Sallie Mae 2010 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.16. Commitments, Contingencies and Guarantees (Continued)

$6 million settlement to avoid the burden and expense of continued litigation. We recorded $6 million of

contingency expense in 2010 related to this matter.

ED’s Office of the Inspector General (“OIG”) commenced an audit regarding Special Allowance

Payments on September 10, 2007. On August 3, 2009, we received the final audit report of the OIG related to

our billing practices for Special Allowance Payments. Among other things, the OIG recommended that ED

instruct us to return approximately $22 million in alleged special allowance overpayments. We continue to

believe that our practices were consistent with longstanding ED guidance and all applicable rules and

regulations and intend to continue disputing these findings. We provided our response to the Secretary on

October 2, 2009 and we provided additional information to ED in 2010. At this time we estimate the range of

potential exposure is $0 to $22 million.

Contingencies

In the ordinary course of business, we and our subsidiaries are routinely defendants in or parties to

pending and threatened legal actions and proceedings including actions brought on behalf of various classes of

claimants. These actions and proceedings may be based on alleged violations of consumer protection,

securities, employment and other laws. In certain of these actions and proceedings, claims for substantial

monetary damage are asserted against us and our subsidiaries.

In the ordinary course of business, we and our subsidiaries are subject to regulatory examinations,

information gathering requests, inquiries and investigations. In connection with formal and informal inquiries

in these cases, we and our subsidiaries receive numerous requests, subpoenas and orders for documents,

testimony and information in connection with various aspects of our regulated activities.

In view of the inherent difficulty of predicting the outcome of such litigation and regulatory matters, we

cannot predict what the eventual outcome of the pending matters will be, what the timing or the ultimate

resolution of these matters will be, or what the eventual loss, fines or penalties related to each pending matter

may be.

We are required to establish reserves for litigation and regulatory matters where those matters present

loss contingencies that are both probable and estimable. When loss contingencies are not both probable and

estimable, we do not establish reserves.

Based on current knowledge, reserves have been established for certain litigation or regulatory matters

where the loss is both probable and estimable. Based on current knowledge, management does not believe that

loss contingencies, if any, arising from pending investigations, litigation or regulatory matters will have a

material adverse effect on our consolidated financial position, liquidity, results of operations or cash flows.

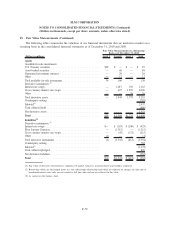

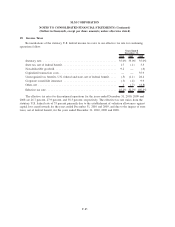

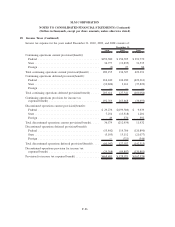

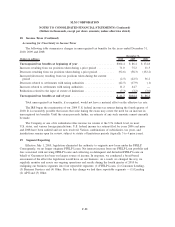

17. Benefit Plans

In 2010 we began the formal process with the Pension Benefit Guaranty Corporation and the IRS to

terminate the qualified pension plan. As of this filing, we are waiting on approval from the IRS in order to

proceed. In conjunction with the termination of the qualified plan, we are also terminating the non-qualified

supplemental pension plan. A portion of these non-qualified benefits were distributed in December 2010 with

the remaining benefits payable in 2011. Subject to the receipt of a favorable determination letter from the

IRS, we intend to complete the termination and settlement of all pension plan benefits during 2011. This

termination will not have a material effect on future financial results.

F-84

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)