Sallie Mae 2010 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

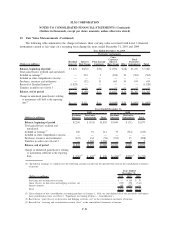

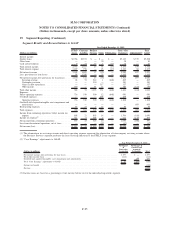

19. Segment Reporting (Continued)

FFELP Loans segment operating expenses primarily represent an intercompany charge from the Business

Services segment which performs the servicing of the majority of these loans. Servicing is primarily charged

at rates paid by the trusts where the loan resides. These servicing rates exceed the actual cost of servicing the

loans.

As a result of the long-term funding used in the FFELP portfolio and the government guarantee provided

on the loans, the net interest margin recorded in the FFELP Loans segment tends to be relatively stable. In

addition to the net interest margin, we earn other fee income which is primarily generated by late fees on the

loans in the portfolio.

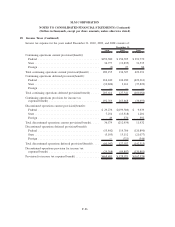

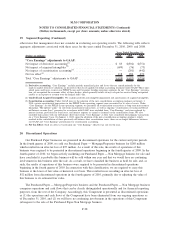

The following table includes asset information for our FFELP Loans segment.

2010 2009

December 31,

FFELP Loans, net ............................................ $148,649 $121,053

Cash and investments

(1)

........................................ 5,963 4,812

Retained Interest in off-balance sheet securitized loans................. — 1,034

Other ..................................................... 3,911 4,484

Total assets ................................................. $158,523 $131,383

(1) Includes restricted cash and investments.

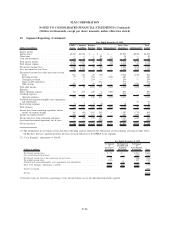

Consumer Lending Segment

In this segment, we originate, acquire, finance and service Private Education Loans. Private Education

Loans consist of two general types: (1) those that are designed to bridge the gap between the cost of higher

education and the amount financed through either federal loans or the borrowers’ resources, and (2) those that

are used to meet the needs of students in alternative learning programs such as career training, distance

learning and lifelong learning programs. Private Education Loans bear the full credit risk of the borrower. We

manage this additional risk through historical risk-performance underwriting strategies and the addition of

qualified cosigners.

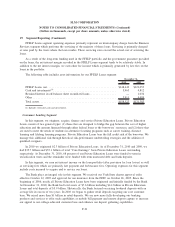

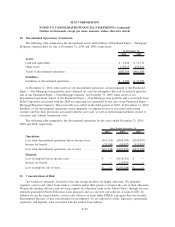

In 2010 we originated $2.3 billion of Private Education Loans. As of December 31, 2010 and 2009, we

had $35.7 billion and $35.1 billion of total “Core Earnings” basis Private Education Loans outstanding,

respectively. At December 31, 2010, 68 percent of our Private Education Loans were funded to term in

securitization trusts and the remainder were funded with term unsecured debt and bank deposits.

In this segment, we earn net interest income on the loan portfolio (after provision for loan losses) as well

as servicing fees which are primarily late payment and forbearance fees. Operating expenses for this segment

include costs incurred to acquire and to service our loans.

The Bank plays an integral role in this segment. We received our Utah State charter approval order

effective October 12, 2005 and approval for our insurance from the FDIC on October 26, 2005. Since the

beginning of 2006, nearly all Private Education Loans have been originated and initially funded by the Bank.

At December 31, 2010, the Bank had total assets of $7.6 billion including $4.4 billion in Private Education

Loans and total deposits of $5.9 billion. Historically, the Bank focused on raising brokered deposits with an

average life in excess of two years. In 2010 we began to gather retail deposits targeting our core customer

base. We raised more than $1 billion in retail deposits. We are now more fully developing our banking

products and services to offer such capabilities as mobile bill payment and remote deposit capture to increase

our appeal to our college-educated customer base and enhance our deposit gathering capabilities.

F-91

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)