Sallie Mae 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

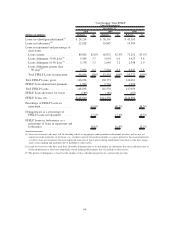

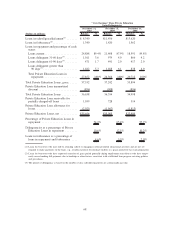

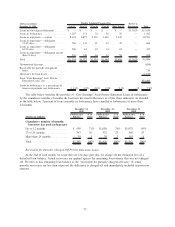

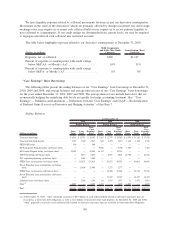

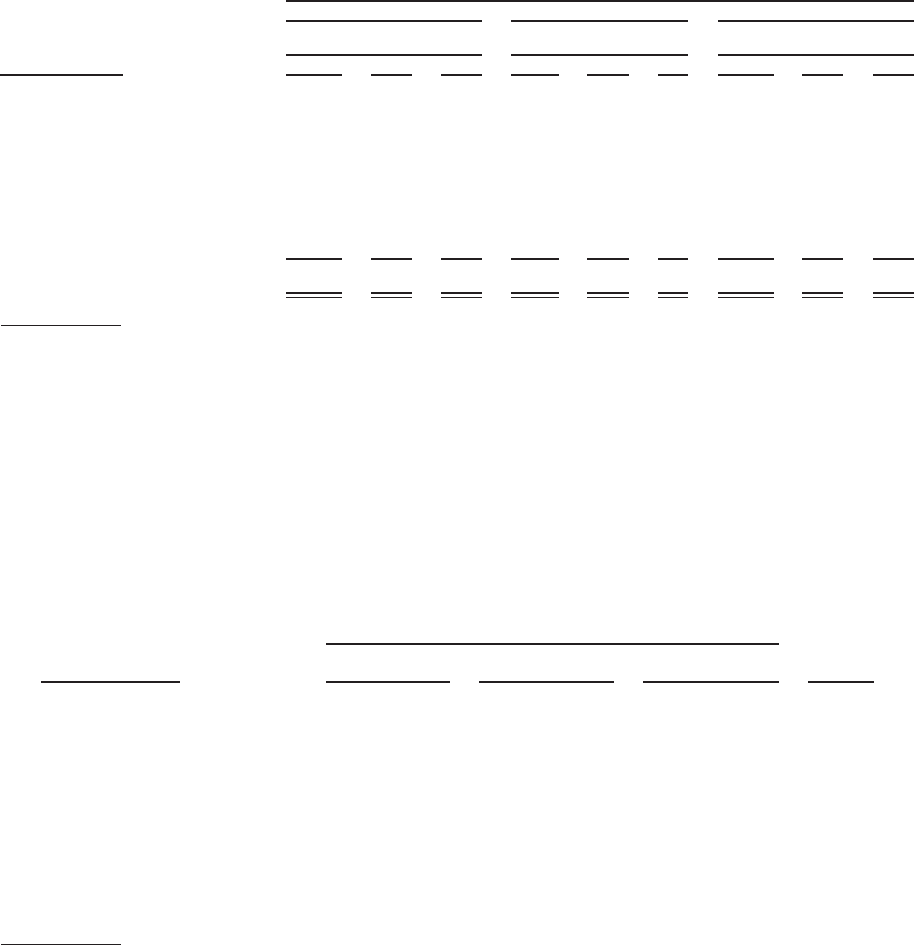

The following tables summarize the activity in the receivable for partially charged-off loans for the years

ended December 31, 2010, 2009 and 2008.

(Dollars in millions) 2010 2009 2008 2010(2) 2009 2008 2010 2009 2008

Years Ended

December 31,

Years Ended

December 31,

Years Ended

December 31,

GAAP-Basis Off-Balance Sheet “Core Earnings” Basis

Activity in Receivable for Partially Charged-Off Loans

Receivable at beginning of

period.................. $ 499 $222 $118 $ 229 $ 92 $28 $ 728 $314 $146

Expected future recoveries of

current period defaults

(1)

.... 415 320 140 — 154 72 415 474 212

Recoveries ................ (104) (43) (36) — (17) (8) (104) (60) (44)

Consolidation of securitization

trusts

(2)

................. 229 — — (229) — — — — —

Receivable at end of period.... $1,039 $499 $222 $ — $229 $92 $1,039 $728 $314

(1) Net of any current period recoveries that were less than expected.

(2) Upon the adoption of the new consolidation accounting guidance on January 1, 2010, we consolidated all of our off-balance sheet

securitization trusts.

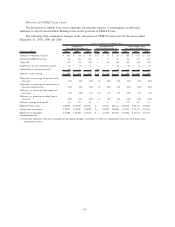

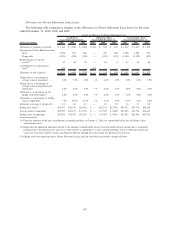

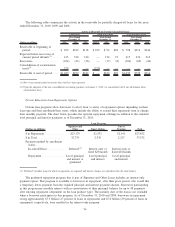

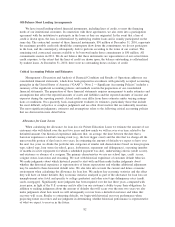

Private Education Loan Repayment Options

Certain loan programs allow borrowers to select from a variety of repayment options depending on their

loan type and their enrollment/loan status, which include the ability to extend their repayment term or change

their monthly payment. The chart below provides the optional repayment offerings in addition to the standard

level principal and interest payments as of December 31, 2010.

(Dollars in millions)

Signature and

Other Smart Option

Career

Training Total

Loan Program

$ in Repayment ............ $23,179 $2,532 $2,141 $27,852

$ in Total ................. 32,779 2,536 2,217 37,532

Payment method by enrollment

status:

In-school/Grace........... Deferred

(1)

Interest-only or

fixed $25/month

Interest-only or

fixed $25/month

Repayment .............. Levelprincipal

and interest or

graduated

Level principal

and interest

Level principal

and interest

(1) “Deferred” includes loans for which no payments are required and interest charges are capitalized into the loan balance.

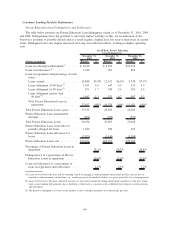

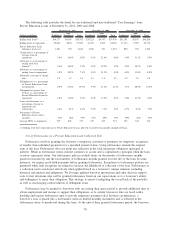

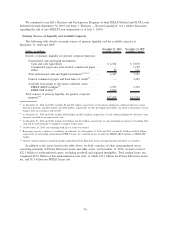

The graduated repayment program that is part of Signature and Other Loans includes an interest-only

payment option. This program is available to borrowers in repayment, after their grace period, who would like

a temporary lower payment from the required principal and interest payment amount. Borrowers participating

in this program pay monthly interest with no amortization of their principal balance for up to 48 payments

after entering repayment (dependent on the loan product type). The maturity date of the loan is not extended

when a borrower participates in this program. As of December 31, 2010 and 2009, borrowers in repayment

owing approximately $7.5 billion (27 percent of loans in repayment) and $7.0 billion (29 percent of loans in

repayment), respectively, were enrolled in the interest-only program.

74