Sallie Mae 2010 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with our Consolidated Financial

Statements and related Notes included elsewhere in this Annual Report on Form 10-K. This discussion and

analysis also contains forward-looking statements and should also be read in conjunction with the disclosures

and information contained in “Forward-Looking and Cautionary Statements” and Item 1A “Risk Factors” in

this Annual Report on Form 10-K.

Through this discussion and analysis, we intend to provide the reader with some narrative context for

how our management views our consolidated financial statements, additional context within which to assess

our operating results, and information on the quality and variability of our earnings, liquidity and cash flows.

Overview

We provide Private Education Loans that help students and their families bridge the gap between family

resources, federal loans, grants, student aid, scholarships, and the cost of a college education. We also provide

savings products to help save for a college education. In addition we provide servicing and collection services on

federal loans. We also offer servicing, collection and transaction support directly to colleges and universities in

addition to the saving for college industry. Finally, we are the largest private owner of FFELP Loans.

Effective July 1, 2010, HCERA legislation eliminated the authority to originate new loans under FFELP.

Consequently, we no longer originate FFELP Loans. As a result, in the fourth quarter of 2010 we changed the

way we regularly monitor and assess our ongoing operations and results by realigning our business segments

into four reportable segments: (1) FFELP Loans, (2) Consumer Lending, (3) Business Services and (4) Other.

Management now views our business as consisting of three primary segments comprised of one runoff business

(FFELP Loans) and two continuing growth businesses (Consumer Lending and Business Services).

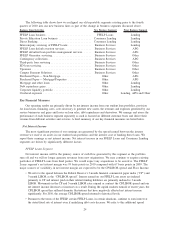

FFELP Loans Segment

Our FFELP Loans segment consists of our $148.6 billion FFELP Loan portfolio and underlying debt and

capital funding these loans. This includes the acquisition of loans from the Student Loan Corporation on

December 31, 2010 (see “Segment Earnings Summary — ‘Core-Earnings’ Basis — FFELP Loans Segment” of

this Item 7 for further discussion). Because we no longer originate FFELP Loans the portfolio is in runoff and

is expected to amortize over approximately the next 25 years with a weighted average remaining life of

7.7 years. We actively seek to acquire FFELP Loan portfolios to leverage our servicing scale and expertise to

generate incremental earnings and cash flow to create additional shareholder value. Of our total FFELP Loan

portfolio, 77 percent was funded to term through securitization trusts, 16 percent was funded through the ED

Conduit Program which terminates on January 19, 2014, 5 percent was funded in our multi-year ABCP facility

and FHLB-DM facility, and the remainder was funded with unsecured debt. It is expected to generate a stable

net interest margin and significant amounts of cash as the portfolio amortizes.

Consumer Lending Segment

In our Consumer Lending segment we originate, acquire, finance and service Private Education Loans. As

of December 31, 2010 we had $35.7 billion of Private Education Loans outstanding. In 2010 we originated

$2.3 billion of Private Education Loans, down from $3.2 billion in the prior year. We provide Private

Education Loans to students and their families to help them pay for a college education. We provide loans

through the financial aid office, direct-to-consumer and through referral and partner lenders. We also provide

savings products, primarily in the form of retail deposits, to help customers save for a college education (we

refer to this as our Direct Banking business line).

Business Services Segment

In our Business Services segment we provide loan servicing to our FFELP Loans segment, ED and other

third parties. We provide default aversion work and contingency collections on behalf of Guarantors, colleges

and ED. We also perform Campus Payment Solutions, account asset servicing and transaction processing

activities.

Other

Our Other segment primarily consists of the financial results related to the repurchase of debt, the

corporate liquidity portfolio and all overhead. We also include results from smaller wind-down and discontin-

ued operations within this segment.

23