Sallie Mae 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We continued to use ED’s Purchase and Participation Programs to fund FFELP Stafford and PLUS Loans

disbursed through September 30, 2010 (see Item 1 “Business — Recent Legislation” for a further discussion

regarding the end of new FFELP Loan originations as of July 1, 2010).

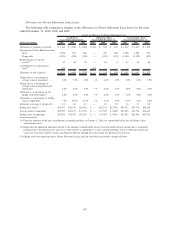

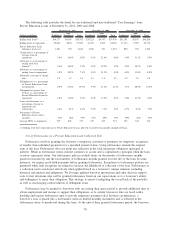

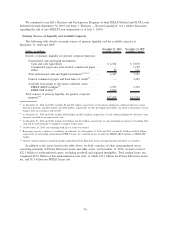

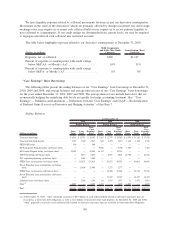

Primary Sources of Liquidity and Available Capacity

The following table details our main sources of primary liquidity and the available capacity at

December 31, 2010 and 2009.

(Dollars in millions)

December 31, 2010

Available Capacity

December 31, 2009

Available Capacity

Sources of primary liquidity for general corporate purposes:

Unrestricted cash and liquid investments:

Cash and cash equivalents . . ...................... $ 4,342 $ 6,070

Commercial paper and asset-backed commercial paper . . . — 1,150

Other ....................................... 85 131

Total unrestricted cash and liquid investments

(1)(2)(3)

...... 4,427 7,351

Unused commercial paper and bank lines of credit

(4)

...... — 3,485

Available borrowings to the extent collateral exists:

FFELP ABCP facilities

(5)

......................... 3,937 1,703

FHLB-DM facility

(5)

............................ 8,664 —

Total sources of primary liquidity for general corporate

purposes

(6)

..................................... $17,028 $12,539

(1)

At December 31, 2010 and 2009, excludes $0 and $25 million, respectively, of investments pledged as collateral related to certain

derivative positions and $872 million and $708 million, respectively, of other non-liquid investments, classified as investments on our

balance sheet in accordance with GAAP.

(2)

At December 31, 2010 and 2009, includes $684 million and $821 million, respectively, of cash collateral pledged by derivative coun-

terparties and held in our unrestricted cash.

(3)

At December 31, 2010 and 2009, includes $2.0 billion and $2.4 billion, respectively, of cash and liquid investments at the Bank. This

cash will be used primarily to originate or acquire student loans.

(4)

On November 24, 2010, our remaining bank line of credit was retired.

(5)

Borrowing capacity is subject to availability of collateral. As of December 31, 2010 and 2009, we had $1.5 billion and $2.1 billion,

respectively, of outstanding unencumbered FFELP Loans, net, available for use in either the FFELP ABCP facilities or FHLB-DM

facility.

(6)

General corporate purposes primarily include originating Private Education Loans and repaying unsecured debt as it matures.

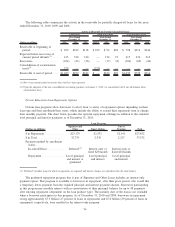

In addition to the assets listed in the table above, we hold a number of other unencumbered assets,

consisting primarily of Private Education Loans and other assets. At December 31, 2010, we had a total of

$22.3 billion of unencumbered assets, excluding goodwill and acquired intangibles. Total student loans, net,

comprised $12.6 billion of this unencumbered asset total, of which $11.1 billion are Private Education Loans,

net, and $1.5 billion are FFELP Loans, net.

76