Wells Fargo 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WellsFargo & Company

Montgomery Street

San Francisco, California

--- wellsfargo.com

WELLS FARGO WELLSFARGO & COMPANY ANNUAL REPORTCULTURE COUNTS

Together we’ll go far

Our Vision:

Satisfy all our customers’ financial needs and help them

succeed financially.

Nuestra visión:

Satisfacer todas las necesidades financieras de nuestros

clientes y ayudarles a alcanzar el éxito financiero.

Notre Vision:

Répondre à tous les besoins financiers de nos clients

et les aider à obtenir du succès financièrement.

© 2015 WellsFargo & Company. All rights reserved.

Deposit products oered through WellsFargo Bank, N.A. Member FDIC.

CCM7043 (Rev00,1/each)

我們的願景

滿足我們所有客戶的財務需求,並協助他們取得財務上的成功

WellsFargo & Company Annual Report 2014

Culture counts.

An unwavering focus on the customer.

Table of contents

-

Page 1

Wells Fargo & Company Annual Report 2014 Culture counts. An unwavering focus on the customer. -

Page 2

... that for me, being an owner operator is more rewarding." Frank secured a Wells Fargo Equipment Express® loan to help buy his rig. He also received guidance from small business bankers on managing his startup company's finances. The HoustonÂarea entrepreneur then landed a client in the... -

Page 3

...24 Community To Our Owners Living Our Culture Corporate Social Responsibility Highlights Board of Directors, Senior Leaders 2014 Financial Report - Financial Review - Controls and Procedures - Financial Statements - Report of Independent Registered Public Accounting Firm 263 Stock... -

Page 4

John G. Stumpf Chairman, President and Chief Executive Officer, Wells Fargo & Company Pictured in the Wells Fargo History Museum in San Francisco. 2 -

Page 5

... In 2014, Wells Fargo generated record earnings for a sixth consecutive year, remaining the most profitable bank in the United States. We also ended 2014 as the world's most valuable bank by market capitalization. Our 2014 net income was $23.1 billion, up 5 percent from 2013. Diluted... -

Page 6

...From checking accounts and debit cards to savings products to treasury management services, we help customers manage their daily financial lives. We help families buy that first home or new car. We provide funding to businesses, small and large, to expand and hire. We help our customers plan... -

Page 7

...old agricultural and industrial equipment company based in Iowa that started with a single product. Wells Fargo Commercial Banking Relationship Manager Mark Conway has worked with Vermeer for 25 years, helping this familyÂowned business as it has grown into a global business that now makes... -

Page 8

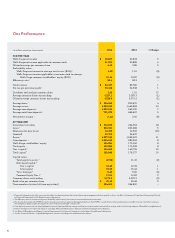

... Average core deposits 4 Average retail core deposits 5 Net interest margin 1 AT YEARÂEND Investment securities Loans 1 Allowance for loan losses Goodwill Assets 1 Core deposits 4 Wells Fargo stockholders' equity Total equity Tier 1 capital 6 Total capital 6 Capital ratios: Total equity to assets... -

Page 9

... to be responsive to economic, social, and environmental challenges. This includes helping underserved consumers who wish to enter or reÂenter the banking system. We offer them products and services such as lowÂcost checking and remittance services, secured credit cards, and loans. Our... -

Page 10

...enterprise," our way of calling out how data and technology are shaping the customer experiences we deliver. Digital is playing a larger role in all of our channels, from our award winning website and mobile banking experience to newer services at our bank locations, ATMs, and call centers... -

Page 11

... close by thanking our 265,000 team members for our success in 2014. They bring our culture to life. And if there is one job I must do for them and our customers, it is to be the keeper of our company's culture. That work doesn't end with this letter, nor should it. 2015 will be another year... -

Page 12

10 -

Page 13

... and other Wells Fargo LIFT programs have created more than 8,500 homeowners. Isaac received a $15,000 NeighborhoodLIFT grant, qualified for a mortgage through a federal Veterans Affairs program, and bought his first home in November 2014. "He's had a tough time," Josh said... -

Page 14

12 -

Page 15

... and ways to enhance customer experiences. Conducting pilots and gathering feedback are key components of Wells Fargo's approach. Mobile banking. RealÂtime account alerts. Making an appointment online with a banker. Wells Fargo developed all of these digital solutions by emphasizing... -

Page 16

14 -

Page 17

...state's food stamp system left scores of North Carolina families without the means to buy needed food. The Kate B. Reynolds Charitable Trust soon found a solution, while working with Wells Fargo, the United Way of Forsyth County, the North Carolina Division of Social Services, several food... -

Page 18

16 -

Page 19

... foreign exchange, and Wells Fargo was there - not only with products and services but also with education and forecasting tools." And when Vermeer needed to move its China facility from one location to another, a line of credit from Wells Fargo helped the company maintain working... -

Page 20

18 -

Page 21

..., a customer service representative at Wells Fargo's Military Banking call center, can relate to the challenges that military service members face when stationed overseas. "I've been in their shoes," said the U.S. Navy veteran. "What they're going through hits home for me." The San Antonio... -

Page 22

20 -

Page 23

...Richard also decided it was time for him to begin a financial journey. Student loan debt led him to Wells Fargo's banking store in Nome one day to talk to Personal Banker Drew McCann. "I had just seen a Wells Fargo commercial that conveyed the message that the company was willing to help... -

Page 24

22 -

Page 25

... works to make such universal access a reality. Maisie, a Business Banking relationship manager in Denver, spends countless hours working to feed those in need by collecting locally grown food that would otherwise go to waste and delivering it to food service organizations in her community... -

Page 26

24 -

Page 27

Community Wells Fargo provided a $75,000 grant to Boston University to support energy efficiency research in lowÂincome housing communities. A team of professors at Boston University is striving to improve energy efficiency and reduce energy costs in lowÂincomeÂhousing communities ... -

Page 28

... financing Military veterans, service members To learn more Read our 2014 Corporate Social Responsibility Interim Report wellsfargo.com/about/csr/reports/ Wells Fargo & Company Corporate Social Responsibility Interim Report 2014 Culture counts. An unwavering focus on our communities... -

Page 29

...Roberson Enterprise Efficiency & Global Services James H. Rowe Investor Relations Eric D. Shand Chief Loan Examiner John R. Shrewsberry Chief Financial Officer * Timothy J. Sloan Wholesale Banking * James M. Strother General Counsel * Oscar Suris Corporate Communications A. Charles Thomas Chief Data... -

Page 30

..., Wells Fargo Funds Management, LLC Deposit Products Group Kenneth A. Zimmerman Daniel I. Ayala, Global Remittance Services Edward M. Kadletz, Debit and Prepaid Products Principal Investments George D. Wick Ross M. Berger, Corporate Credit Rosy Le Cohen, Municipal Bonds Arthur Evans, Municipal... -

Page 31

...Interest Entities Mortgage Banking Activities Intangible Assets Deposits Short-Term Borrowings Long-Term Debt Guarantees, Pledged Assets and Collateral Legal Actions Derivatives Fair Values of Assets and Liabilities Preferred Stock Common Stock and Stock Plans Employee Benefits and Other... -

Page 32

...terms used throughout this Report. Financial Review1 Overview Wells Fargo & Company is a nationwide, diversified, community-based financial services company with $1.7 trillion in assets. Founded in 1852 and headquartered in San Francisco, we provide banking, insurance, investments, mortgage... -

Page 33

.... Credit Quality Credit quality continued to improve in 2014, with solid performance in several of our commercial and consumer loan portfolios as losses remained near historically low levels, reflecting our long-term risk focus and the benefit from the improving housing market. Net charge... -

Page 34

... common share Balance sheet (at year end) Investment securities Loans Allowance for loan losses Goodwill Assets Core deposits (1) LongÂterm debt Wells Fargo stockholders' equity Noncontrolling interests Total equity (1) 2014 2013 2012 2011 2010 2009 % Change 2014/ 2013... -

Page 35

... (2) Common Equity Tier 1 (3) Average balances: Average Wells Fargo common stockholders' equity to average assets Average total equity to average assets Per common share data Dividend payout (4) Book value Market price (5) High Low Year end (1) (2) (3) (4) (5) 2013 2012 1.45... -

Page 36

...%) in 2013 and $42.9 billion (50%) in 2012. The decrease in 2014 was driven predominantly by a 27% decline in mortgage banking income due to decreased net gains on mortgage loan origination/sales activities, partially offset by higher trust and investment fee income. Mortgage loan originations... -

Page 37

... income (A) Noninterest income Service charges on deposit accounts Trust and investment fees (1) Card fees Other fees (1) Mortgage banking (1) Insurance Net gains from trading activities Net gains (losses) on debt securities Net gains from equity investments Lease income Other Total... -

Page 38

... 36 basis points from 3.76% in 2012. The increase in net interest income for 2014, compared with 2013, was largely driven by securities purchases, higher trading balances, and reduced funding costs due to disciplined deposit pricing and lower long term debt yields. Strong growth in commercial... -

Page 39

...revolving credit and installment Total consumer Total loans (1) Other Total earning assets Funding sources Deposits: InterestÂbearing checking Market rate and other savings Savings certificates Other time deposits Deposits in foreign offices Total interestÂbearing deposits ShortÂterm... -

Page 40

... revolving credit and installment Total consumer Total loans (4) Other Total earning assets Funding sources Deposits: InterestÂbearing checking Market rate and other savings Savings certificates Other time deposits Deposits in foreign offices Total interestÂbearing deposits ShortÂterm... -

Page 41

...average balance amounts represent amortized cost for the periods presented. Nonaccrual loans and related income are included in their respective loan categories. Includes taxableÂequivalent adjustments of $902 million, $792 million, $701 million, $696 million and $629 million for 2014, 2013, 2012... -

Page 42

... of Changes of Net Interest Income Year ended December 31, 2014 over 2013 (in millions) Increase (decrease) in interest income: Federal funds sold, securities purchased under resale agreements and other shortÂterm investments $ Trading assets Investment securities: AvailableÂforÂsale... -

Page 43

... of credit fees All other fees Total other fees Mortgage banking: Servicing income, net Net gains on mortgage loan origination/sales activities Total mortgage banking Insurance Net gains from trading activities Net gains (losses) on debt securities Net gains from equity investments Lease... -

Page 44

... the investment activities of our customers, execute economic hedging to manage certain of our balance sheet risks and for a very limited amount of proprietary trading for our own account. Net gains (losses) from trading activities, which reflect unrealized changes in fair value of our trading... -

Page 45

... to Wells Fargo Foundation in 2012. Our full year 2014 efficiency ratio improved slightly to 58.1% compared with 58.3% in 2013. The Company expects to operate within its targeted efficiency ratio range of 55% - 59% for full year 2015. Income Tax Expense The 2014 annual effective tax rate was... -

Page 46

... and long-term viability. Products and services that generally do not meet these criteria - such as ATM cards, online banking and direct deposit - are not included. In addition, multiple holdings by a brokerage customer within an investment category, such as common stock, mutual funds or bonds... -

Page 47

...and savings accounts, credit and debit cards, and auto, student, and small business lending. These products also include investment, insurance and trust services in 39 states and D.C., and mortgage and home equity loans in all 50 states and D.C. through its Regional Banking and Wells Fargo Home... -

Page 48

...Insurance, International, Real Estate Capital Markets, Commercial Mortgage Servicing, Corporate Trust, Equipment Finance, Wells Fargo Securities, Principal Investments, Asset Backed Finance, and Asset Management. Wholesale Banking cross-sell was 7.2 products per relationship in September 2014... -

Page 49

...: Service charges on deposit accounts Trust and investment fees: Brokerage advisory, commissions and other fees Trust and investment management Investment banking Total trust and investment fees Card fees Other fees Mortgage banking Insurance Net gains from trading activities Net gains... -

Page 50

...: Service charges on deposit accounts Trust and investment fees: Brokerage advisory, commissions and other fees Trust and investment management Investment banking (1) Total trust and investment fees Card fees Other fees Mortgage banking Insurance Net gains from trading activities Net... -

Page 51

... lower net charge-offs and continued improvement in credit quality. Balance Sheet Analysis At December 31, 2014, our assets totaled $1.7 trillion, up $163.7 billion from December 31, 2013. The predominant areas of asset growth were in federal funds sold and other short-term investments, which... -

Page 52

... due to changes in overall economic or market conditions, which could influence loan origination demand, prepayment speeds, or deposit balances and mix. In response, the available-for-sale securities portfolio can be rebalanced to meet the Company's interest rate risk management objectives. In... -

Page 53

..., credit card and other revolving credit and installment loan portfolios, partially offset by a decrease in the real estate 1-4 family junior lien mortgage portfolio and the transfer of the government guaranteed student loan portfolio to loans held for sale at the end of second quarter 2014... -

Page 54

... in net unrealized gains on our investment securities portfolio resulting from a decrease in long term interest rates. See Note 5 (Investment Securities) to Financial Statements in this Report for additional information. OffÂBalance Sheet Arrangements In the ordinary course of business, we... -

Page 55

...and noninterestÂbearing checking, and market rate and other savings accounts. Balances are presented net of unamortized debt discounts and premiums and purchase accounting adjustments. Represents the future interest obligations related to interestÂbearing time deposits and longÂterm debt in the... -

Page 56

... customers and meeting our customers' long-term financial needs by offering products and valueadded services that are appropriate for their needs and circumstances. In addition, our team members are committed to operational excellence, and we recognize that our infrastructure, systems, processes... -

Page 57

... • EnterpriseÂwide risk management framework, which outlines the policies, processes, and governance structures used to execute the Company's risk management program • Functional framework and oversight policies, which outline roles and responsibilities for managing key risk... -

Page 58

... strategy of all risks taken by the businesses, and provides credible challenge to risks incurred. The Chief Risk Officer, as well as the Chief Enterprise, Credit, Market, Compliance, Operational, Information Security and Financial Crimes Risk Officers as his or her direct reports, work closely... -

Page 59

... losses relating to these or other cyber attacks. Addressing cybersecurity risks is a priority for Wells Fargo, and we continue to develop and enhance our controls, processes and systems in order to protect our networks, computers, software and data from attack, damage or unauthorized access... -

Page 60

...Pay mortgage portfolio and PCI loans acquired from Wachovia, certain portfolios from legacy Wells Fargo Home Equity and Wells Fargo Financial, and our education finance government guaranteed loan portfolio. We transferred the government guaranteed student loan portfolio to loans held for sale... -

Page 61

...real estate PCI loans (1) Total commercial Consumer: PickÂaÂPay mortgage (1)(2) Legacy Wells Fargo Financial debt consolidation Liquidating home equity Legacy Wachovia other PCI loans (1) Legacy Wells Fargo Financial indirect auto Education Finance  government insured (3) Total consumer... -

Page 62

...settlement with borrower (1) Loans resolved by sales to third parties (2) Reclassification to accretable yield for loans with improving creditÂrelated cash flows (3) Use of nonaccretable difference due to: Losses from loan resolutions and writeÂdowns (4) Balance, December 31, 2012 Addition of... -

Page 63

... variety of relationship focused products and services, including loans supporting short-term trade finance and working capital needs. Slightly more than half of our oil and gas loans were to businesses in the exploration and production (E&P) sector. Nearly all of these E&P loans are secured by... -

Page 64

... Industrial Loans and Lease Financing by Industry (1) December 31, 2014 (in millions) Investors Financial institutions Oil and gas Food and beverage Real estate lessor Cyclical retailers Healthcare Industrial equipment Technology Public administration Transportation Business services... -

Page 65

... at December 31, 2008, reflecting principal payments, loan resolutions and write-downs. December 31, 2014 Real estate mortgage (in millions) By state: California Texas Florida New York North Carolina Arizona Washington Virginia Georgia Colorado Other Total By property: Office... -

Page 66

... 31, 2013. Foreign loans were approximately 3% of our consolidated total assets at December 31, 2014 and at December 31, 2013. Our foreign country risk monitoring process incorporates frequent dialogue with our financial institution customers, counterparties and regulatory agencies, enhanced by... -

Page 67

...cash credit trading businesses, which sometimes results in selling and purchasing protection on the identical reference entity. Generally, we do not use market instruments such as CDS to hedge the credit risk of our investment or loan positions, although we do use them to manage risk in our trading... -

Page 68

... December 31, 2014, as a result of our modification activities and customers exercising their option to convert to fixed payments. For more information, see the "Pick a-Pay Portfolio" section later in this Report. We continue to modify real estate 1-4 family mortgage loans to assist homeowners... -

Page 69

... property loans. Additional information about AVMs and our policy for their use can be found in Note 6 (Loans and Allowance for Credit Losses) to Financial Statements in this Report. Table 24: Real Estate 1Â4 Family First and Junior Lien Mortgage Loans by State December 31, 2014 Real... -

Page 70

... estate 1-4 family first lien mortgage portfolio as of December 31, 2014. First lien mortgage portfolios by state are presented in Table 25. % of loans two payments or more past due Dec 31, 2014 Dec 31, 2013 Loss rate Year ended December 31, 2014 2013 Dec 31, 2013 2014 $ 67... -

Page 71

... the option feature as a result of our modification efforts since the acquisition, and loans where the customer voluntarily converted to a fixed-rate product. The Pick a-Pay portfolio is included in the consumer real estate 1-4 family first mortgage class of loans throughout this Report. Table... -

Page 72

... ratio of carrying value to current value is calculated as the carrying value divided by the collateral value. To maximize return and allow flexibility for customers to avoid foreclosure, we have in place several loss mitigation strategies for our Pick-a-Pay loan portfolio. We contact customers... -

Page 73

... Outstanding balance Dec 31, (in millions) Junior lien mortgages behind: Wells Fargo owned or serviced first lien Third party first lien Total junior lien mortgages (1) Loss rate (annualized) quarter ended Dec 31, 2014 Sep 30, 2014 Jun 30, 2014 Mar 31, 2014 Dec 31, 2013 or... -

Page 74

... five to 30 years. At the end of the draw period, a line of credit generally converts to an amortizing payment schedule with repayment terms of up to 30 years based on the balance at time of conversion. Certain lines and loans have been structured with a balloon payment, which requires full... -

Page 75

... terms. Real estate 1Â4 family mortgage loans predominantly insured by the FHA or guaranteed by the VA and student loans predominantly guaranteed by agencies on behalf of the U.S. Department of Education under the Federal Family Education Loan Program are not placed on nonaccrual status... -

Page 76

... March 31, 2014, respectively, and are excluded from this table. For more information on the changes in foreclosures for government guaranteed residential real estate mortgage loans, see Note 1 (Summary of Significant Accounting Policies) and Note 7 (Premises, Equipment, Lease Commitments and Other... -

Page 77

... by bank regulatory agencies), we transfer it to nonaccrual status. When the loan reaches 180 days past due, or is discharged in bankruptcy, it is our policy to write these loans down to net realizable value (fair value of collateral less estimated costs to sell), except for modifications in... -

Page 78

... of period Net change in government insured/guaranteed (1)(2) Additions to foreclosed assets (3) Reductions: Sales WriteÂdowns and net gains (losses) on sales Total reductions Balance, end of period (1) Sep 30, 2014 Jun 30, 2014 Mar 31, 2014 Year ended Dec 31, 2014 2013 2014... -

Page 79

... estate 1Â4 family first mortgage Real estate 1Â4 family junior lien mortgage Credit Card Automobile Other revolving credit and installment Trial modifications Total consumer TDRs (1) Total TDRs TDRs on nonaccrual status TDRs on accrual status (1) Total TDRs (1) 2014 2013 2012 2011... -

Page 80

..., generally six consecutive months of payments, or equivalent, inclusive of consecutive payments made prior to modification. Loans will also be placed on nonaccrual, and a corresponding charge-off is recorded to the loan balance, when Table 37: Analysis of Changes in TDRs Quarter ended Dec 31... -

Page 81

..., 2014, 2013, 2012, 2011 and 2010, respectively. Represents loans whose repayments are predominantly insured by the FHA or guaranteed by the VA. Includes mortgages held for sale 90 days or more past due and still accruing. Represents loans whose repayments are predominantly guaranteed by agencies... -

Page 82

... Management (continued) NET CHARGEÂOFFS Table 39: Net ChargeÂoffs Year ended December 31, Net loan charge ($ in millions) 2014 Commercial: Commercial and industrial Real estate mortgage Real estate construction Lease financing Total commercial Consumer: Real estate 1Â4 family... -

Page 83

... additional information on PCI loans, see the "Risk Management - Credit Risk Management - Purchased Credit-Impaired Loans" section, Note 1 (Summary of Significant Accounting Policies) and Note 6 (Loans and Allowance for Credit Losses) to Financial Statements in this Report. The ratio of the... -

Page 84

... housing market. The total provision for credit losses was $1.4 billion in 2014, $2.3 billion in 2013 and $7.2 billion in 2012. The 2014 provision for credit losses was $1.4 billion, $1.6 billion less than net charge-offs, due to strong underlying credit, and improvement in the housing market... -

Page 85

... and warranties that reflect management's estimate of losses for loans for which we could have a repurchase obligation, whether or not we currently service those loans, based on a combination of factors. Our mortgage repurchase liability estimation process also incorporates a forecast of... -

Page 86

... in our consolidated balance sheet, represents our best estimate of the probable loss that we expect to incur for various representations and warranties in the contractual provisions of our sales of mortgage loans. The mortgage repurchase liability estimation process requires management to make... -

Page 87

represent a probable loss, and is based on currently available information, significant judgment, and a number of assumptions that are subject to change. The high end of this range of reasonably possible losses in excess of our recorded liability was $973 million at December 31, 2014, and was ... -

Page 88

...regarding how changes in interest rates and related market conditions could influence drivers of earnings and balance sheet composition such as loan origination demand, prepayment speeds, deposit balances and mix, as well as pricing strategies. Our risk measures include both net interest income... -

Page 89

... and long-term debt, from fixed-rate payments to floating-rate payments, or vice versa; and • to economically hedge our mortgage origination pipeline, funded mortgage loans and MSRs using interest rate swaps, swaptions, futures, forwards and options. MORTGAGE BANKING INTEREST RATE AND MARKET... -

Page 90

...servicing sides of our mortgage business change continually, the types of instruments used in our hedging are reviewed daily and rebalanced based on our evaluation of current market factors and the interest rate risk inherent in our MSRs portfolio. Throughout 2014, our economic hedging strategy... -

Page 91

... accommodate the investment and risk management activities of our customers, execute economic hedging to manage certain balance sheet risks and, to a very limited degree, for proprietary trading for our own account. These activities primarily occur within our Wholesale Banking businesses and to... -

Page 92

...and tradingrelated intra-day gains and losses. Net tradingÂrelated revenue does not include activity related to long-term positions held for economic hedging purposes, period-end adjustments, and other activity not representative of daily price changes driven by market factors. Market Risk is... -

Page 93

... by changes in portfolio composition. Quarter ended December 31, 2014 (in millions) General VaR Risk Categories Credit Interest rate Equity Commodity Foreign exchange Diversification benefit (1) Total VaR (1) September 30, 2014 Period end Average Low High Period end Average... -

Page 94

... Banking engages in the fixed income, traded credit, foreign exchange, equities, and commodities markets businesses. Other business segments hold small additional trading positions covered under the market risk capital rule. Table 48 summarizes the market risk-based capital requirements charge... -

Page 95

... measures the risk of broad market movements such as changes in the level of credit spreads, interest rates, equity prices, commodity prices, and foreign exchange rates. General VaR uses historical simulation analysis based on 99% confidence level and a 10-day time horizon. Table 50 shows the... -

Page 96

... securitized credit-sensitive products. The Company calculates Incremental Risk by generating a portfolio loss distribution using Monte Carlo simulation, which assumes numerous scenarios, where an assumption is made that the portfolio's composition remains constant for a one-year time horizon... -

Page 97

...group is responsible for developing corporate market risk policy, creating quantitative market risk models, establishing independent risk limits, calculating and analyzing market risk capital, and reporting aggregated and lineÂofÂbusiness market risk information. Limits are regularly reviewed... -

Page 98

.... We manage these investments within capital risk limits approved by management and the Board and monitored by Corporate ALCO. Gains and losses on these securities are recognized in net income when realized and periodically include OTTI charges. Changes in equity market prices may also... -

Page 99

... funding is provided by long-term debt, other foreign deposits, and short-term borrowings. Table 56 shows selected information for short-term borrowings, which generally mature in less than 30 days. Quarter ended (in millions) Balance, period end Federal funds purchased and securities... -

Page 100

... in the event our credit ratings were to fall below investment grade. The credit ratings of the Parent and Wells Fargo Bank, N.A. as of December 31, 2014, are presented in Table 57. Wells Fargo Bank, N.A. LongÂterm deposits Aa3 AAÂ AA AA** ShortÂterm borrowings PÂ1 AÂ1+ F1... -

Page 101

..., or will be admitted to listing, trading and/or quotation by a stock exchange or quotation system that is not considered to be a regulated market. As amended in October 2005, March 2010 and September 2013. Wells Fargo Bank, N.A. Wells Fargo Bank, N.A. is authorized by its board of directors... -

Page 102

... shares. For additional information about our forward repurchase agreements, see Note 1 (Summary of Significant Accounting Policies) to Financial Statements in this Report. market risks of significant trading activities. In December 2013, the FRB approved a final rule, effective April 1, 2014... -

Page 103

... process of considering new rules to address the amount of equity and unsecured debt a company must hold to facilitate its orderly liquidation, often referred to as Total Loss Absorbing Capacity (TLAC). In November 2014, the Financial Stability Board (FSB) issued for public consultation policy... -

Page 104

... Securities Exchange Act of 1934. Various factors determine the amount and timing of our share repurchases, including our capital requirements, the number of shares we expect to issue for employee benefit plans and acquisitions, market conditions (including the trading price of our stock), and... -

Page 105

... tax liabilities. CET1 (formerly Tier 1 common equity under Basel I) is a nonÂGAAP financial measure that is used by investors, analysts and bank regulatory agencies to assess the capital position of financial services companies. Management reviews CET1 along with other measures of capital as... -

Page 106

...guarantees (4) Derivatives Other Total offÂbalance sheet RWAs Total RWAs (1) (2) (3) (4) Represents federal funds sold and securities purchased under resale agreements. Represents loans held for sale and loans held for investment. Represents regulatory ' covered' positions within trading... -

Page 107

..., 2013 Net change in onÂbalance sheet RWAs: Investment securities Securities financing transactions Loans Market risk Other Total change in onÂbalance sheet RWAs Net change in offÂbalance sheet RWAs: Commitments and guarantees Derivatives Other Total change in offÂbalance sheet RWAs... -

Page 108

...for systemically important firms. The FRB has finalized a number of regulations implementing enhanced prudential requirements for large bank holding companies (BHCs) like Wells Fargo regarding risk-based capital and leverage, risk and liquidity management, and imposing debt-to-equity limits on... -

Page 109

...bank subsidiary, Wells Fargo Bank, N.A., as a swap dealer, which occurred at the end of 2012. In addition, the CFTC has adopted final rules that, among other things, require extensive regulatory and public reporting of swaps, require certain swaps to be centrally cleared and traded on exchanges... -

Page 110

... unfunded credit commitments, at the balance sheet date, excluding loans carried at fair value. For a description of our related accounting policies, see Note 1 (Summary of Significant Accounting Policies) to Financial Statements in this Report. Changes in the allowance for credit losses and... -

Page 111

... at acquisition using our internal credit risk, interest rate risk and prepayment risk models, which incorporate our best estimate of current key assumptions, such as property values, default rates, loss severity and prepayment speeds. Our estimation includes the timing and amount of cash flows... -

Page 112

...to corroborate internally developed prices. For additional information on our use of pricing services, see Note 1 (Summary of Significant Accounting Policies) and Note 17 (Fair Value of Assets and Liabilities) to Financial Statements in this Report. The degree of management judgment involved in... -

Page 113

... Report for a complete discussion on our fair value of financial instruments, our related measurement techniques and the impact to our financial statements. Income Taxes We are subject to the income tax laws of the U.S., its states and municipalities and those of the foreign jurisdictions... -

Page 114

... the new guidance, companies can measure both the financial assets and financial liabilities of a CFE using the more observable fair value of the financial assets or of the financial liabilities. The Update provides accounting guidance for employee share-based payment awards with specific... -

Page 115

...the following, without limitation: • current and future economic and market conditions, including the effects of declines in housing prices, high unemployment rates, U.S. fiscal debt, budget and tax matters, geopolitical matters, and the overall slowdown in global economic growth; • our... -

Page 116

...of our operational or security systems or infrastructure, or those of our third party vendors or other service providers, including as a result of cyber attacks; the effect of changes in the level of checking or savings account deposits on our funding costs and net interest margin; fiscal and... -

Page 117

... interest payments. As described below, changes in interest rates also affect our mortgage business, including the value of our MSRs. Changes in the slope of the "yield curve" - or the spread between short-term and long-term interest rates - could also reduce our net interest margin. Normally... -

Page 118

.... Our net income also is exposed to changes in interest rates, credit spreads, foreign exchange rates, equity and commodity prices in connection with our trading activities, which are conducted primarily to accommodate our customers in the management of their market price risk, as well as when... -

Page 119

... our net interest margin and net interest income. Checking and savings account balances and other forms of customer deposits may decrease when customers perceive alternative investments, such as the stock market, as providing a better risk/return tradeoff. When customers move money out of bank... -

Page 120

... its authority to give banking entities two additional one-year extensions to conform their ownership interests in and sponsorships of covered funds under the rule. Companies with $50 billion or more in trading assets and liabilities such as Wells Fargo were required to report trading metrics... -

Page 121

... FRB guidelines and rules, may require higher capital and liquidity levels, limiting our ability to pay common stock dividends, repurchase our common stock, invest in our business, or provide loans or other products and services to our customers. Federal banking regulators continually monitor... -

Page 122

...costs as well as limit our ability to invest in our business or provide loans or other products and services to our customers. For more information, refer to the "Capital Management" and "Regulatory Reform" sections in this Report and the "Regulation and Supervision" section of our 2014 Form 10... -

Page 123

... net interest margin as it may result in us holding lower yielding loans and investment securities on our balance sheet. RISKS RELATED TO CREDIT AND OUR MORTGAGE BUSINESS As one of the largest lenders in the U.S., increased credit risk, including as a result of a deterioration in economic... -

Page 124

...their current form, as well as any effect on the Company's business and financial results, are uncertain. For more information, refer to the "Risk Management - Asset/Liability Management - Mortgage Banking Interest Rate and Market Risk" and "Critical Accounting Policies" sections in this Report... -

Page 125

... of the range of possible loss for representations and warranties does not represent a probable loss, and is based on currently available information, significant judgment, and a number of assumptions that are subject to change. If economic conditions and the housing market do not continue... -

Page 126

...downgrades experienced by the bond insurers. For more information, refer to the "Earnings Performance - Balance Sheet Analysis - Investment Securities" and "Risk Management - Credit Risk Management- Liability for Mortgage Loan Repurchase Losses" sections in this Report. OPERATIONAL AND LEGAL... -

Page 127

... and enhancement of our controls, processes and systems designed to protect our networks, computers, software and data from attack, damage or unauthorized access remain a priority for Wells Fargo. We are also proactively involved in industry cybersecurity efforts and working with other parties... -

Page 128

... such as Wells Fargo, and possible public backlash to bank fees, there is increased competitive pressure to provide products and services at current or lower prices. Consequently, our ability to reposition or reprice our products and services from time to time may be limited and could... -

Page 129

... prospects. The success of Wells Fargo is heavily dependent on the talents and efforts of our team members, and in many areas of our business, including the commercial banking, brokerage, investment advisory, and capital markets businesses, the competition for highly qualified personnel is... -

Page 130

... increases, cost savings, increases in geographic or product presence, and other projected benefits from the acquisition. The integration could result in higher than expected deposit attrition, loss of key team members, disruption of our business or the business of the acquired company, or... -

Page 131

... that the Company's disclosure controls and procedures were effective as of December 31, 2014. Internal Control Over Financial Reporting Internal control over financial reporting is defined in Rule 13a-15(f) promulgated under the Securities Exchange Act of 1934 as a process designed by... -

Page 132

...), the consolidated balance sheet of the Company as of December 31, 2014 and 2013, and the related consolidated statements of income, comprehensive income, changes in equity, and cash flows for each of the years in the three-year period ended December 31, 2014, and our report dated February 25... -

Page 133

... for credit losses Noninterest income Service charges on deposit accounts Trust and investment fees Card fees Other fees Mortgage banking Insurance Net gains from trading activities Net gains (losses) on debt securities (1) Net gains from equity investments (2) Lease income Other... -

Page 134

Wells Fargo & Company and Subsidiaries Consolidated Statement of Comprehensive Income (in millions) Wells Fargo net income Other comprehensive income (loss), before tax: Investment securities: Net unrealized gains (losses) arising during the period Reclassification of net gains to net ... -

Page 135

Wells Fargo & Company and Subsidiaries Consolidated Balance Sheet Dec 31, (in millions, except shares) Assets Cash and due from banks Federal funds sold, securities purchased under resale agreements and other shortÂterm investments Trading assets Investment securities: AvailableÂforÂsale... -

Page 136

Wells Fargo & Company and Subsidiaries Consolidated Statement of Changes in Equity Preferred stock (in millions, except shares) Balance December 31, 2011 Cumulative effect of fair value election for certain residential mortgage servicing rights Balance January 1, 2012 Net income Other ... -

Page 137

... Cumulative other comprehensive income 3,207 Total Wells Fargo stockholders' equity 140,241 2 3,207 (2,744) (926) 140... Retained earnings 64,385 2 Treasury stock (2,744) Unearned ESOP shares (926) Noncontrolling interests 1,446 Total equity 141,687 2 141,689 19,... -

Page 138

(continued from previous pages) Wells Fargo & Company and Subsidiaries Consolidated Statement of Changes in Equity Preferred stock (in millions, except shares) Balance December 31, 2013 Balance January 1, 2014 Net income Other comprehensive income, net of tax Noncontrolling interests ... -

Page 139

... earnings 92,361 92,361 23,057 Cumulative other comprehensive income 1,386 1,386 Treasury stock (8,104) (8,104) Unearned ESOP shares (1,200) (1,200) Total Wells Fargo stockholders' equity 170,142 170,142 23,057 Noncontrolling interests 866 866 551 (227) (322... -

Page 140

... accrued expenses and liabilities Net cash provided by operating activities Cash flows from investing activities: Net change in: Federal funds sold, securities purchased under resale agreements and other shortÂterm investments AvailableÂforÂsale securities: Sales proceeds Prepayments and... -

Page 141

... the end of this Report for terms used throughout the Financial Statements and related Notes. Note 1: Summary of Significant Accounting Policies Wells Fargo & Company is a diversified financial services company. We provide banking, insurance, trust and investments, mortgage banking, investment... -

Page 142

... remaining credit enhancement compared with expected credit losses; • any change in rating agencies' credit ratings at evaluation date from acquisition date and any likely imminent action; • independent analyst reports and forecasts, sector credit ratings and other independent market data... -

Page 143

... low income housing tax credit investments, equity securities that are not publicly traded and securities acquired for various purposes, such as to meet regulatory requirements (for example, Federal Reserve Bank and Federal Home Loan Bank (FHLB) stock). We have elected the fair value option for... -

Page 144

... or our banking regulatory agencies; • the customer has filed bankruptcy and the loss becomes evident owing to a lack of assets; or • the loan is 180 days past due unless both well-secured and in the process of collection. For consumer loans, we fully charge off or charge down to net... -

Page 145

... end) - We generally fully charge off when the loan is 180 days past due. Other secured loans - We generally fully or partially charge down to net realizable value when the loan is 120 days past due. IMPAIRED LOANS We consider a loan to be impaired when, based on current information and... -

Page 146

... first lien mortgages and junior lien lines of credit subject to near term significant payment increases. We incorporate the default rates and high severity of loss for these higher risk portfolios, including the impact of our established loan modification programs. When modifications occur or... -

Page 147

...information on our repurchase liability, see Note 9 (Mortgage Banking Activities). Pension Accounting We account for our defined benefit pension plans using an actuarial model. Two principal assumptions in determining net periodic pension cost are the discount rate and the expected long term... -

Page 148

...1: Summary of Significant Accounting Policies (continued) benefit payments for our plans. Such portfolios are derived from a broad-based universe of high quality corporate bonds as of the measurement date. Our determination of the reasonableness of our expected long-term rate of return on plan... -

Page 149

..., we report changes in the fair values in current period noninterest income. For fair value and cash flow hedges qualifying for hedge accounting, we formally document at inception the relationship between hedging instruments and hedged items, our risk management objective, strategy and our... -

Page 150

... our open-market common stock repurchase strategies, to allow us to manage our share repurchases in a manner consistent with our capital plans, currently submitted under the 2014 Comprehensive Capital Analysis and Review (CCAR), and to provide an economic benefit to the Company. Our payments to... -

Page 151

... 31, 2014. Additionally, no business combinations were completed in 2013. Business combinations completed in 2014 and 2012 are presented below. (in millions) 2014 Helm Financial Corporation 2012 EverKey Global Partners Limited / EverKey Global Management LLC / EverKey Global Partners (GP... -

Page 152

... of our subsidiary banks maintain reserve balances on deposit with the Federal Reserve Banks. The total daily average required reserve balance for all our subsidiary banks was $12.9 billion in 2014 and $11.8 billion in 2013. Federal law restricts the amount and the terms of both credit and non... -

Page 153

... and Lending Agreements" section of Note 14 (Guarantees, Pledged Assets and Collateral). Dec. 31, (in millions) Federal funds sold and securities purchased under resale agreements InterestÂearning deposits Other shortÂterm investments Total $ $ 2014 36,856 219,220 2,353 258,429... -

Page 154

...Âsale securities predominantly includes assetÂbacked securities collateralized by credit cards, student loans, home equity loans and auto leases or loans and cash. Included in the "Other" category of heldÂtoÂmaturity securities are assetÂbacked securities collateralized by auto leases or loans... -

Page 155

... losses and fair value of securities in the investment securities portfolio by length of time that individual securities in each category had been in a continuous loss position. Debt securities on which we have taken credit-related OTTI write-downs are categorized as being "less than 12 months... -

Page 156

...in the structure. We also consider cash flow forecasts and, as applicable, independent industry analyst reports and forecasts, sector credit ratings, and other independent market data. Based upon our assessment of the expected credit losses and the credit enhancement level of the securities, we... -

Page 157

... losses and fair value of debt and perpetual preferred investment securities by those rated investment grade and those rated less than investment grade according to their lowest credit rating by Standard & Poor's Rating Services (S&P) or Moody's Investors Service (Moody's). Credit ratings... -

Page 158

... Total mortgageÂbacked securities Corporate debt securities Collateralized loan and other debt obligations Other Total availableÂforÂsale debt securities at fair value December 31, 2013 AvailableÂforÂsale securities (1): Securities of U.S. Treasury and federal agencies Securities of... -

Page 159

...maturity After one year Total (in millions) December 31, 2014 HeldÂtoÂmaturity securities: Fair value: Securities of U.S. Treasury and federal agencies $ Securities of U.S. states and political subdivisions Federal agency mortgageÂbacked securities Collateralized loan and other debt... -

Page 160

...OTTI write-downs related to the available-for-sale securities portfolio, which includes marketable equity securities, as well as net realized gains and losses on nonmarketable equity investments (see Note 7 (Premises, Equipment, Lease Commitments and Other Assets)). Year ended December 31, (in... -

Page 161

... credit loss represents the difference between the present value of expected future cash flows discounted using the security's current effective interest rate and the amortized cost basis of the security prior to considering credit loss. Year ended December 31, (in millions) Credit loss... -

Page 162

Note 6: Loans and Allowance for Credit Losses The following table presents total loans outstanding by portfolio segment and class of financing receivable. Outstanding balances include a total net reduction of $4.5 billion and $6.4 billion at December 31, 2014 and December 31, 2013, respectively... -

Page 163

...allowance for loan losses in the same manner because the loans are predominantly insured by the Federal Housing Administration (FHA) or guaranteed by the Department of Veterans Affairs (VA). Such purchases net of transfers to MHFS were $2.9 billion and $8.2 billion for the year ended 2014 and 2013... -

Page 164

..., including home equity lines and credit card lines, in accordance with the contracts and applicable law. We may, as a representative for other lenders, advance funds or provide for the issuance of letters of credit under syndicated loan or letter of credit agreements. Any advances are... -

Page 165

... mortgage Real estate 1Â4 family junior lien mortgage Credit card Automobile Other revolving credit and installment Total consumer Total loan recoveries Net loan chargeÂoffs (2) Allowances related to business combinations/other (3) Balance, end of year Components: Allowance for loan losses... -

Page 166

... segments. Year ended December 31, 2014 (in millions) Balance, beginning of period Provision for credit losses Interest income on certain impaired loans Loan chargeÂoffs Loan recoveries Net loan chargeÂoffs Allowance related to business combinations/other Balance, end of period... -

Page 167

... provides past due information for commercial loans, which we monitor as part of our credit risk management practices. Commercial and industrial Real estate mortgage Real estate construction Lease financing (in millions) December 31, 2014 By delinquency status: CurrentÂ29 DPD and... -

Page 168

... consumer loans December 31, 2013 By delinquency status: CurrentÂ29 DPD 30Â59 DPD 60Â89 DPD 90Â119 DPD 120Â179 DPD 180+ DPD Government insured/guaranteed loans (1) Total consumer loans (excluding PCI) Total consumer PCI loans (carrying value) Total consumer loans (1) Credit card... -

Page 169

... to the ratio comparing the loan's unpaid principal balance to the property's collateral value. CLTV refers to the combination of first mortgage and junior lien mortgage (including unused line amounts for credit line products) ratios. LTVs and CLTVs are updated quarterly using a cascade approach... -

Page 170

... insured/ guaranteed. We commence the foreclosure process on consumer real estate loans when a borrower becomes 120 days delinquent in accordance with Consumer Finance Protection Bureau Guidelines. Foreclosure procedures and timelines vary depending on whether the property address resides... -

Page 171

... VA. Includes mortgage loans held for sale 90 days or more past due and still accruing. Represents loans whose repayments are predominantly guaranteed by agencies on behalf of the U.S. Department of Education under the FFELP. At the end of second quarter 2014, all government guaranteed student... -

Page 172

... modifications that totaled $452 million at December 31, 2014, and $650 million at December 31, 2013. For additional information on our impaired loans and allowance for credit losses, see Note 1 (Summary of Significant Accounting Policies). Recorded investment Impaired loans with related... -

Page 173

... investment 2012 Recognized interest income (in millions) Commercial: Commercial and industrial Real estate mortgage Real estate construction Lease financing Total commercial Consumer: Real estate 1Â4 family first mortgage Real estate 1Â4 family junior lien mortgage Credit card... -

Page 174

... represent trial modifications, which we classify and account for as TDRs. While loans are in trial payment programs, their original terms are not considered modified and they continue to advance through delinquency status and accrue interest according to their original terms. The planned... -

Page 175

... for the years ended December 31, 2014, 2013, and 2012, respectively. Reflects the effect of reduced interest rates on loans with principal or interest rate reduction primary modification type. Trial modifications are granted a delay in payments due under the original terms during the trial... -

Page 176

... 2014 2013 2012 Purchased CreditÂImpaired Loans Substantially all of our PCI loans were acquired from Wachovia on December 31, 2008, at which time we acquired commercial and consumer loans with a carrying value of $18.7 billion and $40.1 billion, respectively. The unpaid principal balance... -

Page 177

... released as a result of sales to third parties, which is included in noninterest income. Represents changes in cash flows expected to be collected due to the impact of modifications, changes in prepayment assumptions, changes in interest rates on variable rate PCI loans and sales to third parties... -

Page 178

... loan losses ChargeÂoffs Balance, December 31, 2011 Provision for loan losses ChargeÂoffs Balance, December 31, 2012 Reversal of provision for loan losses ChargeÂoffs Balance, December 31, 2013 Reversal of provision for loan losses ChargeÂoffs Balance, December 31, 2014 Commercial... -

Page 179

... PCI loans. December 31, 2014 Real estate 1Â4 family first mortgage Real estate 1Â4 family junior lien mortgage Real estate 1Â4 family first mortgage December 31, 2013 Real estate 1Â4 family junior lien mortgage (in millions) By delinquency status: CurrentÂ29 DPD... -

Page 180

...and Allowance for Credit Losses (continued) The following table provides FICO scores for consumer PCI loans. December 31, 2014 Real estate 1Â4 family first mortgage Real estate 1Â4 family junior lien mortgage Real estate 1Â4 family first mortgage December 31, 2013 Real estate... -

Page 181

... (economic hedges), and derivative loan commitments, which are carried at fair value. See Note 16 (Derivatives) for additional information. Income (expense) related to nonmarketable equity investments was: Year ended December 31, (in millions) 2014 2013 1,158 (287) 871 2012 1,086... -

Page 182

... liquidity facilities to support short-term obligations of SPEs issued to third party investors; • providing credit enhancement on securities issued by SPEs or market value guarantees of assets held by SPEs through the use of letters of credit, financial guarantees, credit default swaps and... -

Page 183

... balance sheet associated with our transactions with VIEs follow: Transfers that we account for as secured borrowings (in millions) December 31, 2014 Cash Trading assets Investment securities (1) Mortgages held for sale Loans Mortgage servicing rights Other assets Total assets Short... -

Page 184

.../nonconforming Commercial mortgage securitizations Collateralized debt obligations: Debt securities Loans (4) AssetÂbased finance structures Tax credit structures Collateralized loan obligations Investment funds Other (5) Total Servicing assets Derivatives Net assets $ 1,268... -

Page 185

... are current and 70% and 72% were rated as investment grade by the primary rating agencies at December 31, 2014 and 2013, respectively. These senior loans are accounted for at amortized cost and are subject to the Company's allowance and credit chargeÂoff policies. Includes structured financing... -

Page 186

... 2014, we sold $8.3 billion of government guaranteed student loans, including the rights to service the loans, to a third party, resulting in a $217 million gain. In connection with the sale, we provided $6.5 billion in floatingrate loan financing to an asset backed financing entity (VIE) formed... -

Page 187

... balance sheet at December 31, 2014 and December 31, 2013, we reported the debt securities issued to the VIEs as long-term junior subordinated debt with a carrying value of $2.1 billion and $1.9 billion, respectively, and the preferred equity securities issued to the VIEs as preferred stock... -

Page 188

... in 2013 and $178 million in 2012, respectively, because the loans were carried at LOCOM. In connection with these transfers, in 2014 we recorded a servicing The following table provides key economic assumptions and the sensitivity of the current fair value of residential mortgage servicing... -

Page 189

... service assumption ($ per loan) Decrease in fair value from: 10% adverse change 25% adverse change Credit loss assumption Decrease in fair value from: 10% higher losses 25% higher losses Fair value of interests held at December 31, 2013 Expected weightedÂaverage life (in years) Key economic... -

Page 190

...on deposit balances at December 31, 2014, and 2013, results in a decrease in fair value of $185 million and $175 million, respectively. See Note 9 (Mortgage Banking Activities) for further information on our commercial MSRs. We also have a $6.5 billion loan to an unconsolidated third party VIE... -

Page 191

... 31, 2014 Secured borrowings: Municipal tender option bond securitizations Commercial real estate loans Residential mortgage securitizations Total secured borrowings Consolidated VIEs: Nonconforming residential mortgage loan securitizations Structured asset finance Investment funds Other... -

Page 192

...par under standby liquidity facilities unless the bond's credit rating has declined below investment grade or there has been an event of default or bankruptcy of the issuer and insurer. NONCONFORMING RESIDENTIAL MORTGAGE LOAN SECURITIZATIONS We have consolidated certain of our nonconforming... -

Page 193

... rate changes. Represents changes due to collection/realization of expected cash flows over time. The changes in amortized MSRs were: Year ended December 31, (in millions) Balance, beginning of year Purchases Servicing from securitizations or asset transfers (1) Amortization Balance, end... -

Page 194

... Net derivative gains (losses) from economic hedges (4) Total servicing income, net Net gains on mortgage loan origination/sales activities Total mortgage banking noninterest income MarketÂrelated valuation changes to MSRs, net of hedge results (2) + (4) (1) (2) (3) (4) 2014 2013 2012... -

Page 195

...Total additions (reductions) Losses (2) Balance, end of year (1) (2) 2014 $ 899 44 (184) (140) (144) $ 615 2013 2,206 143 285 428 (1,735) 899 2012 1,326 275 1,665 1,940 (1,060) 2,206 Results from changes in investor demand, mortgage insurer practices, credit and the... -

Page 196

... December 31, 2012 December 31, 2013 Reduction in goodwill related to divested businesses Goodwill from business combinations Other December 31, 2014 $ $ $ Community Banking 17,922 17,922 - - (8) 17,914 Wholesale Banking 7,344 7,344 (11) 87 - 7,420 Wealth, Brokerage and... -

Page 197

... time deposits issued by domestic and foreign offices were interest bearing. The contractual maturities of these deposits are presented in the following table. Demand deposit overdrafts of $581 million and $554 million were included as loan balances at December 31, 2014 and 2013, respectively... -

Page 198

... 14 (Guarantees, Pledged Assets and Collateral). 2014 (in millions) As of December 31, Federal funds purchased and securities sold under agreements to repurchase Commercial paper Other shortÂterm borrowings Total Year ended December 31, Average daily balance Federal funds purchased and... -

Page 199

...to manage our exposure to foreign currency risk. As a result, a major portion of the long-term debt presented below is hedged in a fair value or cash flow hedge relationship. See Note 16 (Derivatives) for further information on qualifying hedge contracts. Following is a summary of our long-term... -

Page 200

... security structures. Represents floatingÂrate extendible notes where holders of the notes may elect to extend the contractual maturity of all or a portion of the principal amount on a periodic basis. At December 31, 2014, Federal Home Loan Bank advances were secured by investment securities... -

Page 201

... Total maximum exposure to loss includes direct pay letters of credit (DPLCs) of $15.0 billion and $16.8 billion at December 31, 2014 and 2013, respectively. We issue DPLCs to provide credit enhancements for certain bond issuances. Beneficiaries (bond trustees) may draw upon these instruments to... -

Page 202

... if receivable debtors default on their payment obligations. See Note 1 (Summary of Significant Accounting Policies) for additional information. OTHER GUARANTEES We are members of exchanges and clearing houses that we use to clear our trades and those of our customers. It is common that all... -

Page 203

... for additional information on consolidated VIE assets and secured borrowings. Dec. 31, (in millions) Trading assets and other (1) Investment securities (2) Mortgages held for sale and loans (3) Total pledged assets (1) (2) Dec. 31, 2013 30,288 85,468 381,597 497,353 2014 49,685... -

Page 204

... consolidated balance sheet in Federal funds sold, securities purchased under resale agreements and other shortÂterm investments and $14.9 billion and $10.1 billion, respectively, in Loans. Represents the fair value of collateral we have received under enforceable MRAs or MSLAs, limited for table... -

Page 205

... Wells Fargo Bank, N.A., as well as many other banks, challenging the high to low order in which the banks post debit card transactions to consumer deposit accounts. There are currently several such cases pending against Wells Fargo Bank (including the Wachovia Bank cases to which Wells Fargo... -

Page 206

... actions brought by securities lending customers of Wells Fargo and Wachovia Bank in various courts. In general, each of the cases alleges losses based on claims that Wells Fargo violated fiduciary and contractual duties in its investment of collateral for loaned securities. Blue Cross/Blue... -

Page 207

... accounting relationship (fair value or cash flow hedge). Our remaining derivatives consist of economic hedges that do not qualify for hedge accounting and derivatives held for customer accommodation, trading or other purposes. Our asset/liability management approach to interest rate, foreign... -

Page 208

... (2) Equity contracts Foreign exchange contracts Subtotal (3) Customer accommodation, trading and other derivatives: Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit contracts  protection sold Credit contracts  protection purchased Other... -

Page 209

...balance sheet netting related to resale and repurchase agreements that are disclosed within Note 14 (Guarantees, Pledged Assets and Collateral). (in millions) December 31, 2014 Derivative assets Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit... -

Page 210

..., $(5) million and $(9) million, respectively, for years ended December 31, 2014, 2013, and 2012 of the time value component recognized as net interest income (expense) on forward derivatives hedging foreign currency availableÂforÂsale securities and longÂterm debt that were excluded from the... -

Page 211

...492 million at December 31, 2014 and a net liability of $531 million at December 31, 2013. The change in fair value of these derivatives for each period end is due to changes in the underlying market indices and interest rates as well as the purchase and sale of derivative financial instruments... -

Page 212

... Year ended December 31, (in millions) Net gains (losses) recognized on economic hedge derivatives: Interest rate contracts Recognized in noninterest income: Mortgage banking (1) Other (2) Equity contracts (3) Foreign exchange contracts (2) Credit contracts (2) Subtotal Net gains (losses... -

Page 213

... Protection purchased with identical underlyings (B) Net protection sold (A)Â(B) Other protection purchased (in millions) December 31, 2014 Credit default swaps on: Corporate bonds Structured products Credit protection on: Default swap index Commercial mortgageÂbacked securities... -

Page 214

...to and approved by the appropriate levels of management. Similarly, while investment securities traded in secondary markets are typically valued using unadjusted vendor prices or vendor prices adjusted by weighting them with internal discounted cash flow techniques, these prices are reviewed and... -

Page 215

...family first and junior lien mortgages, we calculate fair value by discounting contractual cash flows, adjusted for prepayment and credit loss estimates, using discount rates based on current industry pricing (where readily available) or our own estimate of an appropriate discount rate for loans... -

Page 216

... publicly traded, we have elected the fair value option and we use a market comparable pricing technique to estimate their fair value. The remaining nonmarketable equity investments include low income housing tax credit investments, Federal Reserve Bank and Federal Home Loan Bank (FHLB) stock... -

Page 217

... subdivisions MortgageÂbacked securities Other debt securities (1) Total debt securities Total marketable equity securities Total availableÂforÂsale securities Derivatives (trading and other assets) Derivatives (liabilities) Other liabilities (1) ThirdÂparty pricing services Level... -

Page 218

... value Derivative liabilities: Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit contracts Other derivative contracts Netting Total derivative liabilities (7) Short sale liabilities: Securities of U.S. Treasury and federal agencies Securities... -

Page 219

...fair value Derivative liabilities: Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit contracts Other derivative contracts Netting Total derivative liabilities (7) Short sale liabilities: Securities of U.S. Treasury and federal agencies Securities... -

Page 220

... Fair Value Levels Level 1 (in millions) Year ended December 31, 2014 Trading assets (excluding derivatives) AvailableÂforÂsale securities Mortgages held for sale Loans Net derivative assets and liabilities (2) Short sale liabilities Total transfers Year ended December 31, 2013 Trading... -

Page 221

... net gains (losses) from equity investments in the income statement. Included in mortgage banking and other noninterest income in the income statement. For more information on the changes in mortgage servicing rights, see Note 9 (Mortgage Banking Activities). Included in mortgage banking, trading... -

Page 222

... securities Total marketable equity securities Total availableÂforÂsale securities Mortgages held for sale Loans Mortgage servicing rights (residential) Net derivative assets and liabilities: Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit... -

Page 223

... net gains (losses) from equity investments in the income statement. Included in mortgage banking and other noninterest income in the income statement. For more information on the changes in mortgage servicing rights, see Note 9 (Mortgage Banking Activities). Included in mortgage banking, trading... -

Page 224

... securities Total marketable equity securities Total availableÂforÂsale securities Mortgages held for sale Loans Mortgage servicing rights (residential) Net derivative assets and liabilities: Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit... -

Page 225

... net gains (losses) from equity investments in the income statement. Included in mortgage banking and other noninterest income in the income statement. For more information on the change in mortgage servicing rights, see Note 9 (Mortgage Banking Activities). Included in mortgage banking, trading... -

Page 226

... securities Total marketable equity securities Total availableÂforÂsale securities Mortgages held for sale Loans Mortgage servicing rights (residential) Net derivative assets and liabilities: Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit... -

Page 227

... of auction rate preferred equity securities with no maturity date that are callable by the issuer. Consists predominantly of reverse mortgage loans securitized with GNMA which were accounted for as secured borrowing transactions. The high end of the range of inputs is for servicing modified loans... -

Page 228

... cash flow Default rate Loss severity Prepayment rate Interest rate contracts: derivative loan commitments Equity contracts (26) 199 (245) Discounted cash flow Discounted cash flow Option model Market comparable pricing Option model FallÂout factor InitialÂvalue servicing... -

Page 229

... mortgage credit lines are expected to be drawn by borrowers expressed as an annualized rate. Volatility factor - is the extent of change in price an item is estimated to fluctuate over a specified period of time expressed as a percentage of relative change in price over a period over time... -

Page 230

...all Level 3 trading securities, mortgages held for sale, loans, other nonmarketable equity investments, and available-for-sale securities have consistent inputs, valuation techniques and correlation to changes in underlying inputs. The internal models used to determine fair value for these Level... -

Page 231

... equity investments. The following table presents the increase (decrease) in value of certain assets for which a nonrecurring fair value adjustment has been recognized during the periods presented. Year ended December 31, (in millions) Mortgages held for sale (LOCOM) Loans held for sale... -

Page 232

... private equity fund investments (4) Insignificant level 3 assets Total December 31, 2013 Residential mortgages held for sale (LOCOM) $ 171 294 1,563 Market comparable pricing Comparability adjustment 893 (3) Discounted cash flow Default rate (5) Discount rate Loss severity... -

Page 233

...DailyÂQuarterly MonthlyÂSemi Annually N/A N/A 1Â180 days 5Â95 days N/A N/A N/A Â Not applicable (1) Excludes a private equity fund investment of $171 million and $505 million at December 31, 2014, and December 31, 2013, respectively for which we recorded a nonrecurring fair value... -

Page 234

...market risk limits. We have elected to measure and carry them at fair value, which best aligns with our risk management practices. Fair value for these loans is primarily determined using readily available market data based on recent transaction prices for similar loans. MORTGAGES HELD FOR SALE... -

Page 235

... under the fair value option. Year ended December 31, (in millions) Gains (losses) attributable to instrumentÂspecific credit risk: Trading assets  loans Mortgages held for sale Loans held for sale Total $ $ 29 60 - 89 40 126 - 166 14 (124) 21 (89) 2014 2013 2012 233 -

Page 236

..., 2014 Financial assets Cash and due from banks (1) Federal funds sold, securities purchased under resale agreements and other shortÂterm investments (1) HeldÂtoÂmaturity securities Mortgages held for sale (2) Loans held for sale (2) Loans, net (3) Nonmarketable equity investments (cost... -

Page 237

... 31, 2013 Shares authorized and designated under this authorization. If issued, preference shares would be limited to one vote per share. Our total authorized, issued and outstanding preferred stock is presented in the following two tables along with the Employee Stock Ownership Plan (ESOP... -

Page 238

... each representing a 1/1,000th interest in a share of the Non-Cumulative Perpetual Class A Preferred Stock, Series T, for an aggregate public offering price of $800 million. See Note 8 (Securitizations and Variable Interest Entities) for additional information on our trust preferred securities... -

Page 239

... behalf of the Wells Fargo & Company 401(k) Plan (the 401(k) Plan). Dividends on the ESOP Preferred Stock are cumulative from the date of initial issuance and are payable quarterly at annual rates based upon the year of issuance. Each share of ESOP Preferred Stock released from the unallocated... -

Page 240

...324 2013 568 157 - 725 273 2012 435 112 13 560 211 Employee Stock Plans We offer stock-based employee compensation plans as described below. For information on our accounting for stock-based compensation plans, see Note 1 (Summary of Significant Accounting Policies). LONGÂTERM... -

Page 241

... whose performance period ended December 31, 2014, the determination of the number of performance shares that will vest will occur in the first quarter of 2015, after review of the Company's performance by the Human Resources Committee of the Board of Directors. Beginning in 2013, PSAs granted... -

Page 242

...ended December 31, 2014 Per share fair value of options granted $ Expected volatility Expected dividends Expected term (in years) RiskÂfree interest rate 2013 1.58 18.3 0.93 0.5 0.1 2012 2.79 29.2 0.68 0.7 0.1 Employee Stock Ownership Plan The Wells Fargo & Company 401(k) Plan... -

Page 243

The balance of common stock and unreleased preferred stock held in the Wells Fargo ESOP fund, the fair value of unreleased ESOP preferred stock and the dividends on allocated shares of common stock and unreleased ESOP Preferred Stock paid to the 401(k) Plan were: Shares outstanding December... -

Page 244

...plans dependent on various factors. We provide health care and life insurance benefits for certain retired employees and reserve the right to terminate, modify or amend any of the benefits at any time. The information set forth in the following tables is based on current actuarial reports using... -

Page 245

...94 (10) Qualified settlements in 2013 include $123 million for the Cash Balance Plan. Amounts recognized in cumulative OCI (pre tax) consist of: December 31, 2014 Pension benefits (in millions) Net actuarial loss (gain) Net prior service credit Total $ $ Qualified 2,677 (2) 2,675... -

Page 246

... We seek to achieve the expected long-term rate of return with a prudent level of risk given the benefit obligations of the pension plans and their funded status. Our overall investment strategy is designed to provide our Cash Balance Plan with long-term growth opportunities while ensuring that... -

Page 247

...cap stocks (4) Global stocks (5) International stocks (6) Emerging market stocks Real estate/timber (7) Hedge funds (8) Private equity Other Total plan investments Payable upon return of securities loaned Net receivables Total plan assets December 31, 2013 Cash and cash equivalents Long... -

Page 248

...of shares held at year end. Long Duration, Intermediate (Core), High-Yield, and International Fixed Income - includes investments traded on the secondary markets; prices are measured by using quoted market prices for similar securities, pricing models, and discounted cash flow analyses using... -

Page 249

... a different fair value measurement at the reporting date. Defined Contribution Retirement Plans We sponsor a defined contribution retirement plan named the Wells Fargo & Company 401(k) Plan (401(k) Plan). Under the 401(k) Plan, after one month of service, eligible employees may contribute up... -

Page 250

... related to net unrealized gains (losses) on investment securities, net unrealized gains (losses) on derivatives, foreign currency translation, and employee benefit plan adjustments are recorded in cumulative OCI (see Note 23 (Other Comprehensive Income)). These associated adjustments decreased... -

Page 251

... rate included a tax benefit resulting from the surrender of previously written-down Wachovia life insurance investments. The change in unrecognized tax benefits follows: Year ended December 31, (in millions) Balance at beginning of year Additions: For tax positions related to the current... -

Page 252

...of Changes in Equity and Note 19 (Common Stock and Stock Plans) for information about stock and options activity and terms and conditions of warrants. Year ended December 31, (in millions, except per share amounts) Wells Fargo net income Less: Preferred stock dividends and other Wells Fargo... -

Page 253

... of net (gains) losses to net income: Interest income on loans Interest expense on longÂterm debt Noninterest income Salaries expense Interest income on investment securities Subtotal reclassifications to net income Net change Defined benefit plans adjustments: Net actuarial gains (losses... -

Page 254

... period $ Investment securities 4,413 3,222 (169) 3,053 4 7,462 (4,680) (178) (4,858) 266 2,338 3,315 Amounts reclassified from accumulated other comprehensive income Net change Less: Other comprehensive loss from noncontrolling interests Balance, December 31, 2014 $ (954... -

Page 255

...Accounts, time deposits, global remittance and debit cards. Community Banking serves customers through a complete range of channels, including traditional banking stores, in-store banking centers, business centers, ATMs, Online and Mobile Banking, and Wells Fargo Customer Connection, a 24-hours... -

Page 256

... in more than one business segment, substantially all of which represents products and services for wealth management customers provided in Community Banking stores. Net interest income is the difference between interest earned on assets and the cost of liabilities to fund those assets. Interest... -

Page 257