Sallie Mae 2010 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

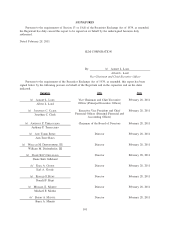

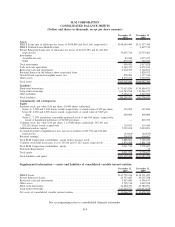

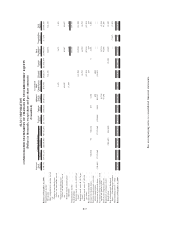

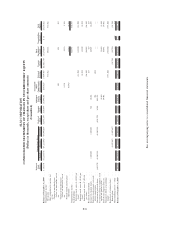

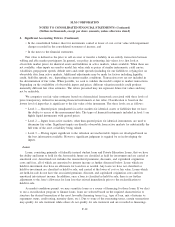

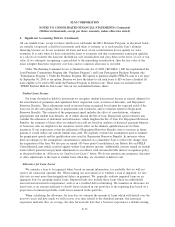

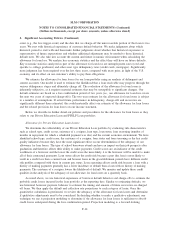

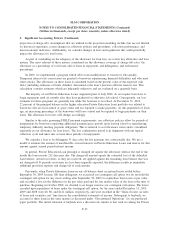

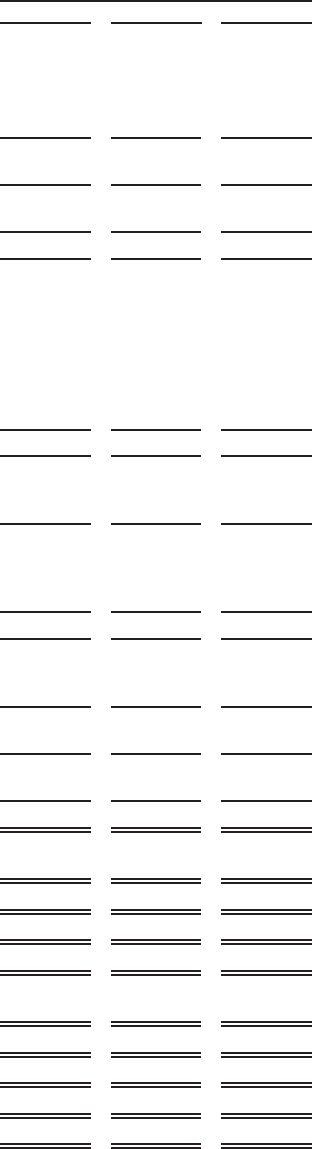

SLM CORPORATION

CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except per share amounts)

2010 2009 2008

Years Ended December 31,

Interest income:

FFELP Loans ......................................... $3,345,175 $3,093,782 $5,173,086

Private Education Loans ................................. 2,353,134 1,582,514 1,737,554

Other loans .......................................... 29,707 56,005 82,734

Cash and investments ................................... 25,899 26,064 276,264

Total interest income ..................................... 5,753,915 4,758,365 7,269,638

Total interest expense ..................................... 2,274,771 3,035,639 5,905,418

Net interest income ...................................... 3,479,144 1,722,726 1,364,220

Less: provisions for loan losses.............................. 1,419,413 1,118,960 719,650

Net interest income after provisions for loan losses ............... 2,059,731 603,766 644,570

Other income (loss):

Securitization servicing and Residual Interest revenue ........... — 295,297 261,819

Gains (losses) on sales of loans and securities, net .............. 324,780 283,836 (186,155)

Losses on derivative and hedging activities, net ................ (360,999) (604,535) (445,413)

Servicing revenue ...................................... 404,927 440,098 407,575

Contingency revenue ................................... 330,390 294,177 329,745

Gains on debt repurchases ............................... 316,941 536,190 64,477

Other ............................................... 6,369 88,016 39,979

Total other income ....................................... 1,022,408 1,333,079 472,027

Expenses:

Salaries and benefits .................................... 561,128 539,423 570,430

Other operating expenses ................................ 646,574 503,013 459,047

Total operating expenses ................................. 1,207,702 1,042,436 1,029,477

Goodwill and acquired intangible assets impairment and

amortization expense.................................. 698,902 75,960 49,674

Restructuring expenses .................................. 85,236 10,571 71,659

Total expenses .......................................... 1,991,840 1,128,967 1,150,810

Income (loss) from continuing operations, before income tax expense

(benefit) ............................................. 1,090,299 807,878 (34,213)

Income tax expense (benefit) ............................... 492,769 263,868 (36,693)

Net income from continuing operations ........................ 597,530 544,010 2,480

Loss from discontinued operations, net of tax benefit ............. (67,148) (219,872) (215,106)

Net income (loss) ....................................... 530,382 324,138 (212,626)

Preferred stock dividends .................................. 72,143 145,836 111,206

Net income (loss) attributable to SLM Corporation common stock .... $ 458,239 $ 178,302 $ (323,832)

Basic earnings (loss) per common share:

Continuing operations .................................... $ 1.08 $ .85 $ (.23)

Discontinued operations ................................... $ (.14) $ (.47) $ (.46)

Total ................................................. $ .94 $ .38 $ (.69)

Average common shares outstanding . . ........................ 486,673 470,858 466,642

Diluted earnings (loss) per common share:

Continuing operations .................................... $ 1.08 $ .85 $ (.23)

Discontinued operations ................................... $ (.14) $ (.47) $ (.46)

Total ................................................. $ .94 $ .38 $ (.69)

Average common and common equivalent shares outstanding ....... 488,485 471,584 466,642

Dividends per common share ............................... $ — $ — $ —

See accompanying notes to consolidated financial statements.

F-5