Wells Fargo 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

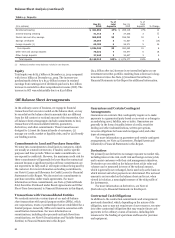

Loan Portfolio

Total loans were $862.6 billion at December 31, 2014, up 5%

from December 31, 2013. Table 12 provides a summary of total

outstanding loans by non-strategic/liquidating and core loan

portfolios. The decrease in the non-strategic/liquidating

portfolios was $20.1 billion, while loans in the core portfolio

grew $60.3 billion from December 31, 2013. Our core loan

growth during 2014 included:

• a $38.6 billion increase in commercial loans, reflecting

broad-based growth in our portfolios, including $6.5 billion

from the financing related to the sale of government

guaranteed student loans out of loans held for sale in fourth

quarter 2014. For additional information on the government

guaranteed student loan sale, see Note 8 (Securitizations

and Variable Interest Entities) to Financial Statements in

this Report; and

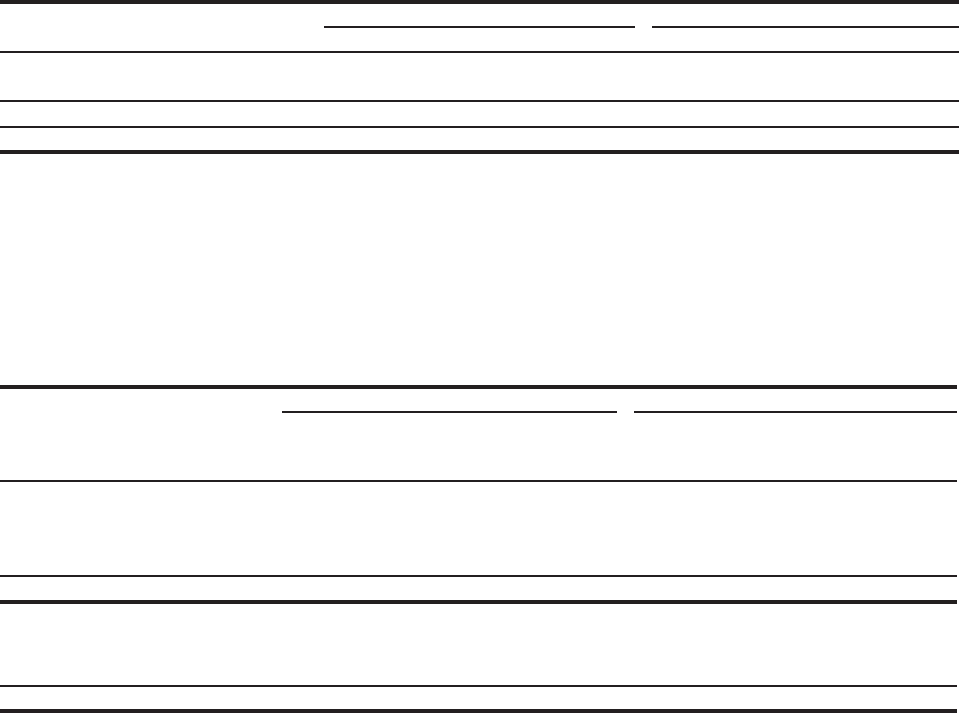

Table 12: Loan Portfolios

• a $21.7 billion increase in consumer loans, predominantly

from growth in the nonconforming mortgage, automobile,

credit card and other revolving credit and installment loan

portfolios, partially offset by a decrease in the real estate 1-4

family junior lien mortgage portfolio and the transfer of the

government guaranteed student loan portfolio to loans held

for sale at the end of second quarter 2014. The increase in

consumer loans also included the acquisition of an existing

private label and co-branded credit card loan portfolio in

fourth quarter 2014 in connection with the new Dillard's

program agreement.

Additional information on the non-strategic and liquidating

loan portfolios is included in Table 17 in the “Risk Management

– Credit Risk Management” section in this Report.

December 31, 2014 December 31, 2013

(in millions) Core Liquidating Total Core Liquidating Total

Commercial

Consumer

$ 413,701

388,062

1,125

59,663

414,826

447,725

375,077

366,343

2,013

78,853

377,090

445,196

Total loans 801,763 60,788 862,551 741,420 80,866 822,286

Change from prior year $ 60,343 (20,078) 40,265 37,631 (13,696) 23,935

A discussion of average loan balances and a comparative

detail of average loan balances is included in Table 5 under

“Earnings Performance – Net Interest Income” earlier in this

Report. Additional information on total loans outstanding by

portfolio segment and class of financing receivable is included in

the “Risk Management – Credit Risk Management” section in

this Report. Period-end balances and other loan related

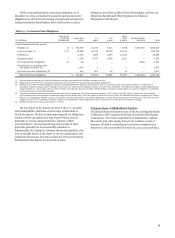

Table 13: Maturities for Selected Commercial Loan Categories

information are in Note 6 (Loans and Allowance for Credit

Losses) to Financial Statements in this Report.

Table 13 shows contractual loan maturities for loan

categories normally not subject to regular periodic principal

reduction and sensitivities of those loans to changes in interest

rates.

December 31, 2014 December 31, 2013

(in millions)

Within

one

year

After

one year

through

five years

After

five

years Total

Within

one

year

After

one year

through

five years

After

five

years Total

Selected loan maturities:

Commercial and industrial $ 76,216 172,801 22,778 271,795 71,921 140,430 23,007 235,358

Real estate mortgage

Real estate construction

17,485

6,079

61,092

11,312

33,419

1,337

111,996

18,728

20,028

6,207

62,965

9,282

29,434

1,445

112,427

16,934

Total selected loans $ 99,780 245,205 57,534 402,519 98,156 212,677 53,886 364,719

Distribution of loans to changes in interest

rates:

Loans at fixed interest rates $ 15,574 25,429 20,002 61,005 14,802 23,846 14,690 53,338

Loans at floating/variable interest rates 84,206 219,776 37,532 341,514 83,354 188,831 39,196 311,381

Total selected loans $ 99,780 245,205 57,534 402,519 98,156 212,677 53,886 364,719

Deposits

Deposits totaled $1.2 trillion at December 31, 2014, compared

with $1.1 trillion at December 31, 2013. Table 14 provides

additional information regarding deposits. Deposit growth of

$89.1 billion from December 31, 2013 reflected continued

customer-driven growth as well as liquidity-related issuances of

term deposits. Information regarding the impact of deposits on

net interest income and a comparison of average deposit

balances is provided in “Earnings Performance – Net Interest

Income” and Table 5 earlier in this Report. Total core deposits

were $1.1 trillion at December 31, 2014, up $74.3 billion from

$980.1 billion at December 31, 2013.

51