Wells Fargo 2014 Annual Report Download - page 223

Download and view the complete annual report

Please find page 223 of the 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

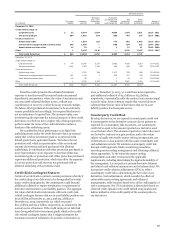

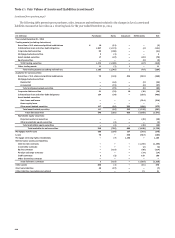

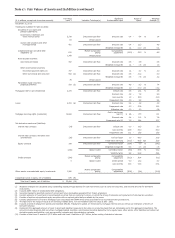

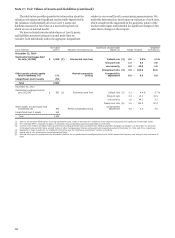

The changes in Level 3 assets and liabilities measured at fair value on a recurring basis for the year ended December 31, 2013,

are summarized as follows:

Total net gains

(losses) included in Purchases,

sales,

Net unrealized

gains (losses)

included in

Other issuances income related

(in millions)

Balance,

beginning

of period Net

income

compre-

hensive

income

and

settlements,

net (1)

Transfers

into

Level 3

Transfers

out of

Level 3

Balance,

end of

period

to assets and

liabilities held

at period end (2)

Year ended December 31, 2013

Trading assets (excluding derivatives):

Securities of U.S. states and

political subdivisions $ 46 3 — (10) — — 39 —

Collateralized loan and other

debt obligations 742 67 — (37) — (231) 541 (33)

Corporate debt securities 52 9 — (1) 13 (20) 53 6

Mortgage-backed securities 6 1 — 9 — (15) 1 1

Asset-backed securities 138 16 — (35) 25 (22) 122 15

Equity securities 3 — — (3) 13 — 13 —

Total trading securities 987 96 — (77) 51 (288) 769 (11)

Other trading assets 76 (22) — — 1 (1) 54 (8)

Total trading assets (excluding derivatives) 1,063 74 — (77) 52 (289) 823 (19) (3)

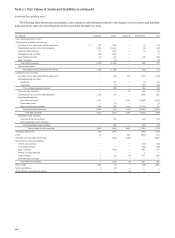

Available-for-sale securities:

Securities of U.S. states and

political subdivisions 3,631 11 (85) (182) 53 (214) 3,214 —

Mortgage-backed securities:

Residential 94 17 (1) (40) — (6) 64 —

Commercial 203 (13) 28 (58) — (22) 138 (8)

Total mortgage-backed securities 297 4 27 (98) — (28) 202 (8)

Corporate debt securities 274 10 (10) (13) 23 (3) 281 —

Collateralized loan and other

debt obligations 13,188 8 124 625 — (12,525) 1,420 —

Asset-backed securities:

Auto loans and leases 5,921 (1) (34) (1,067) — (4,327) 492 —

Home equity loans 51 3 (1) (5) — (48) — —

Other asset-backed securities 3,283 27 19 31 24 (1,727) 1,657 (7)

Total asset-backed securities 9,255 29 (16) (1,041) 24 (6,102) 2,149 (7) (4)

Total debt securities 26,645 62 40 (709) 100 (18,872) 7,266 (15) (5)

Marketable equity securities:

Perpetual preferred securities 794 10 (2) (73) — — 729 —

Other marketable equity securities — — — — — — — —

Total marketable equity securities 794 10 (2) (73) — — 729 — (6)

Total available-for-sale

securities 27,439 72 38 (782) 100 (18,872) 7,995 (15)

Mortgages held for sale 3,250 5 — (874) 336 (343) 2,374 (74) (7)

Loans 6,021 (211) — 106 — (193) 5,723 (178) (7)

Mortgage servicing rights (residential) (8) 11,538 1,156 — 2,886 — — 15,580 3,398 (7)

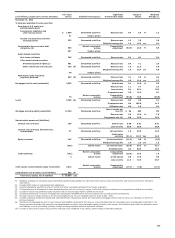

Net derivative assets and liabilities:

Interest rate contracts 659 (662) — (39) — 2 (40) (186)

Commodity contracts 21 — — (66) (1) 36 (10) (19)

Equity contracts (122) (151) — 137 (14) 104 (46) 48

Foreign exchange contracts 21 (15) — 1 2 — 9 (8)

Credit contracts (1,150) (30) — 805 — — (375) 345

Other derivative contracts (78) 75 — — — — (3) —

Total derivative contracts (649) (783) — 838 (13) 142 (465) 180 (9)

Other assets 162 315 — 1,026 — — 1,503 (2) (3)

Short sale liabilities — — — — — — — — (3)

Other liabilities (excluding derivatives) (49) 3 — 7 — — (39) 5 (7)

(1) See next page for detail.

(2) Represents only net gains (losses) that are due to changes in economic conditions and management’s estimates of fair value and excludes changes due to the collection/

realization of cash flows over time.

(3) Included in net gains (losses) from trading activities and other noninterest income in the income statement.

(4) Level 3 transfers out include $6.0 billion in asset-backed securities that were transferred from the available-for-sale portfolio to held-to-maturity securities.

(5) Included in net gains (losses) from debt securities in the income statement.

(6) Included in net gains (losses) from equity investments in the income statement.

(7) Included in mortgage banking and other noninterest income in the income statement.

(8) For more information on the changes in mortgage servicing rights, see Note 9 (Mortgage Banking Activities).

(9) Included in mortgage banking, trading activities, equity investments and other noninterest income in the income statement.

(continued on following page)

221