Sallie Mae 2010 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

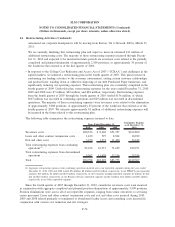

14. Restructuring Activities (Continued)

announced our corporate headquarters will be moving from Reston, VA to Newark, DE by March 31,

2011.

We are currently finalizing this restructuring plan and expect to incur an estimated $11 million of

additional restructuring costs. The majority of these restructuring expenses incurred through Decem-

ber 31, 2010 and expected to be incurred in future periods are severance costs related to the partially

completed and planned elimination of approximately 2,500 positions, or approximately 30 percent of

the workforce that existed as of the first quarter of 2010.

• In response to the College Cost Reduction and Access Act of 2007 (“CCRAA”) and challenges in the

capital markets, we initiated a restructuring plan in the fourth quarter of 2007. This plan focused on

conforming our lending activities to the economic environment, exiting certain customer relationships

and product lines, winding down or otherwise disposing of our debt Purchased Paper businesses, and

significantly reducing our operating expenses. This restructuring plan was essentially completed in the

fourth quarter of 2009. Under this plan, restructuring expenses for the years ended December 31, 2010,

2009 and 2008 were $7 million, $22 million, and $84 million, respectively. Restructuring expenses

from the fourth quarter of 2007 through the fourth quarter of 2010 totaled $136 million, of which

$107 million was recorded in continuing operations and $29 million was recorded in discontinued

operations. The majority of these restructuring expenses were severance costs related to the elimination

of approximately 3,000 positions, or approximately 25 percent of the workforce that existed as of the

fourth quarter of 2007. We estimate approximately $1 million of additional restructuring expenses will

be incurred in the future related to this restructuring plan.

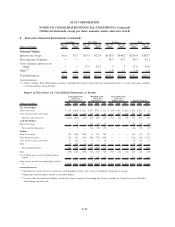

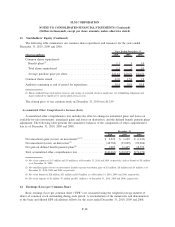

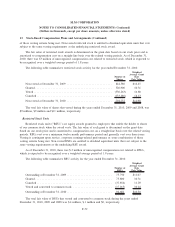

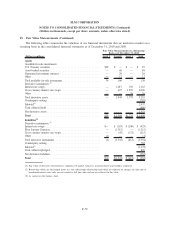

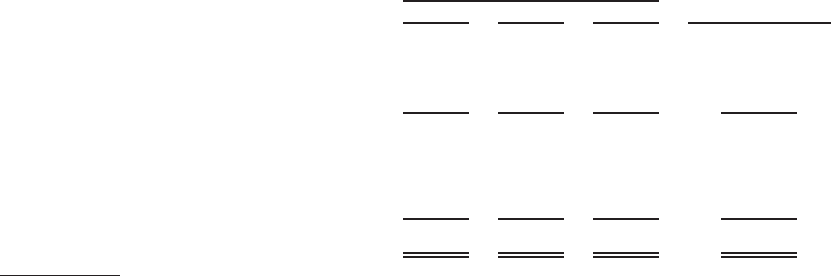

The following table summarizes the restructuring expenses incurred to date.

2010 2009 2008

Cumulative Expense

as of December 31,

2010

Years Ended December 31,

Severance costs ....................... $80,536 $ 8,402 $51,357 $162,800

Lease and other contract termination costs . . . 1,430 597 8,902 10,929

Exit and other costs .................... 3,270 1,572 11,400 16,242

Total restructuring expenses from continuing

operations

(1)

........................ 85,236 10,571 71,659 189,971

Total restructuring expenses from discontinued

operations ......................... 5,562 11,658 12,116 29,336

Total ............................... $90,798 $22,229 $83,775 $219,307

(1) Aggregate restructuring expenses from continuing operations incurred across our reportable segments during the years ended

December 31, 2010, 2009 and 2008 totaled $54 million, $8 million and $42 million, respectively, in our FFELP Loans reportable

segment; $12 million, $2 million and $25 million, respectively, in our Consumer Lending reportable segment; $7 million, $2 mil-

lion and $10 million, respectively, in our Business Services reportable segment; and $12 million, $(2) million and $(5) million,

respectively, in our Other reportable segment.

Since the fourth quarter of 2007 through December 31, 2010, cumulative severance costs were incurred

in conjunction with aggregate completed and planned position eliminations of approximately 5,500 positions.

Position eliminations were across all of our reportable segments, ranging from senior executives to servicing

center personnel. Lease and other contract termination costs and exit and other costs incurred during 2010,

2009 and 2008 related primarily to terminated or abandoned facility leases and consulting costs incurred in

conjunction with various cost reduction and exit strategies.

F-74

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)