Sallie Mae 2010 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

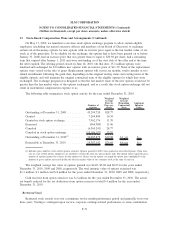

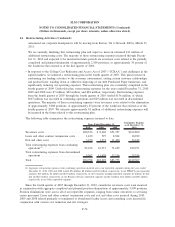

13. Stock-Based Compensation Plans and Arrangements (Continued)

Our Directors Equity Plan, under which stock options and restricted stock are granted to non-employee

members of the board of directors, was approved on May 22, 2009, and expires on May 22, 2012. At

December 31, 2010, 1 million shares were authorized to be issued from this plan.

From January 1, 2007 through May 21, 2009, we granted stock options and restricted stock to our

employees and non-employee directors under the SLM Corporation Incentive Plan and the Directors Stock

Plan.

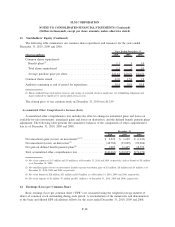

The total stock-based compensation cost recognized in the consolidated statements of income for the

years ended December 31, 2010, 2009 and 2008 was $40 million, $51 million, and $86 million, respectively.

The related income tax benefit for the years ended December 31, 2010, 2009 and 2008 was $15 million,

$19 million and $32 million, respectively. As of December 31, 2010, there was $25 million of total

unrecognized compensation cost related to stock-based compensation programs, which is expected to be

recognized over a weighted average period of 1.9 years.

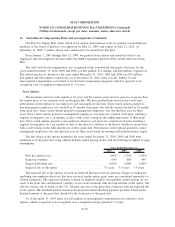

Stock Options

The maximum term for stock options is 10 years and the exercise price must be equal to or greater than

the market price of our common stock on the grant date. We have granted time-vested, price-vested and

performance-vested options to our employees and non-employee directors. Time-vested options granted to

non-management employees vest one-half in 18 months from grant date and the second one-half in 36 months

from grant date. Time-vested options granted to management employees vest one-third per year for three

years. Price-vested options granted to management employees vest upon our common stock price reaching a

targeted closing price for a set number of days, with a cliff vesting on the eighth anniversary of their grant

date. Price-vested options granted to non-employee directors vest upon our common stock price reaching a

targeted closing price for a set number of days or the director’s election to the Board, whichever occurs later,

with a cliff vesting on the fifth anniversary of their grant date. Performance-vested options granted to senior

management employees vest one-third per year for three years based on earnings-related performance targets.

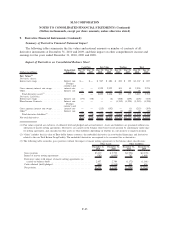

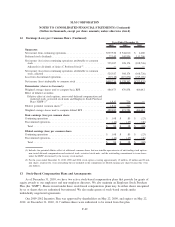

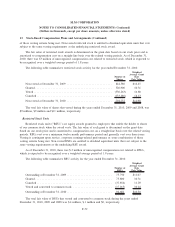

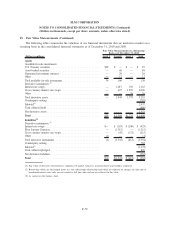

The fair values of the options granted in the years ended December 31, 2010, 2009 and 2008 were

estimated as of the grant date using a Black-Scholes option pricing model with the following weighted average

assumptions:

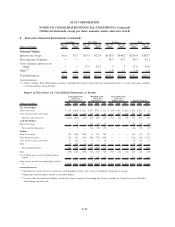

2010 2009 2008

Years Ended December 31,

Risk-free interest rate ................................ 1.60% 1.51% 2.50%

Expected volatility .................................. 60% 80% 44%

Expected dividend rate ............................... 0.00% 0.00% 0.00%

Expected life of the option ............................ 3.3years 3.5 years 3.3 years

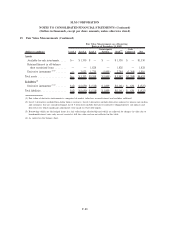

The expected life of the options is based on observed historical exercise patterns. Groups of employees

(including non-employee directors) that have received similar option grant terms are considered separately for

valuation purposes. The expected volatility is based on implied volatility from publicly-traded options on our

stock at the grant date and historical volatility of our stock consistent with the expected life of the option. The

risk-free interest rate is based on the U.S. Treasury spot rate at the grant date consistent with the expected life

of the option. The dividend yield is based on the projected annual dividend payment per share based on the

dividend amount at the grant date, divided by the stock price at the grant date.

As of December 31, 2010, there was $22 million of unrecognized compensation cost related to stock

options, which is expected to be recognized over a weighted average period of 1.9 years.

F-70

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)