Sallie Mae 2010 Annual Report Download - page 34

Download and view the complete annual report

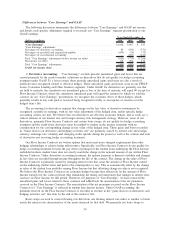

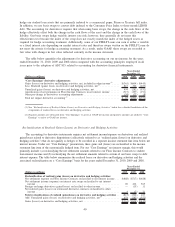

Please find page 34 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Income tax expense from continuing operations increased $229 million for the year ended December 31,

2010 as compared with the prior year. The effective tax rates for fiscal years 2010 and 2009 were

45 percent and 33 percent, respectively. The change in the effective tax rate for the year ended

December 31, 2010 was primarily driven by the impact of non-deductible goodwill impairments

recorded in 2010 and state tax rate changes recorded in both periods.

Net Loss from Discontinued Operations.

Net loss from discontinued operations in the year ended December 31, 2010 was $67 million compared with

a net loss from discontinued operations of $220 million for the year ended December 31, 2009. In the fourth

quarter of 2009, we sold our Purchased Paper — Mortgage/Properties business for $280 million which resulted

in an after-tax loss of $95 million. As a result of this sale, the results of operations of this business were

presented in discontinued operations in the fourth quarter of 2009. In the fourth quarter of 2010, we began

actively marketing our Purchased Paper — Non Mortgage business for sale and have concluded it is probable

this business will be sold within one year at which time we would exit the business. As a result, the results of

operations of this business were also required to be presented in discontinued operations beginning in the

fourth quarter of 2010. In connection with this presentation, we are required to carry this business at the lower

of fair value or historical cost basis. As a result, we recorded an after-tax loss of $52 million from

discontinued operations in the fourth quarter of 2010, primarily due to adjusting the value of this business to

its estimated fair value. Our Purchased Paper businesses are presented in discontinued operations for the

current and prior periods. The additional losses for both years that are more than the losses discussed above

relate to ongoing impairment recorded as a result of the weakened economy’s effect on our ability to collect

the receivables.

Year Ended December 31, 2009 Compared with Year Ended December 31, 2008

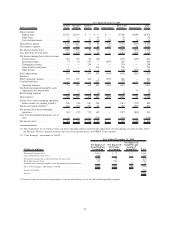

For the years ended December 31, 2009 and 2008, net income was $324 million, or $.38 diluted earnings

per common share, and a net loss of $213 million, or $.69 diluted loss per common share, respectively. For

the years ended December 31, 2009 and 2008, net income from continuing operations was $544 million, or

$.85 diluted earnings per common share, and $2 million, or $.23 diluted loss per common share, respectively.

For the years ended December 31, 2009 and 2008, net loss from discontinued operations was $220 million, or

$.47 diluted loss per common share, and $215 million, or $.46 diluted loss from discontinued operations per

common share, respectively.

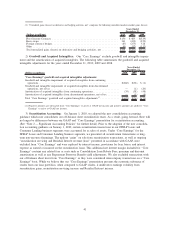

Income from Continuing Operations before Income Tax Expense.

Income from continuing operations before income tax expense for the year ended December 31, 2009

increased $842 million from the prior year. The $842 million increase was primarily due to an increase in

gains on debt repurchases of $472 million and an increase in gains on sales of loans and securities of

$470 million offset by an increase of $159 million in net losses on derivative and hedging activities.

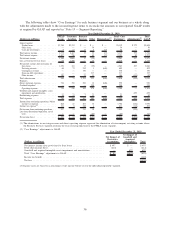

The primary contributors to each of the identified drivers of changes in income from continuing

operations before income tax expense for the year-over-year period are as follows:

• Net interest income after provisions for loan losses decreased by $41 million in the year ended

December 31, 2009 from the prior year. This decrease was due to a $399 million increase in provisions

for loan losses partially offset by a $358 million increase in net interest income. The increase in net

interest income was primarily due to an increase in the FFELP Loans net interest margin primarily due

to an increase in Gross Floor Income and the impact of derivative accounting and a $15 billion increase

in the average balance of GAAP-basis student loans. The increase in provisions for loan losses related

primarily to increases in charge-off expectations on Private Education Loans primarily as a result of the

continued weakening of the U.S. economy.

• Securitization servicing and Residual Interest revenue increased by $33 million from the prior year

primarily due to a $95 million decrease in the current-year unrealized mark-to-market loss on our Residual

Interests compared with the prior year, partially offset by a decrease in net Embedded Floor value.

33