Sallie Mae 2010 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

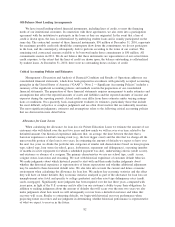

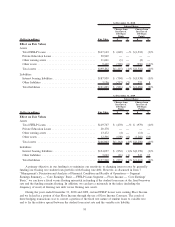

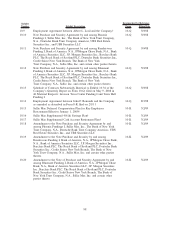

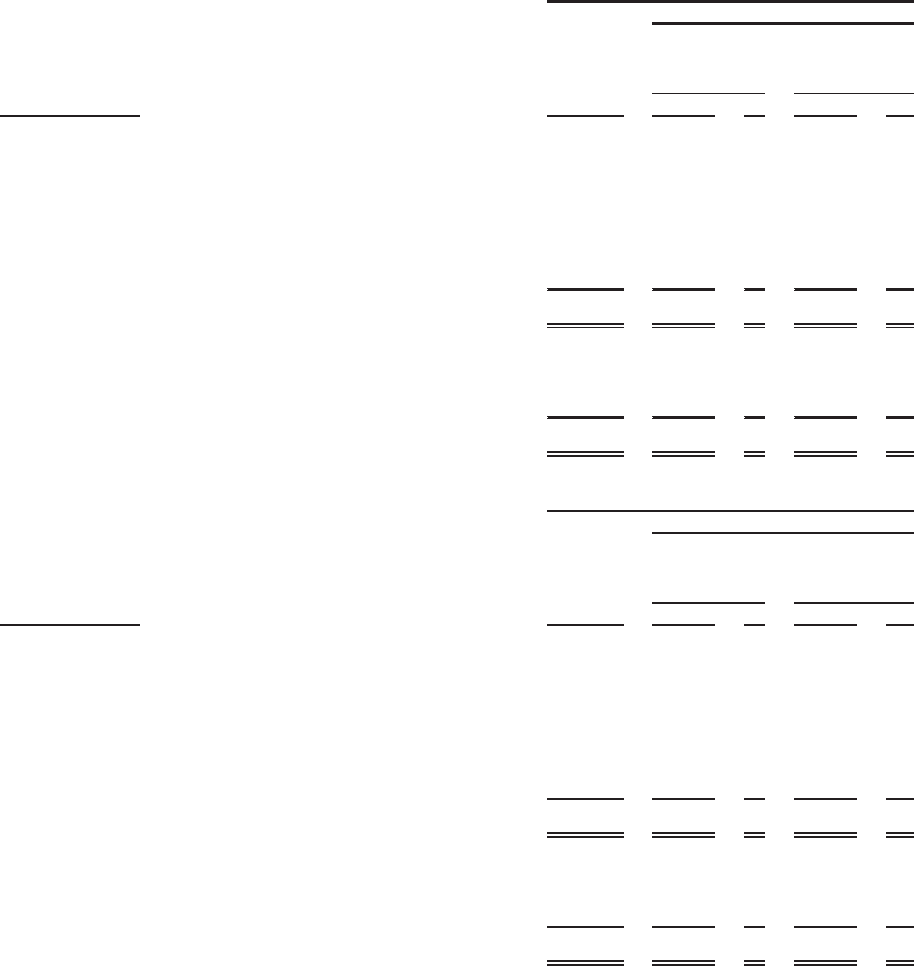

(Dollars in millions) Fair Value $ % $ %

Change from

Increase of

100 Basis

Points

Change from

Increase of

300 Basis

Points

Interest Rates:

At December 31, 2010

Effect on Fair Values

Assets

Total FFELP Loans ............................... $147,163 $ (649) —% $(1,318) (1)%

Private Education Loans ............................ 30,949 — — — —

Other earning assets ............................... 11,641 (1) — (2) —

Other assets ..................................... 9,449 (565) (6) (996) (11)%

Total assets ..................................... $199,202 $(1,215) (1)% $(2,316) (1)%

Liabilities

Interest bearing liabilities ........................... $187,959 $ (704) —% $(1,938) (1)%

Other liabilities .................................. 3,136 (217) (7) 257 8

Total liabilities ................................... $191,095 $ (921) —% $(1,681) (1)%

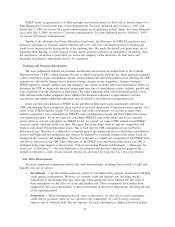

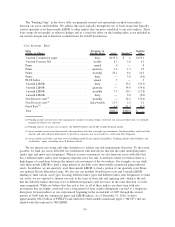

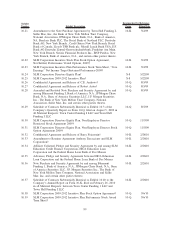

(Dollars in millions) Fair Value $ % $ %

Change from

Increase of

100 Basis

Points

Change from

Increase of

300 Basis

Points

Interest Rates:

At December 31, 2009

Effect on Fair Values

Assets

Total FFELP Loans ............................... $119,747 $ (470) —% $ (979) (1)%

Private Education Loans ............................ 20,278 — — — —

Other earning assets ............................... 13,472 (4) — (11) —

Other assets ..................................... 12,506 (690) (6) (1,266) (10)

Total assets ..................................... $166,003 $(1,164) (1)% $(2,256) (1)%

Liabilities

Interest bearing liabilities ........................... $154,037 $ (852) (1)% $(2,159) (1)%

Other liabilities .................................. 3,263 (21) (1) 547 17

Total liabilities ................................... $157,300 $ (873) (1)% $(1,612) (1)%

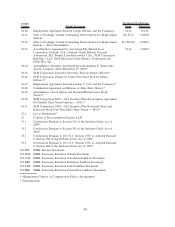

A primary objective in our funding is to minimize our sensitivity to changing interest rates by generally

funding our floating rate student loan portfolio with floating rate debt. However, as discussed in Item 7

“Management’s Discussion and Analysis of Financial Condition and Results of Operations — Segment

Earnings Summary — ‘Core Earnings’ Basis — FFELP Loans Segment — Floor Income — ‘Core Earnings’

Basis,” we can have a fixed versus floating mismatch in funding if the student loan earns at the fixed borrower

rate and the funding remains floating. In addition, we can have a mismatch in the index (including the

frequency of reset) of floating rate debt versus floating rate assets.

During the years ended December 31, 2010 and 2009, certain FFELP Loans were earning Floor Income

and we locked in a portion of that Floor Income through the use of Floor Income Contracts. The result of

these hedging transactions was to convert a portion of the fixed rate nature of student loans to variable rate,

and to fix the relative spread between the student loan asset rate and the variable rate liability.

91