Sallie Mae 2010 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

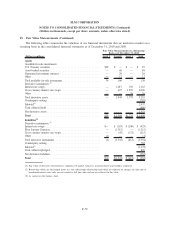

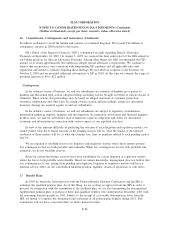

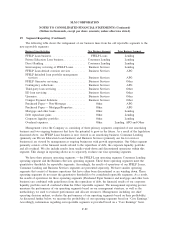

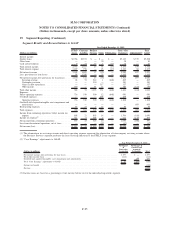

19. Segment Reporting (Continued)

The following table shows the realignment of our business lines from the old reportable segments to the

new reportable segments:

Business Lines/Activities New Business Segment Prior Business Segment

FFELP Loan business. . . ................... FFELP Loans Lending

Private Education Loan business .............. Consumer Lending Lending

Direct Banking........................... Consumer Lending Lending

Intercompany servicing of FFELP Loans........ Business Services Lending

FFELP Loan default aversion services ......... Business Services APG

FFELP defaulted loan portfolio management

services .............................. Business Services APG

FFELP Guarantor servicing ................. Business Services Other

Contingency collections . ................... Business Services APG

Third-party loan servicing .................. Business Services Other

ED loan servicing ........................ Business Services Other

Upromise ............................... Business Services Other

Campus Payment Solutions ................. Business Services Other

Purchased Paper — Non-Mortgage ............ Other APG

Purchased Paper — Mortgage/Properties ........ Other APG

Mortgage and other loans ................... Other Lending

Debt repurchase gains . . ................... Other Lending

Corporate liquidity portfolio ................. Other Lending

Overhead expenses ........................ Other Lending, APG and Other

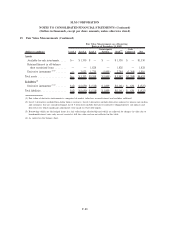

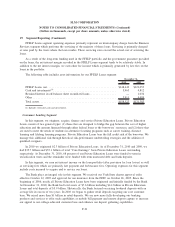

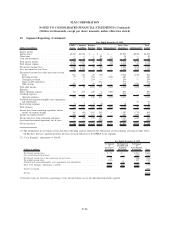

Management views the Company as consisting of three primary segments comprised of one amortizing

business and two ongoing businesses that have the potential to grow in the future. As a result of the legislation

discussed above, our FFELP Loan business is now viewed as an amortizing business. Consumer Lending

(primarily our Private Education Loan business) and Business Services (primarily our fee-for-services

businesses) are viewed by management as ongoing businesses with growth opportunities. Our Other segment

primarily consists of the financial results related to the repurchase of debt, the corporate liquidity portfolio

and all overhead. We also include results from smaller wind-down and discontinued operations within this

segment. This change in reporting allows us to separately evaluate our four operating segments.

We have three primary operating segments — the FFELP Loan operating segment, Consumer Lending

operating segment and the Business Services operating segment. These three operating segments meet the

quantitative thresholds for reportable segments. Accordingly, the results of operations of our FFELP Loans,

Consumer Lending and Business Services segments are presented separately. We have smaller operating

segments that consist of business operations that have either been discontinued or are winding down. These

operating segments do not meet the quantitative thresholds to be considered reportable segments. As a result,

the results of operations for these operating segments (Purchased Paper business and mortgage and other loan

business) are combined with gains/losses from the repurchase of debt, the financial results of our corporate

liquidity portfolio and all overhead within the Other reportable segment. The management reporting process

measures the performance of our operating segments based on our management structure, as well as the

methodology we used to evaluate performance and allocate resources. Management, including our chief

operating decision makers, evaluates the performance of our operating segments based on their profitability.

As discussed further below, we measure the profitability of our operating segments based on “Core Earnings.”

Accordingly, information regarding our reportable segments is provided based on a “Core Earnings” basis.

F-89

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)