Sallie Mae 2010 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2. Significant Accounting Policies (Continued)

Retained Interest in off-balance sheet securitized loans

Prior to the adoption of the new consolidation accounting rules on January 1, 2010, certain of our

securitization transactions qualified as sales and we retained the Residual Interests in the trusts as well as

servicing rights (all of which are referred to as our Retained Interest in off-balance sheet securitized loans.

The following accounting policies were applied prior to the January 1, 2010 adoption of the new consolidation

accounting guidance which required us to consolidate all of our previously off-balance sheet trusts and

therefore eliminated any accounting for Residual Interests.

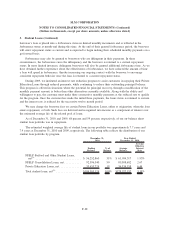

When our securitization transactions qualified for sale treatment we recognized the resulting gain on

student loan securitizations in the consolidated statements of income. This gain was based upon the difference

between the allocated cost basis of the assets sold and the relative fair value of the assets received. The

component in determining the fair value of the assets received that involves the most judgment is the valuation

of the Residual Interest. We estimated the fair value of the Residual Interest, both initially and each

subsequent quarter, based on the present value of future expected cash flows using our best estimates of the

following key assumptions — credit losses, prepayment speeds and discount rates commensurate with the risks

involved. Quoted market prices were not available. When we adopted the new financial instruments accounting

guidance on January 1, 2008, we elected to carry all Residual Interests at fair value with subsequent changes

in fair value recorded in earnings. We chose this election in order to simplify the accounting for Residual

Interests under one accounting model.

The fair value of the Fixed Rate Embedded Floor Income is a component of the Residual Interest and

was determined initially at the time of the sale of the student loans and during each subsequent quarter. This

estimate was based on an option valuation and a discounted cash flow calculation that considered the current

borrower rate, Special Allowance Payment (“SAP”) spreads and the term for which the loan is eligible to earn

Floor Income as well as time value, forward interest rate curve and volatility factors. Variable Rate Floor

Income received was recorded as earned in securitization servicing and Residual Interest revenue.

We also receive income for servicing the loans in our securitization trusts which was recognized as

earned. We assessed the amounts received as compensation for these activities at inception and on an ongoing

basis to determine if the amounts received are adequate compensation. To the extent such compensation was

determined to be no more or less than adequate compensation, no servicing asset or obligation was recorded

at the time of securitization. Servicing rights are subsequently carried at the lower of cost or market. At

December 31, 2010 and 2009, we did not have servicing assets or liabilities recorded on the balance sheet.

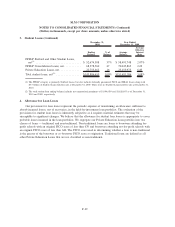

Derivative Accounting

The accounting guidance for our derivative instruments, which includes interest rate swaps, cross-

currency interest rate swaps, interest rate futures contracts, interest rate cap contracts and Floor Income

Contracts, requires that every derivative instrument, including certain derivative instruments embedded in other

contracts, be recorded at fair value on the balance sheet as either an asset or liability. Derivative positions are

recorded as net positions by counterparty based on master netting arrangements (see Note 9, “Derivative

Instruments,” under Risk Management Strategy) exclusive of accrued interest and cash collateral held or

pledged.

Many of our derivatives, mainly interest rate swaps hedging the fair value of fixed-rate assets and

liabilities, and cross-currency interest rate swaps, qualify as effective hedges. For these derivatives, the

relationship between the hedging instrument and the hedged items (including the hedged risk and method for

assessing effectiveness), as well as the risk management objective and strategy for undertaking various hedge

transactions at the inception of the hedging relationship, is documented. Each derivative is designated to either

F-20

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)