Sallie Mae 2010 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226

|

|

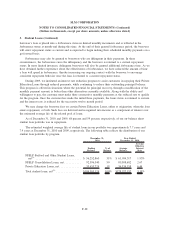

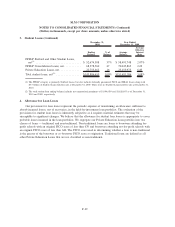

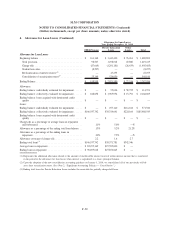

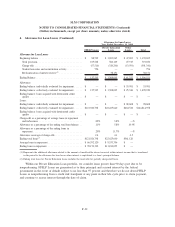

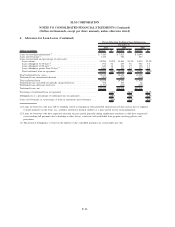

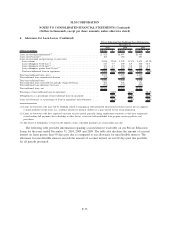

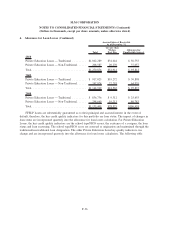

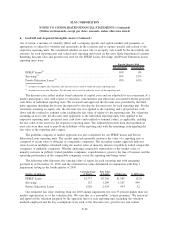

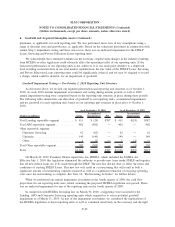

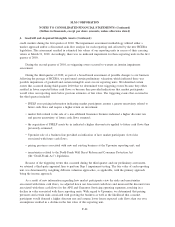

4. Allowance for Loan Losses (Continued)

(Dollars in millions) Balance % Balance % Balance %

2010 2009 2008

December 31,

Private Education Traditional Loan Delinquencies

Loans in-school/grace/deferment

(1)

............................... $ 7,419 $ 7,812 $ 8,694

Loans in forbearance

(2)

...................................... 1,156 784 625

Loans in repayment and percentage of each status:

Loans current ........................................... 22,850 91.2% 10,844 90.2% 8,074 92.2%

Loans delinquent 31-60 days

(3)

............................... 794 3.2 437 3.6 302 3.4

Loans delinquent 61-90 days

(3)

............................... 340 1.4 204 1.7 128 1.5

Loans delinquent greater than 90 days

(3)

......................... 1,060 4.2 543 4.5 257 2.9

Total traditional loans in repayment ............................ 25,044 100% 12,028 100% 8,761 100%

Total traditional loans, gross . . ................................. 33,619 20,624 18,080

Traditional loans unamortized discount ............................ (801) (475) (436)

Total traditional loans . ...................................... 32,818 20,149 17,644

Traditional loans receivable for partially charged-off loans . . ............. 558 193 82

Traditional loans allowance for losses . ............................ (1,231) (664) (485)

Traditional loans, net. . ...................................... $32,145 $19,678 $17,241

Percentage of traditional loans in repayment . ....................... 74.5% 58.3% 48.5%

Delinquencies as a percentage of traditional loans in repayment ............ 8.8% 9.8% 7.8%

Loans in forbearance as a percentage of loans in repayment and forbearance . . . 4.4% 6.1% 6.7%

(1) Loans for borrowers who may still be attending school or engaging in other permitted educational activities and are not yet required

to make payments on the loans, e.g., residency periods for medical students or a grace period for bar exam preparation.

(2) Loans for borrowers who have requested extension of grace period generally during employment transition or who have temporarily

ceased making full payments due to hardship or other factors, consistent with established loan program servicing policies and

procedures.

(3) The period of delinquency is based on the number of days scheduled payments are contractually past due.

F-34

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)