under

BaselIII (General Approach). Under

BaselIII (Advanced Approach, fully

phased-in), our 2014 estimated

Common Equity Tier1 capital ratio

was 10.43percent.1

In2014, our shareholders continued

to see strong returns. Full-year return

on assets was 1.45percent, and full-

year return on equity was 13.41percent,

well within our target performance

ranges. We returned $12.5billion to

our shareholders through dividends

and net share repurchases. We

1 For more information regarding our regulatory capital and

related ratios, please see the “Financial Review — Capital

Management” section in this Report.

increased the quarterly dividend rate

by 17percent to 35cents per share,

and we purchased 87million shares

of our common stock on a net basis.

During the year, shareholders also

saw the price of our common stock

rise 21percent.

Because we believe culture

influences performance,

WellsFargo counts among its 2014

accomplishments some notable

recognition: “Most Respected

Bank” by Barron’s magazine, “Most

Admired” among the world’s largest

banks byFortune magazine, “Best

U.S. Bank” by TheBanker magazine,

and “Most Valuable Bank Brand”

by Brand Finance,® a global brand

valuation company. However, just as

we think about profits, the accolades

would ring hollow if we didn’t believe

they were the result of doing what’s

right for our customers.

Customers

Our passion for helping customers

motivates our team members. It

gratifies us when we hear how our

banking and financial services improve

lives and transform businesses. For

even as we increasingly serve tens of

millions of customers through digital

and mobile means, our business is

still about people helping people.

Some call this a “Main Street” focus.

We also call it helping individuals

and businesses in the “real economy.”

From checking accounts and

debit cards to savings products to

treasury management services, we

help customers manage their daily

financial lives. We help families

buy that first home or new car. We

provide funding to businesses, small

and large, to expand and hire. We

help our customers plan and save for

retirement. So convinced are we that

this is WellsFargo’s core purpose

that in2014 we began sharing stories

of how we serve customers and

communities through “WellsFargo

Stories,” a new online journal located

at wellsfargo.com/stories.

One story that especially touched

us involved Sam and Kerri Taylor of

Ocean Springs, Mississippi. Before

the recession, the family built a

dream home. But when illness caused

Kerri to cut back on her work, the

family’s income fell, and financial

challenges followed.

Fortunately, we were able to modify

the Taylors’ mortgage—one of more

than 1million mortgage modifications

we have completed since 2009—

tohelp them avoid foreclosure.

Sadly, there are times when families

simply can’t aord to remain in their

current home, but our mortgage

servicing team works extremely hard

to help our customers find solutions

to sustain homeownership. Over

the past six years, WellsFargo has

been able to work with families like

the Taylors to forgive more than

$8.4billion of mortgage principal.

“All I can say is WOW,” Sam

Taylor told us. “Angela [Ludwig,

a WellsFargo Home Mortgage

specialist] not only helped us get

approved for the modification and

keep our home, she displayed the

most professional and courteous

attitude I’ve ever seen.”

We also hear “wows” from our

business customers. In2014,

WellsFargo extended $18billion

in new loan commitments to small

businesses. Additionally, for the

12th consecutive year, we were the

nation’s largest small business lender

in dollars, based on Community

Reinvestment Act government

data (2002–2013; 2014 data will be

released later in 2015). Last year, we

also launched WellsFargo Works

forSmall Business,

SM a broad initiative

to deliver resources, guidance,

and services to small businesses,

including a goal to extend $100billion

in new loans by the end of 2018.

We’re proud to lend to entrepreneurs

like David Dorrough of Boise, Idaho.

Our relationship with David began

not long after he became frustrated

with the quality of commercially

available stud finders when installing

bookshelves at his home. David

put his electrical engineering skills

to work to create a more accurate