Sallie Mae 2010 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

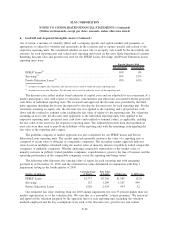

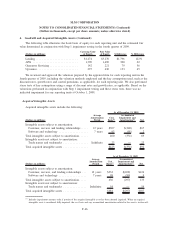

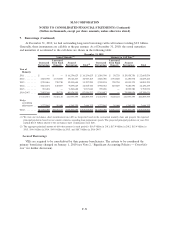

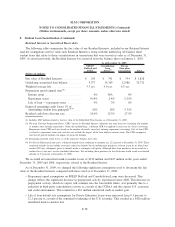

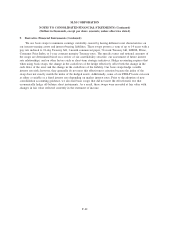

7. Borrowings (Continued)

We currently consolidate all of our financing entities that are VIEs as a result of being the entities’

primary beneficiary. As a result, these financing VIEs are accounted for as secured borrowings. We consolidate

the following financing VIEs as of December 31, 2010 and 2009:

Short

Term

Long

Term Total Loans Cash Other Assets Total

Carrying Amount of Assets Securing Debt

Outstanding

Debt Outstanding

December 31, 2010

(Dollars in millions)

Secured Borrowings:

ED Conduit Program Facility .................. $24,484 $ — $ 24,484 $ 24,511 $ 819 $ 634 $ 25,964

ABCP borrowings . . . ...................... — 5,853 5,853 6,290 94 53 6,437

Securitizations — FFELP Loans ................. — 112,425 112,425 113,400 3,728 966 118,094

Securitizations — Private Education Loans . . ........ — 21,409 21,409 24,355 1,213 690 26,258

Indentured trusts .......................... — 1,246 1,246 1,549 129 15 1,693

Total before hedge accounting adjustments . . ........ 24,484 140,933 165,417 170,105 5,983 2,358 178,446

Hedge accounting adjustments .................. — 1,311 1,311 — — 1,348 1,348

Total . ................................ $24,484 $142,244 $166,728 $170,105 $5,983 $3,706 $179,794

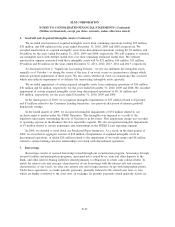

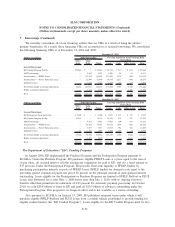

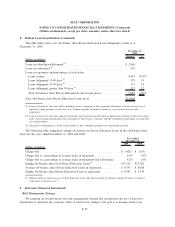

Short

Term

Long

Term Total Loans Cash Other Assets Total

Carrying Amount of Assets Securing Debt

Outstanding

Debt Outstanding

December 31, 2009

(Dollars in millions)

Secured Borrowings:

ED Participation Program Facility . . . ............. $9,006 $ — $ 9,006 $ 9,397 $ 115 $ 61 $ 9,573

ED Conduit Program facility . .................. 14,314 — 14,314 14,594 478 372 15,444

ABCP borrowings . . . ...................... — 8,801 8,801 9,929 204 100 10,233

Securitizations — FFELP Loans ................. — 81,923 81,923 82,913 2,693 686 86,292

Securitizations — Private Education Loans . . ........ — 7,277 7,277 10,108 934 763 11,805

Indentured trusts .......................... 64 1,533 1,597 1,898 172 24 2,094

Total before hedge accounting adjustments . . ........ 23,384 99,534 122,918 128,839 4,596 2,006 135,441

Hedge accounting adjustments .................. — 1,479 1,479 — — 1,634 1,634

Total . ................................ $23,384 $101,013 $124,397 $128,839 $4,596 $3,640 $137,075

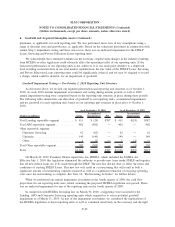

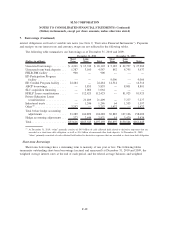

The Department of Education (“ED”) Funding Programs

In August 2008, ED implemented the Purchase Program and the Participation Program pursuant to

ECASLA. Under the Purchase Program, ED purchases eligible FFELP Loans at a price equal to the sum of

(i) par value, (ii) accrued interest, (iii) the one-percent origination fee paid to ED, and (iv) a fixed amount of

$75 per loan. Under the Participation Program, ED provides short-term liquidity to FFELP lenders by

purchasing participation interests in pools of FFELP Loans. FFELP lenders are charged a rate equal to the

preceding quarter commercial paper rate plus 0.50 percent on the principal amount of participation interests

outstanding. Loans eligible for the Participation or Purchase Programs are limited to FFELP Stafford or PLUS

Loans, first disbursed on or after May 1, 2008 but no later than July 1, 2010, with no ongoing borrower

benefits other than permitted rate reductions of 0.25 percent for automatic payment processing. In October

2010, we sold $20.4 billion of loans to ED and paid off $20.3 billion of advances outstanding under the

Participation Program. This program is no longer in effect and is not available as a source of funding.

Also pursuant to ECASLA, on January 15, 2009, ED published summary terms under which it will

purchase eligible FFELP Stafford and PLUS Loans from a conduit vehicle established to provide funding for

eligible student lenders (the “ED Conduit Program”). Loans eligible for the ED Conduit Program must be first

F-52

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)