Sallie Mae 2010 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2010 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

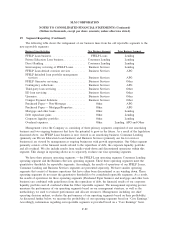

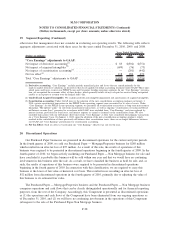

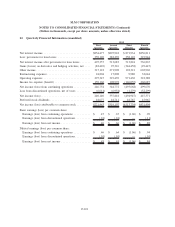

20. Discontinued Operations (Continued)

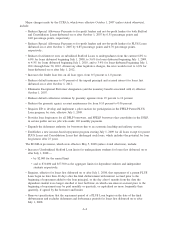

The following table summarizes the discontinued assets and liabilities of Purchased Paper — Mortgage/

Properties business held for sale at December 31, 2010 and 2009, respectively.

2010 2009

At December 31,

Assets:

Cash and equivalents.......................................... $ 3,848 $ 11,570

Other assets ................................................ 176,916 450,410

Assets of discontinued operations ................................ $180,764 $461,980

Liabilities:

Liabilities of discontinued operations .............................. $ 6,300 $ 31,500

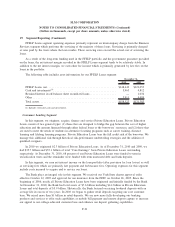

At December 31, 2010, other assets of our discontinued operations consist primarily of the Purchased

Paper — Non Mortgage loan portfolio and a deferred tax asset for intangibles that will be realized upon the

sale of our Purchased Paper — Non Mortgage business. At December 31, 2009, other assets of our

discontinued operations consist of the Purchased Paper — Non Mortgage loan portfolio and a receivable from

SLM Corporation associated with the 2009 net operating loss generated by the sale of our Purchased Paper —

Mortgage/Properties business. This receivable was settled in the third quarter of 2010. At December 31, 2010,

liabilities of our discontinued operations consist primarily of estimated reserves associated with certain

recourse and buy-back provisions associated with the asset sale, as well as restructuring liabilities related to

severance and contract termination costs.

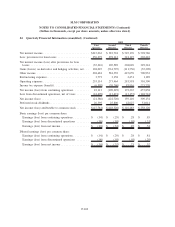

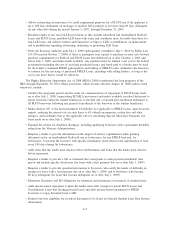

The following table summarizes the discontinued operations for the years ended December 31, 2010,

2009 and 2008, respectively.

2010 2009 2008

Years Ended December 31,

Operations:

Loss from discontinued operations before income taxes ...... $(91,516) $(304,769) $(345,987)

Income tax benefit ................................. (24,368) (84,897) (130,881)

Loss from discontinued operations, net of taxes ........... $(67,148) $(219,872) $(215,106)

Disposal:

Loss on disposal before income taxes ................... $ — $(118,761) $ —

Income tax benefit ................................. — (23,053) —

Loss on disposal, net of taxes ......................... $ — $ (95,708) $ —

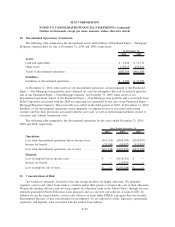

21. Concentrations of Risk

Our business is primarily focused in loan and savings products for higher education. We primarily

originate, service and collect loans made to students and/or their parents to finance the cost of their education.

We provide funding, delivery and servicing support for education loans in the United States, through our non-

federally guaranteed Private Education Loan programs and as a servicer and collector of loans for ED. In

addition we are the largest holder, servicer and collector of loans under FFELP, a program that was recently

discontinued. Because of this concentration in one industry, we are exposed to credit, legislative, operational,

regulatory, and liquidity risks associated with the student loan industry.

F-99

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)